The leading digital asset dipped to $81K over the weekend, but news of Strategy (MSTR) and Metaplanet (3350) institutional purchases of $1.92 billion and $13.3 million respectively, helped buoy BTC back above the $83K threshold.

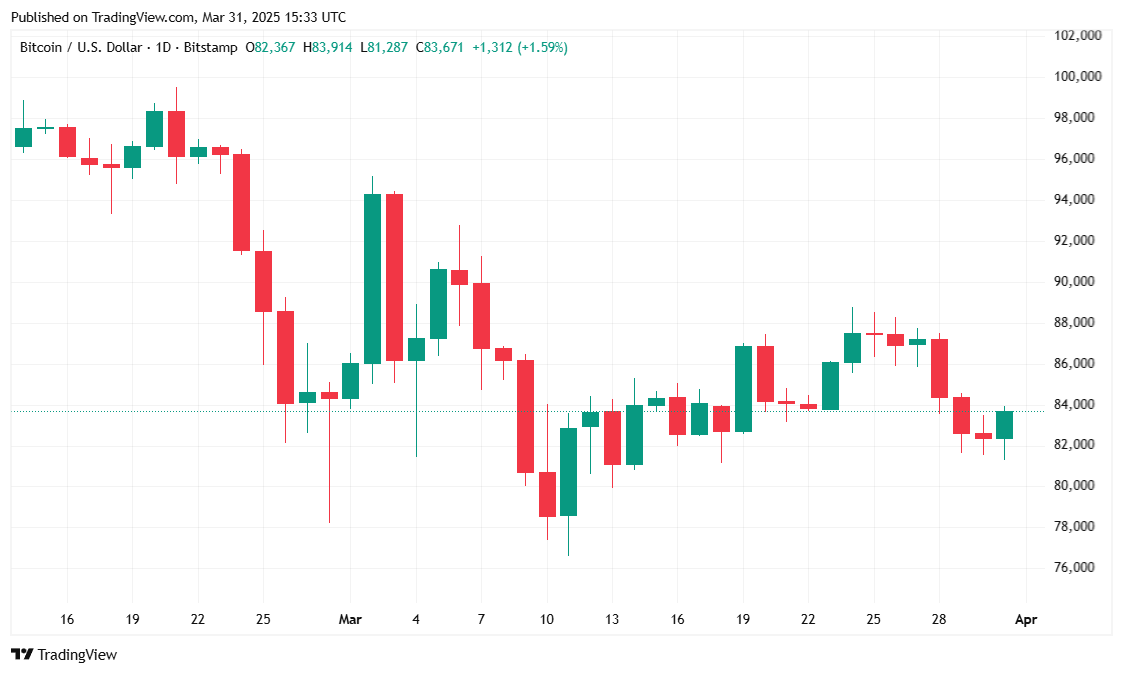

Bitcoin’s price remained volatile over the past 24 hours, trading in a range between $83,557.64 and $87,489.86. The flagship cryptocurrency, at the time of reporting, stands at $83,678.74, marking a 1.01% increase over the last 24 hours but a 5.07% decline over the past week, according to Coinmarketcap.

( BTC price / Trading View)

Despite the drop over the past seven days, the market showed signs of renewed activity. Trading volume surged by 90.34% to $27.27 billion, though much of this was due to the anticipated weekend trading slump. Meanwhile, bitcoin’s market capitalization dropped slightly by 0.95% to $1.65 trillion.

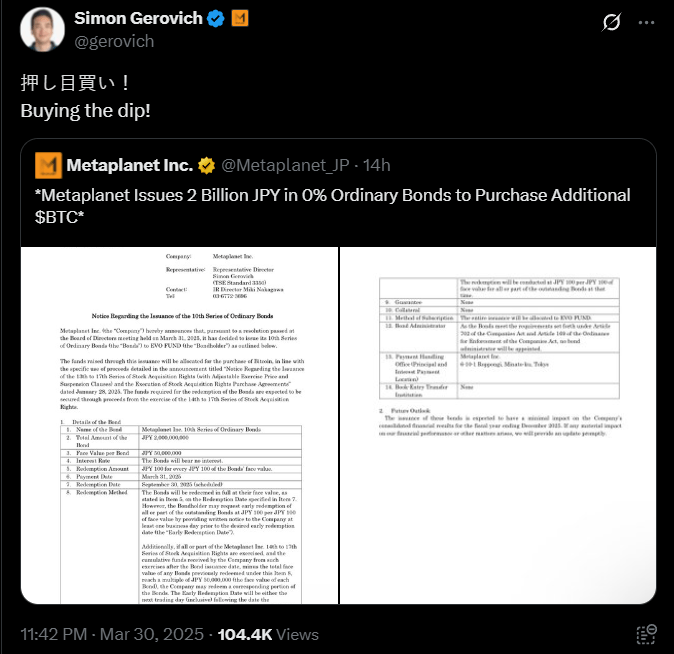

Two firms that have made headlines by successfully pivoting from traditional businesses to bitcoin treasury companies, Strategy and Metaplanet, both announced bitcoin purchases of 22,048 BTC (roughly $1.92 billion) and just under 160 BTC (for roughly $13.3 million or ¥2 billion) respectively. Metaplanet announced on March 30th that it had issued zero coupon bonds for the purchase while Strategy made its purchase announcement on March 31st.

(Metaplanet CEO Simon Gerovich announces his company’s latest BTC purchase / Simon Gerovich on X)

The acquisitions are a strong indication of persistent institutional interest in the digital asset which likely bodes well for bitcoin’s medium-to-long-term price action.

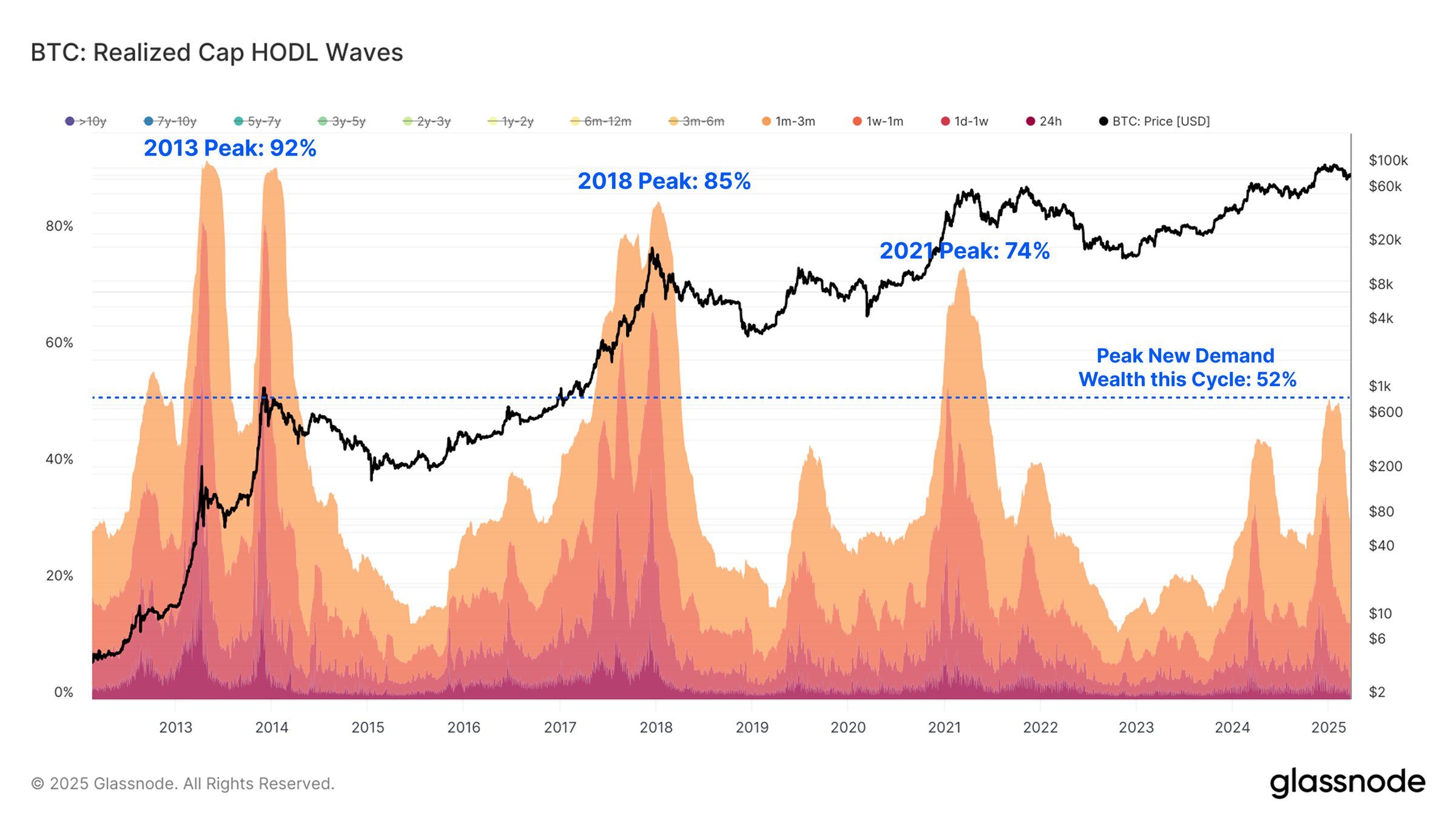

Analysis by crypto metrics firm Glassnode shows that only 40% of bitcoin is currently held by short-term holders versus 50% earlier in the year, indicating less dramatic price appreciation in the future.

(Short-term holders currently hold around 40% of bitcoin, after peaking at almost 50% earlier this year / Glassnode)

“This remains significantly below prior cycle tops, where new investor wealth peaked at 70–90%, suggesting a more tempered and distributed bull market so far,” Glassnode explained.

Other key indicators paint a mixed picture for bitcoin’s short-term outlook:

- BTC dominance rose slightly to 62.42% (+0.38%), indicating bitcoin is holding up better than altcoins.

- Futures open interest dipped slightly to $53.74 billion (-0.26%), suggesting some cooling in leveraged trading.

- Liquidations totaled $8.19 million over the past day, with shorts suffering nearly all losses ($8.15 million). This signals that bearish traders were caught off guard by bitcoin’s resilience.

While short-term price action remains volatile, bitcoin’s medium-to-long-term fundamentals appear strong, driven by increasing institutional adoption and a maturing investor base. With long-term holders increasing their grip on supply, volatility may gradually subside, setting the stage for more sustainable price growth in the coming months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。