Date: Mon, March 31, 2025 | 05:45 PM GMT

he cryptocurrency market has faced major selling pressure, with Ethereum (ETH) dropping over 12% in the past week. This decline is partly due to escalating global trade tensions and ETH dipping below the $1,850 mark, triggering further sell-offs across altcoins .

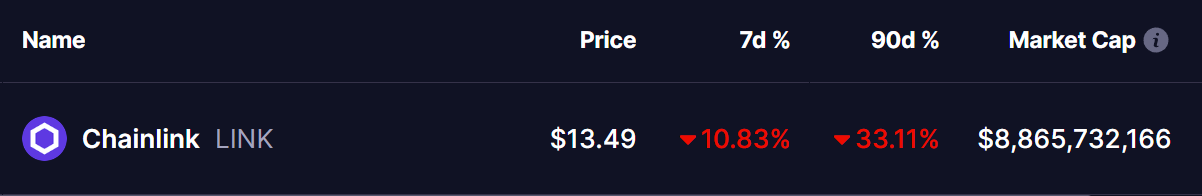

In the midst of this downturn, Chainlink (LINK) has also taken a hit, falling over 10% in the past week and extending its 90-day correction to a total loss of 33%. However, despite the recent bearish sentiment, a strong technical pattern is emerging, hinting at a potential trend reversal in the near future.

Source: Coinmarketcap

Source: Coinmarketcap

LINK Retesting Key Breakout

According to chart analyst Bit Amberly , LINK has successfully broken out of a three-year-long symmetrical triangle pattern on the weekly timeframe. The breakout occurred on November 22, 2024, when LINK surged above the triangle’s upper resistance trendline at approximately $15. This bullish breakout fueled an impressive rally, pushing LINK to a local high of $31.

Chainlink (LINK) Weekly Chart/Source: @bitamberly (X)

Chainlink (LINK) Weekly Chart/Source: @bitamberly (X)

However, recent market turbulence has led to a retest of this breakout level, with LINK briefly falling to its current price of $13.49. Retesting previous breakout levels is a common occurrence in technical analysis, as assets often confirm their new trend direction before continuing their upward movement.

Could a Bounce Ignite a Recovery?

The current retest phase is crucial. If LINK can hold its breakout level and establish support, it could pave the way for another bullish move. Analysts highlight key resistance levels at $19.40, $31.10, and ultimately $49.00. These levels represent significant price milestones based on historical resistance and psychological factors. A successful bounce from the current level could result in a +260% move from its current price.

Additionally, the 100-week moving average (MA) is acting as a critical support level. If LINK maintains strength above this moving average, it may signal renewed bullish momentum in the coming weeks.

Final Thoughts

While the broader market remains uncertain, LINK’s technical setup suggests a potentially lucrative recovery. If historical price action within symmetrical triangle formations repeats, a major move upward could be on the horizon.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.