US Rep. Bryan Steil Talks GENIUS Act vs. STABLE Act: Minor Differences, Big Crypto Impact

The STABLE Act and GENIUS Act are nearing alignment, paving the way for US stablecoin regulation. With bipartisan backing and SEC/CFTC support, a clear legal framework could emerge soon. However, global regulators are wary of the implications.

Stablecoin bills in the US are drawing attention from institutional investors and politicians. Recently, US Representative Bryan Steil told journalist Eleanor Terrett that the two major stablecoin bills—the STABLE Act and the GENIUS Act—have only minor differences.

This raises hope for a unified regulatory framework in the near future. The STABLE Act was drafted by the House, and the Senate proposed the GENIUS Act.

STABLE Act and GENIUS Act Differ by Only 20%

On March 31, journalist Eleanor Terrett posted on X (formerly Twitter) about the discussion.

Representative Bryan Steil stated that after Wednesday’s review, the STABLE Act is “well positioned to mirror up” with the GENIUS Act after a few more drafting rounds in the House and Senate. The Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are providing technical support.

Steil emphasized that about 20% of the differences between the two bills are mainly textual, not fundamental. The biggest differences involve requirements for international stablecoin issuers, state-level oversight of issuers, and some minor technical details.

He expressed optimism about working with Senate colleagues to pass the bill.

“At the end of the day, I think there’s recognition that we want to work with our Senate colleagues to get this across the line,” he said.

This agreement is a positive sign. Both bills enjoy bipartisan support, which is crucial in the often-divided US political landscape.

According to NatLawReview, Senators Bill Hagerty, Tim Scott, Cynthia Lummis, and Kirsten Gillibrand support the GENIUS (Guiding and Establishing National Innovation for US Stablecoins) Act.

Meanwhile, the STABLE (Stablecoin Transparency and Accountability for a Better Ledger Economy) Act was drafted by House Financial Services Committee Chair French Hill and Representative Bryan Steil.

Despite some differences, both bills aim to establish a legal framework for issuing stablecoins under federal or state supervision. For example, the GENIUS Act requires the Treasury Department to study algorithmic stablecoins, whereas the STABLE Act imposes a two-year ban on issuing them.

If passed, these bills could reshape the future of stablecoins and accelerate crypto adoption in the US. This would benefit both investors and everyday users.

However, experts in Europe and China have voiced concerns. They worry that US lawmakers’ support for stablecoins could destabilize their financial systems.

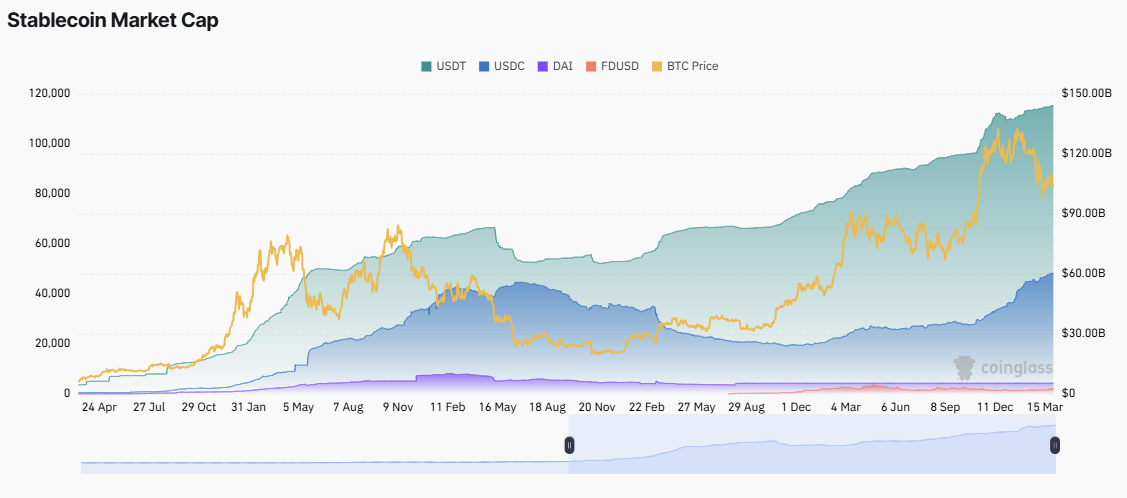

Stablecoin Market Cap. Source:

Coinglass

Stablecoin Market Cap. Source:

Coinglass

As of this writing, the stablecoin market capitalization has surpassed $230 billion. Tether’s USDT accounts for 61%, while Circle’s USDC holds 25%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget to support loan and margin functions for select assets in unified account

Subscribe to CYC Savings and enjoy up to 20% APR

[Initial Listing] Bitget Will List Succinct (PROVE). Come and grab a share of 66,666 PROVE

BGB Holders' August Surf Fest — ride the wealth wave and win from $10,000!