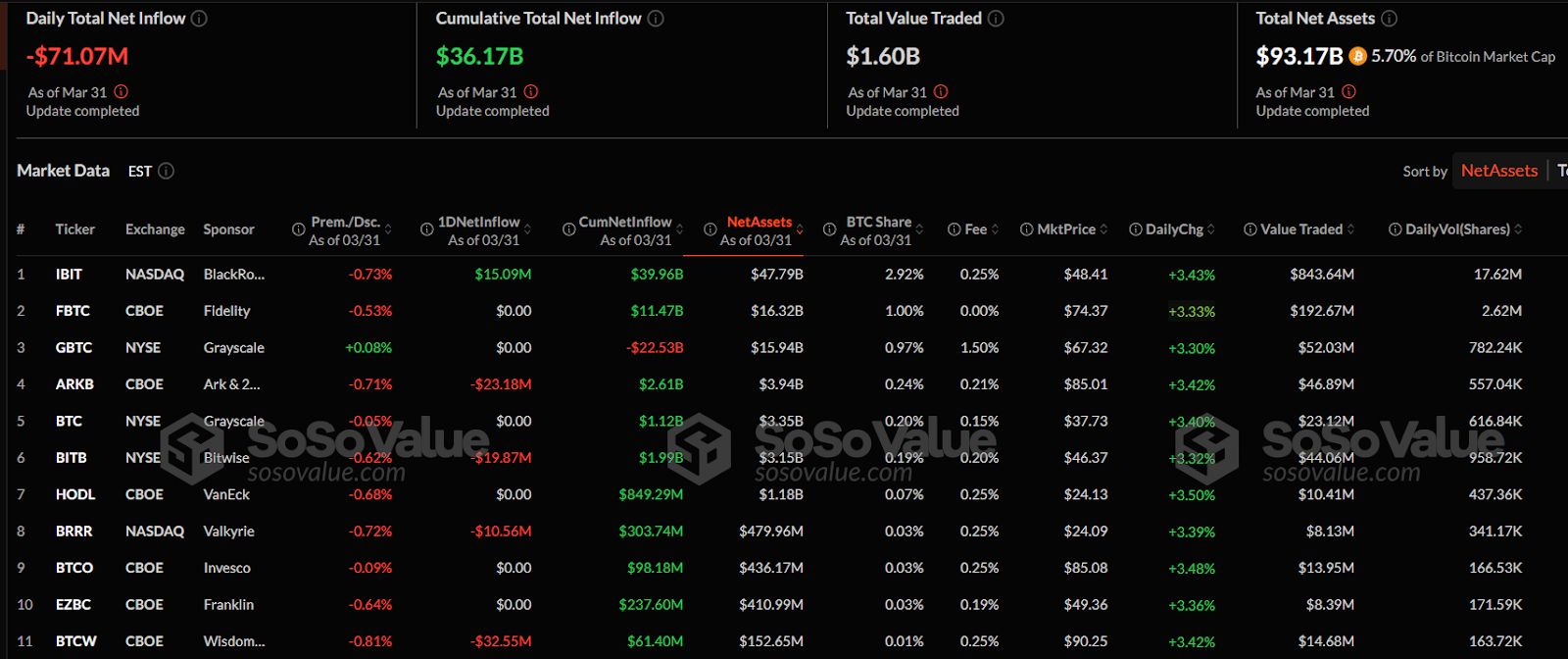

Bitcoin ETF Market Struggles with $71.07M Daily Outflow Despite Holding $93.17B in Assets

- Bitcoin ETF daily inflow drops by $71.07M, while total assets reach $93.17B.

- BlackRock’s iShares Bitcoin Trust shows strong trading with a $843.64M value.

- Grayscale Bitcoin Trust maintains a slight premium with $22.53B in cumulative inflows.

According to a SoSoValue update as of March 31 on Bitcoin Exchange Traded Funds, the daily total net inflow reported a negative value of -$71.07 million, indicating a decrease in inflows for the day. Meanwhile, the “Cumulative Total Net Inflow” stands at $36.17 billion, showing the total net inflow to these funds over time.

Total net assets across all assets amount to $93.17 billion, with Bitcoin representing 5.70% of the total market cap. This suggests that the funds reflect substantial activity in both traditional financial markets and cryptocurrency-based investments.

BlackRock and Fidelity See Positive Movements, Grayscale Steady

Looking at specific funds, the ticker for BlackRock’s iShares Bitcoin Trust (IBIT) shows a 0.73% discount with a daily net inflow of $15.09 million. The fund has accumulated $39.96 billion in net inflows, with a total net asset value of $47.79 billion. It also holds 2.92% of the Bitcoin market share and has a daily change of +3.43%, with $843.64 million in value traded.

Fidelity’s Bitcoin Trust (FBTC) reports no new inflows for the day, but the fund has accumulated $11.47 billion i total inflows. Its total net assets stand at $16.32 billion. The fund holds 1% of the Bitcoin market share and has traded $192.67 million in value with a 3.33% daily increase.

Grayscale Bitcoin Trust (GBTC) shows a slight premium of +0.08%. The fund has no new inflows but holds a significant $22.53 billion in cumulative inflows. Its total assets are valued at $15.94 billion. The trust holds 0.97% of the Bitcoin market share and reported a 3.30% daily change, with $52.03 million in value traded.

Ark Invest Sees Positive Daily Change, BTC and Bitwise Decline

Ark Invest’s ARKB, with a -0.71% premium/discount, shows a negative daily inflow of -$23.18 million. The total net assets stand at $3.94 billion, and it has accumulated $2.61 billion in inflows. Its daily change stands at +3.42%, with a traded value of $46.89 million.

Bitcoin itself, represented by BTC, recorded a slight decrease of -0.05% in its net inflows but has accumulated $3.35 billion in assets. Its Bitcoin share stands at 0.20%, and its daily change was +3.40%, with $23.12 million in traded value.

Bitwise’s Bitwise Bitcoin (BITB) shows a significant daily decline of -0.62%, with a daily net outflow of -$19.87 million. Its net assets total $3.15 billion, and the fund holds a smaller Bitcoin market share of 0.19%. The daily price change is +3.32%, with $44.06 million in trading volume.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List Succinct (PROVE). Come and grab a share of 66,666 PROVE

BGB Holders' August Surf Fest — ride the wealth wave and win from $10,000!

Subscribe to CYC Savings and enjoy up to 20% APR

Wealth Management Festival: 50 USDT for New Users & Up to 30,000 USDT in Wealth Bonuses!