SEC, Gemini file joint motion to seek 'potential resolution' to crypto lawsuit

Quick Take The SEC and Gemini have filed a joint motion for a 60-day stay for their legal case to seek a resolution. The SEC has recently been dropping its lawsuit against crypto companies, including Coinbase and OpenSea.

The U.S. Securities and Exchange Commission and crypto exchange Gemini filed a joint letter requesting a 60-day stay to explore a potential resolution to their legal dispute over Gemini Earn.

The letter, filed with the U.S. District Court for the Southern District of New York on Tuesday, asked the judge to delay "all deadlines" in the SEC's lawsuit against Gemini in January 2023.

In the lawsuit, the securities regulator claimed that the exchange offered and sold unregistered securities via its crypto lending program, Gemini Earn, raising billions of dollars worth of crypto assets.

The joint letter came a month after Gemini co-founder Cameron Winklevoss announced that the SEC had informed the team it had closed its investigation into the exchange and would no longer pursue an enforcement action against the company.

This is part of a wave of the SEC's canceled lawsuits and paused investigations into crypto firms as the agency shifted to a more pro-crypto stance following President Trump's election. The SEC has withdrawn cases against Coinbase, OpenSea, Immutable and others.

Gemini co-founders Cameron and Tyler Winklevoss previously donated $2 million in bitcoin to support Trump's campaign last June, though it was later refunded for exceeding the donation limit.

Earlier in January, the Gemini Trust Company also agreed to pay $5 million to settle a case brought by the U.S. Commodity Futures Trading Commission over misleading statements.

While it moves to resolve its past legal troubles, Gemini is reportedly eyeing an initial public offering to potentially happen this year, according to Bloomberg. In the midst of IPO plans, the crypto exchange also appointed a new chief financial officer last month.

The Block has reached out to Gemini and the SEC for further comment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Meta faces antitrust probe in Italy over AI integration in WhatsApp

Share link:In this post: Italy’s antitrust watchdog (AGCM) is investigating Meta for integrating its AI assistant into WhatsApp without user consent. The regulator suspects the tech firm abused its dominant position by forcing users toward its AI, potentially harming competitors. AGCM warns that this integration may limit consumer choice and distort market competition under EU law.

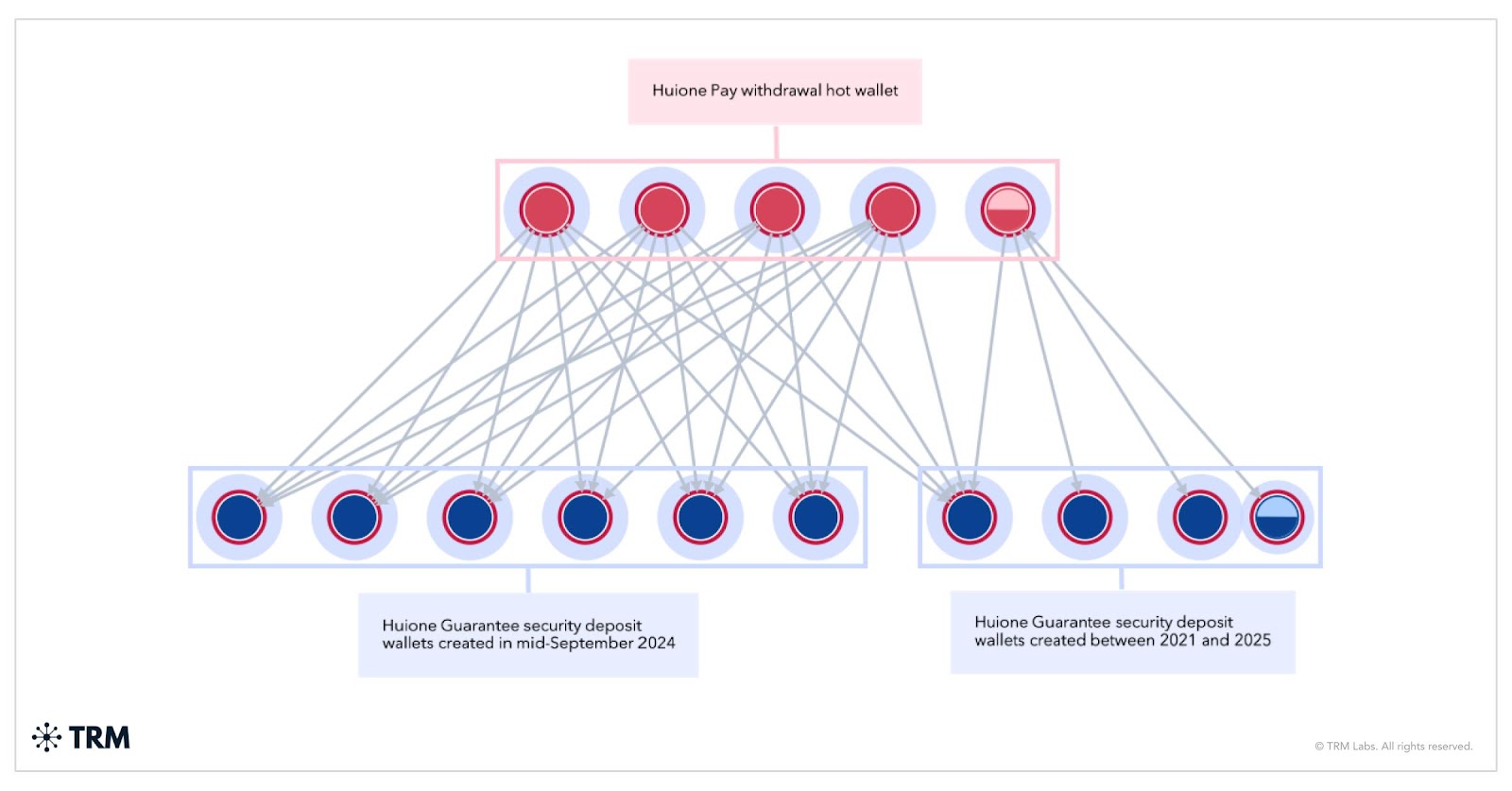

Telegram-banned $35B scam marketplaces find life away from US regulators

Share link:In this post: Telegram banned Huione Guarantee and Xinbi Guarantee after a $35B scam crackdown, but operations quickly shifted to Tudou Guarantee. TRM Labs and Elliptic revealed Huione vendors migrated to alternate platforms, with Tudou seeing a 70x surge in daily transactions. Despite US sanctions and enforcement, Huione Pay, USDH stablecoin, and affiliated services continue operating under new Telegram identities.

Polygon Labs calms fears about reports that its network went down for hours

Share link:In this post: Polygon Labs confirmed its network remained active despite Polygonscan showing no new blocks for over an hour. The issue was caused by a display glitch during a backend update on Polygonscan, not an actual network outage. The incident sparked renewed concerns about overreliance on third-party tools like explorers and RPC providers.

Federal Reserve keeps interest rates unchanged again, as expected

Share link:In this post: The Federal Reserve kept interest rates steady at 4.25% to 4.5%, delaying any cuts until at least September. Trump criticized the Fed’s decision, blaming tariffs for rising costs and demanding lower rates. Borrowers face high rates on credit cards, mortgages, car loans, and student loans, with no relief in sight.