Justin Sun Accuses First Digital Trust of Insolvency, FDUSD Depegs to $0.87

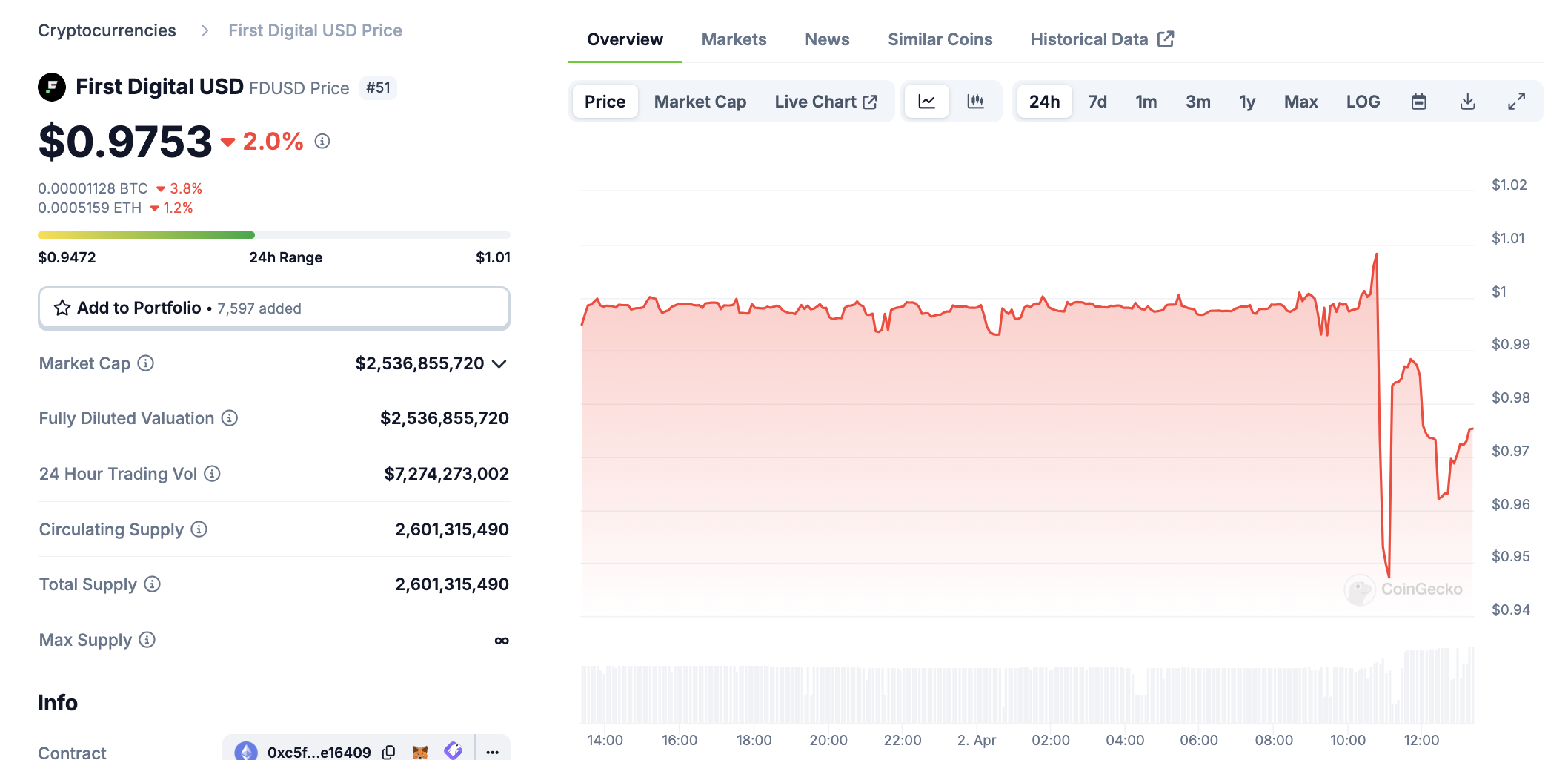

Justin Sun's accusations against First Digital over TUSD's solvency triggered FDUSD's price drop and market fears, drawing responses from Binance and Wintermute.

Tron founder Justin Sun accused First Digital Trust of being insolvent regarding its TUSD stablecoin. This prompted another FDUSD, another asset from the same company, to temporarily depeg to a low of $0.87.

Even though the lawsuit primarily concerns TUSD, Wintermute pulled more than $30 million out of FDUSD. Binance cofounder Yi He subsequently got involved, suggesting that her company audit FDUSD’s reserves.

Justin Sun’s Stablecoin Lawsuit

Justin Sun, the founder of TRON, is at the center of a new stablecoin controversy. In the past, he has raised concerns about First Digital’s TUSD token but also allegedly purchased it in 2023. Today, Sun filed a lawsuit against Trust Digital, claiming that the firm is insolvent and unable to maintain a peg over TUSD:

“First Digital Trust (FDT) is effectively insolvent and unable to fulfill client fund redemptions. I strongly recommend that users take immediate action to secure their assets. I urge regulators and law enforcement to take swift action to address these issues and prevent further major losses. Hong Kong’s reputation as a global financial center is at stake,” Sun stated.

Although the centerpiece of Sun’s lawsuit is the TUSD stablecoin, it was barely affected by these claims. Last September, First Digital settled with the SEC over allegations that 99% of TUSD reserves were in risky funds, so Sun’s claims may indeed be legitimate. However, it was FDUSD, an unrelated FDT stablecoin, that depegged to a low of $.087.

First Digital USD (FDUSD) Price Performance. Source:

CoinGecko.

First Digital USD (FDUSD) Price Performance. Source:

CoinGecko.

FDUSD may be an unintended target of Sun’s stablecoin lawsuit, but its price drops could have broader market implications. It is one of the largest stablecoins, and Binance is a major supporter. After Sun’s allegations, Wintermute withdrew over $30 million in FDUSD from Binance accounts, further contributing to market chaos.

This prompted Yi He, cofounder of Binance, to respond in a few different ways. She reminded her audience that FDUSD is not directly connected with Sun’s stablecoin lawsuit and claimed to have no insider knowledge about either party. She also suggested that Binance conduct its own audit. First Digital, for its part, refuted Sun’s claims in very clear terms:

“The recent allegations by Justin Sun against First Digital Trust are completely false. This dispute is with TUSD and not with FDUSD. First Digital is completely solvent. This is a typical Justin Sun smear campaign to try to attack a competitor to his business. FDT will pursue legal action to protect its rights and reputation,” the firm’s statement read.

Considering that both of the principal actors are trying to bring direct legal challenges, more answers will hopefully come soon. Sun, for his part, has been completely resolute in his stablecoin allegations, asserting that First Digital is already insolvent. Whatever happens at the end of this legal battle may have further implications for the stablecoin market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List DePHY (PHY). Come and grab a share of 6,600,000 PHY

New spot margin trading pair — ES/USDT!

Bitget Trading Club Championship (Phase 1) – Make spot trades daily to share 50,000 BGB

SLPUSDT now launched for futures trading and trading bots