On-Chain Data School (Part 2): The Evergreen Profitable Hodlers, What Was Their Cost Basis for Buying BTC?

This article will build upon the previous one and introduce the concept of LTH-MVRV.

Original Article Title: "On-chain Data School (Part 2): The Evergreen Hodlers, What Is Their $BTC Acquisition Cost?"

Original Article Author: Mr. Berg, On-chain Data Analyst

TLDR

- This article will continue the concept of MVRV from the previous part, introducing LTH-MVRV

- LTH = Long Term Holder, defined as BTC held for over 155 days

- LTH-MVRV represents the profitability status of long term holders

- LTH-RP represents the average cost of long term holders

Let's now dive into the main content!

What Is LTH?

LTH = Long Term Holder, defined by Glassnode as "BTC held for over 155 days".

As for why it is 155 days, Glassnode has provided a detailed explanation on their official website; due to the complexity of the content, I will not delve into it here, but interested readers can explore it on their own.

Introduction to LTH-RP

LTH-RP, which stands for Long Term Holder's Realized Price, is essentially their average holding cost. The algorithm divides LTH-Realized Cap by the circulating supply.

As shown in the graph below, the light green color represents the overall market's Realized Price, while the dark green color represents the LTH's Realized Price. The holding cost of long term holders is usually lower than the overall market's average cost.

Comparison of Realized Price and LTH-RP

Introduction to LTH-MVRV

Representing the profit situation of long-term holders, similar to the calculation of MVRV, the LTH-MVRV algorithm is "current market value / LTH-Realized Cap," which can also be expressed as "current market price / LTH-Realized Price."

As shown in the chart below, the change in LTH-MVRV is usually more pronounced than MVRV, because the profits of long-term holders are usually substantial.

Comparison ofMVRV and LTH-MVRV, where the orange line represents LTH-MVRV and the yellow line represents MVRV

Application of Bottom Fishing for LTH-MVRV

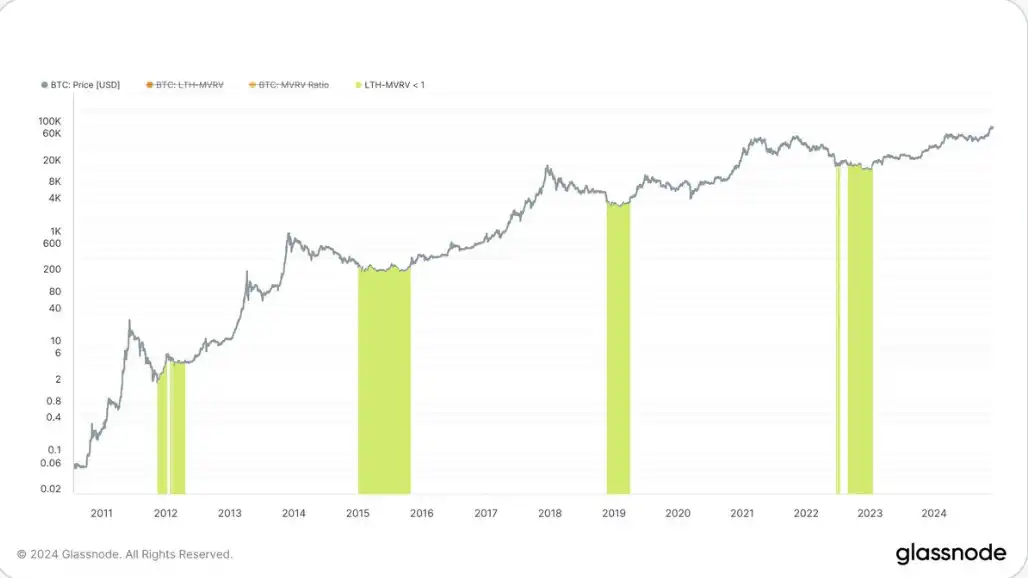

When LTH-MVRV < 1 (or in other words, when the market price is below LTH-RP), it means that even the average long-term holder is at a loss, usually indicating a good bottom fishing opportunity.

As shown in the chart below, I have marked the times when LTH-MVRV < 1, which mostly correspond to cyclical major bottoms. When designing a bottom fishing strategy, this indicator can be taken into consideration~

Prices corresponding to LTH-MVRV < 1

Conclusion

Above is all the content of On-Chain Data Academy (Part Two). Readers interested in delving deeper into on-chain data analysis, be sure to follow this article series!

If you want to see more analysis and educational content on on-chain data, feel free to follow my Twitter (X) account!

Hope this article has been helpful to you. Thank you for reading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Rally Mirrors 12% Surge in Global M2

Bitcoin’s latest rally aligns with a 12.1% rise in global M2, highlighting growing investor concerns over fiat debasement.Understanding the Global M2-Bitcoin LinkMore Printing, More Bitcoiners

Bitcoin Search Trends Remain Low Despite ETF Hype

Google searches for Bitcoin are still far below 2017 and 2021 levels, even with ETF approvals and institutional interest.Institutions Are In, But Retail Is AbsentWhat This Means for the Market

Ethereum Staking Hits Record 29.44% – Smart Money Holds Strong

Ethereum staking reaches an all-time high of 29.44%, signaling strong confidence among long-term holders.Smart Money Signals Long-Term ConfidenceWhat This Means for Ethereum’s Future

El Salvador Adds 8 BTC, Holdings Now Top $735M

El Salvador buys 8 more Bitcoin, raising its total to 6,236 BTC worth over $735 million.A Long-Term Vision for BitcoinImpact on Global Crypto Sentiment