Matrixport: BTC is currently hindered by the key resistance area of 90,000 US dollars, and buying interest remains relatively low

Matrixport's latest investment research points out that despite the recent announcement of a new round of tariff measures by US President Trump and some stock market pullback, the market reaction has been relatively mild. This indicates that the current situation is not yet seen as a full-scale "risk aversion" event. The price of Bitcoin is currently blocked at a key resistance area of $90,000, with buying interest still relatively low. The Federal Reserve's neutral stance and shrinking basis and financing rates indicate that arbitrage selling pressure may weaken.

The analysis also mentioned that the U.S earnings season is approaching, coupled with the recent ISM manufacturing index falling back into contraction territory, which could lead to further softening in the market. Meanwhile, Bitcoin options skew rate once soared to 20%, reflecting an increased demand for downside protection near $80,000 but has fallen back to 9% as tariff concerns gradually ease.

Matrixport believes that Trump might stabilize market sentiment through policies such as tax cuts or deregulation which could create a more favorable investment environment for his plan to bring manufacturing back home. Changes in market sentiment may trigger moderate buying; investors need to pay attention to potential impacts on crypto markets from tariff policy changes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

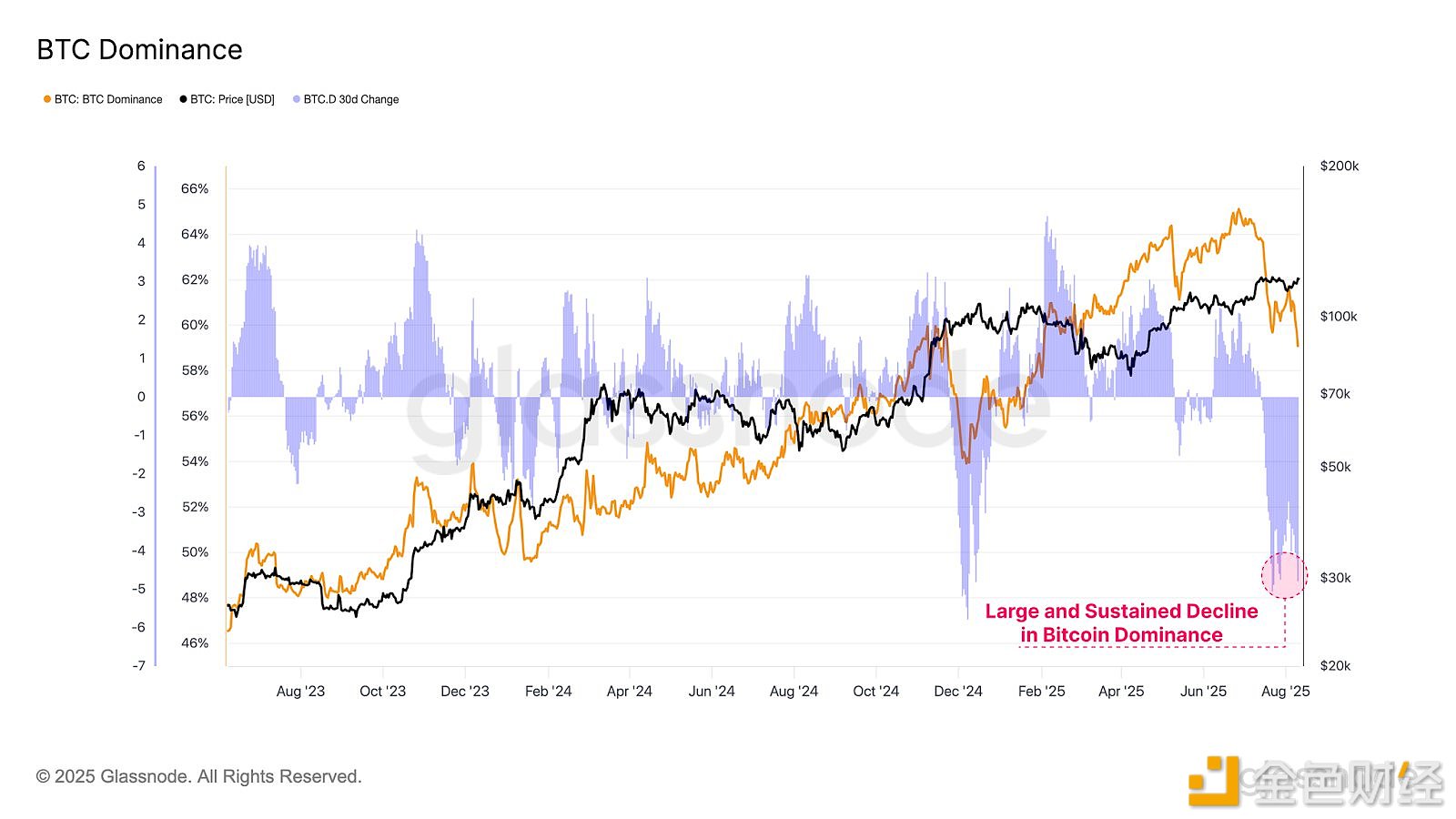

Bitcoin dominance has dropped from 65% to 59% over the past two months

US Treasury Department Calls for Public Comments on Illicit Activities Involving Cryptocurrency

The three major U.S. stock indexes closed nearly flat

U.S. Stocks Close: iQIYI Surges 17%, Intel Falls 3.6%