Anti-CBDC Bill Passes Crucial Vote in House Financial Services Committee

The Anti-CBDC Surveillance State Act aims to limit the Federal Reserve's role in issuing digital currencies, addressing concerns about government surveillance and privacy risks.

The US House Financial Services Committee has approved the Anti-CBDC Surveillance State Act (HR 1919). The bill passed with 27 votes in favor and 22 against.

It aims to ban the Federal Reserve from developing or issuing a Central Bank Digital Currency (CBDC) without explicit Congressional authorization.

US Committee Pushes Back Against CBDCs with Surveillance Act

GOP Majority Whip Tom Emmer introduced the bill on March 6. It seeks to limit the centralization and potential surveillance aspects associated with digital currencies issued by central banks.

“To amend the Federal Reserve Act to prohibit the Federal reserve banks from offering certain products or services directly to an individual, to prohibit the use of central bank digital currency for monetary policy, and for other purposes,” the bill reads.

The bill bans the Federal Reserve from issuing a CBDC directly to individuals. It also prevents the Fed from creating accounts for them or using the currency for monetary policy.

Representative Emmer took a firm stand against government overreach in the committee session. He argued that they have no business developing tools for financial surveillance. Emmer also zeroed in on the risks posed by CBDCs.

He described it as a government-controlled, programmable form of money. Furthermore, the representative explained that without cash-like privacy safeguards, it could hand federal authorities unprecedented power to monitor Americans’ every transaction and clamp down on politically inconvenient activities.

Drawing from global examples, Emmer highlighted China’s use of a CBDC under Communist Party control to keep tabs on citizens’ spending patterns. He also pointed to Canada, where the Trudeau government froze the bank accounts of trucker protest participants in 2022, as a stark warning of how such tools could be weaponized.

“The Anti-CBDC Surveillance State Act ensures that the United States digital currency policy is in the hands of the American people, not the administrative state. It reflects our American values of privacy, individual sovereignty, and free market competitiveness,” Emmer stated.

Notably, a January 2025 White House executive order echoed similar concerns. President Trump’s order warned that CBDCs could jeopardize financial stability, privacy, and US sovereignty.

It called for measures to prohibit them within US jurisdiction while encouraging alternatives such as dollar-backed stablecoins and ensuring continued access to open blockchain networks.

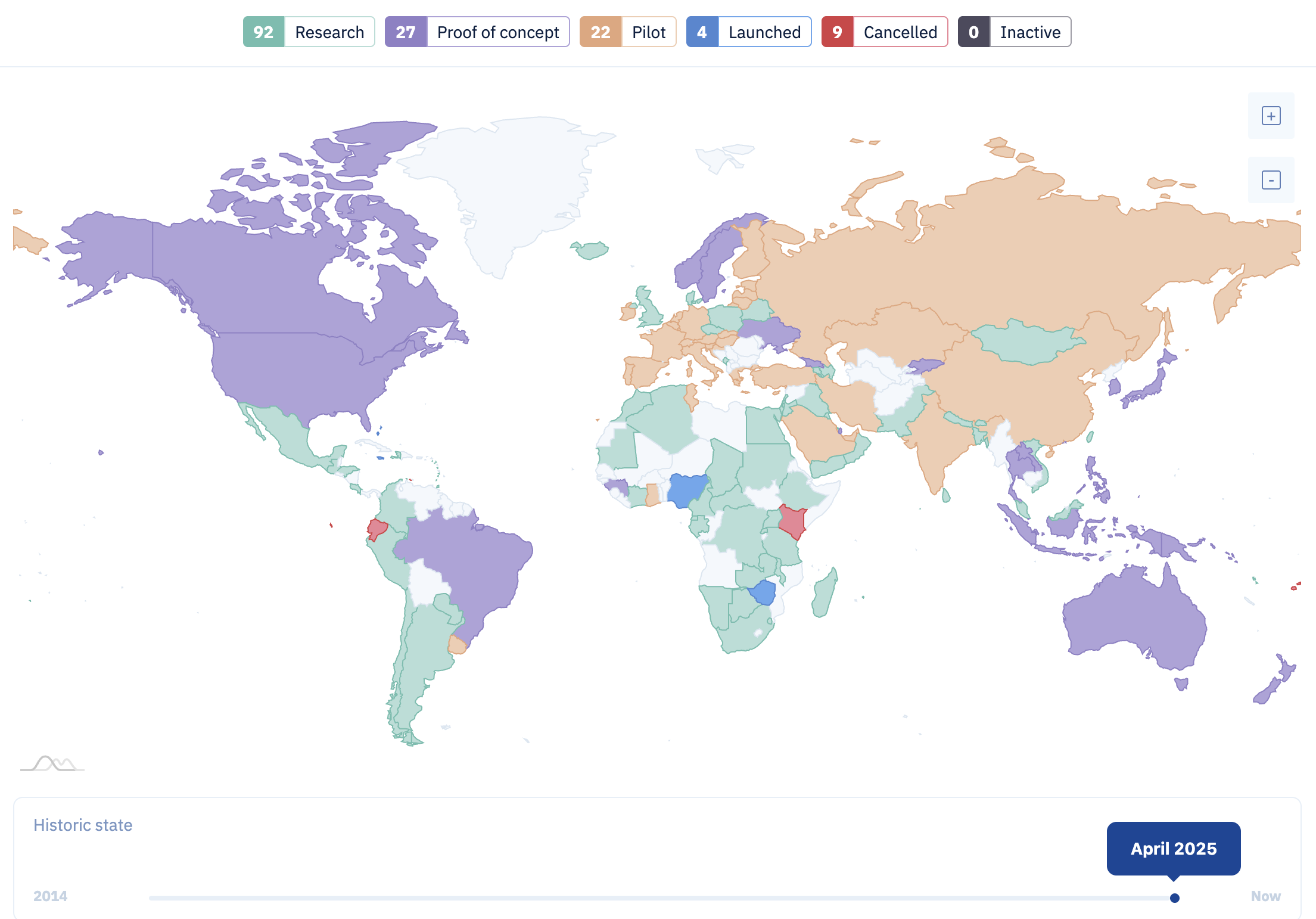

Meanwhile, the US push against CBDCs comes amid heightened global interest in them. As of March 2025, 115 countries and regions are actively involved in CBDC projects.

Countries Exploring CBDCs. Source:

CDBC Tracker

Countries Exploring CBDCs. Source:

CDBC Tracker

Among these, 92 are in the research phase, 27 are working on proof of concepts, and 22 are conducting pilot programs. Moreover, four countries have officially launched their CBDCs. Lastly, only nine projects have been canceled.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK