Date: Fri, April 04, 2025 | 01:20 PM GMT

The cryptocurrency market has been struggling with an extended correction phase following the late 2024 rallies. Even strong assets like Ethereum (ETH) have taken a significant hit, falling from their December 6 high of $4,000 to $1,800.

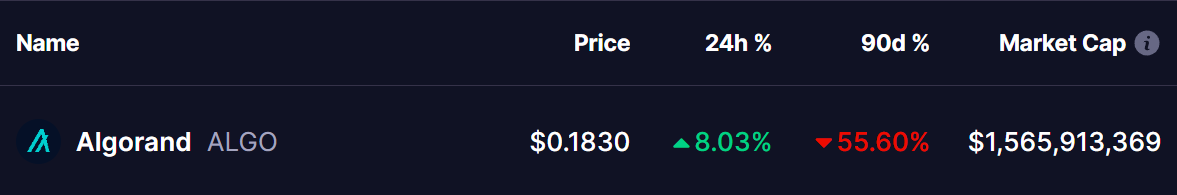

Among major altcoins , Algorand (ALGO) has also suffered, dropping more than 55% in the last 90 days. However, historical price trends suggest that ALGO might be on the verge of a strong trend reversal, potentially setting the stage for another major rally.

Source: Coinmarketcap

Source: Coinmarketcap

Historical Pattern Hints at a Big Rally

A closer look at ALGO’s weekly chart reveals a recurring accumulation pattern that has previously led to massive price surges. The structure looks strikingly similar to ALGO’s 2020 price action, which eventually fueled its 2021 bull run.

In previous cycles, ALGO has faced multiple rejections from an ascending resistance trendline, leading to short-term corrections. However, each rejection has been followed by higher lows, a sign of gradual accumulation before a breakout. This pattern is evident again, with ALGO recently touching this key resistance zone before pulling back.

Another crucial signal is ALGO’s interaction with the 50-week moving average (MA). Historically, every major breakout has occurred after ALGO successfully tested this moving average as support. The last time this happened, the token surged by over 900% in a parabolic rally. The current market structure shows a similar retest of the 50-week MA, suggesting that ALGO might be repeating its historical price movement.

The MACD indicator further strengthens this bullish argument. In past market cycles, whenever ALGO’s MACD displayed a bullish crossover near the 50-week MA, it signaled the start of a major uptrend. The latest MACD readings hint at a similar setup, raising the possibility of a trend reversal in the coming weeks.

What’s Ahead for ALGO?

If ALGO follows its previous cycle, a breakout above the ascending resistance trendline could confirm a bullish reversal. The immediate resistance levels to watch are in the $0.40–$0.50 range, a key zone where ALGO has historically struggled before breaking out. If momentum picks up, the token could aim for $1.00 and beyond, similar to its 2021 price surge.

However, if ALGO fails to break this resistance, it could continue consolidating for an extended period, delaying any potential rally. The key factors to monitor in the coming weeks are whether the 50-week MA holds as support and if the MACD crossover confirms bullish momentum.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.