XRP Price Primed For Explosive 73% Breakout, $2 Support Firm

XRP forms bullish triangle pattern targeting a 73% upside move. $2 support holds despite weak retail sentiment and whale outflows. Ripple’s RLUSD integration could boost XRP adoption and liquidity.

XRP price stabilized above $2 this week, holding its key support despite a wider crypto market slump and weakening on-chain signals.

Analysts now point to a bullish triangle pattern, suggesting a 73% upside if confirmed.

The XRP/USD pair hovered near $2.06 on Apr. 4, up 0.6% intraday, per TradingView.

The move follows a brief dip to $2.03 after a marketwide sell-off triggered by U.S. President Donald Trump’s sweeping “Liberation Day” tariffs.

XRP Price Eyes Breakout Amid Triangle Compression

XRP/USD price appears to be compressing within a symmetrical triangle, with a potential target of $3.55.

The projected move represents a 73.77% rally from the current levels, based on the height of the formation.

XRP/USD

XRP/USD

The triangle’s support line has held firm since late March, while resistance around $2.33 remains unbroken.

Technical analyst Steph Is Crypto said in an Apr. 2 post that XRP is “heavily compressing” and preparing for a major breakout.

Crypto trader CasiTrades echoed that view, pointing to a bullish divergence on the relative strength index (RSI).

Source: Steph Is Crypto/X

Source: Steph Is Crypto/X

“XRP could bottom at $1.95 where subwaves converge,” she noted, citing Elliott Wave theory. She warned, however, that a wick down to $1.90 could invalidate the structure.

RLUSD Integration Could Fuel Utility Surge

Ripple announced on Apr. 2 the integration of its stablecoin Ripple USD (RLUSD) into Ripple Payments.

The move aims to strengthen XRP’s utility by pairing it with RLUSD for institutional settlements.

Source: X / Ripple

Source: X / Ripple

“Ripple’s $RLUSD integration is a pivotal move for cross-border payments,” said insights firm Alva on Apr. 3 via X, adding,

“Optimism around $RLUSD soaring, with eyes on its ripple effect on XRP.”

Source: Alva/X

Source: Alva/X

Launched in Dec. 2024, RLUSD saw its market cap grow 87% in March to $244 million, according to rwa.xyz.

Paired with XRP, the stablecoin supports liquidity in Ripple’s cross-border system, potentially driving volume on the XRP Ledger’s decentralized exchange.

Ripple claims this dual-asset setup could tap into the $230 billion cross-border payments market by combining stability (RLUSD) with liquidity (XRP).

Retail Confidence Wavers Despite 600% Rally

Despite the bullish structure and new integrations, on-chain data paints a more cautious picture.

XRP gained over 600% since 2022, driven by retail speculation and expectations of a crypto-friendly U.S. presidency.

XRP’s new investor realized the cap. Source: Glassnode

XRP’s new investor realized the cap. Source: Glassnode

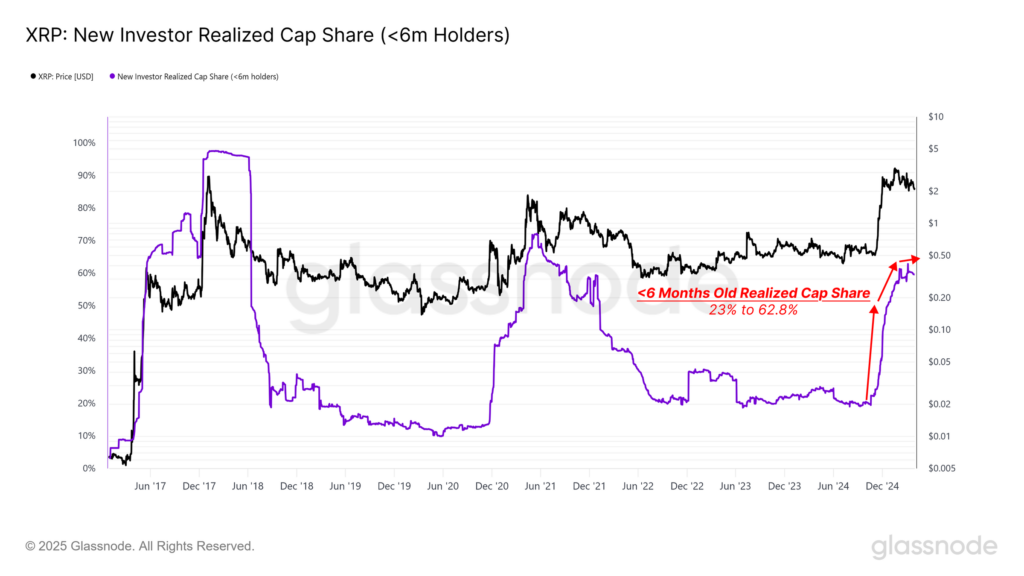

Glassnode data shows daily active addresses for XRP surged 490%, peaking alongside a seven-year price high.

But since Feb. 2025, activity has dropped. Network Growth declined from 514 to 42. Active addresses also fell from 10,200 in Jan. to 4,388.

Meanwhile, new investors now hold 62.8% of XRP’s realized cap, up from 23% six months ago. Glassnode analysts warned that

“retail investor confidence in XRP may be slipping.”

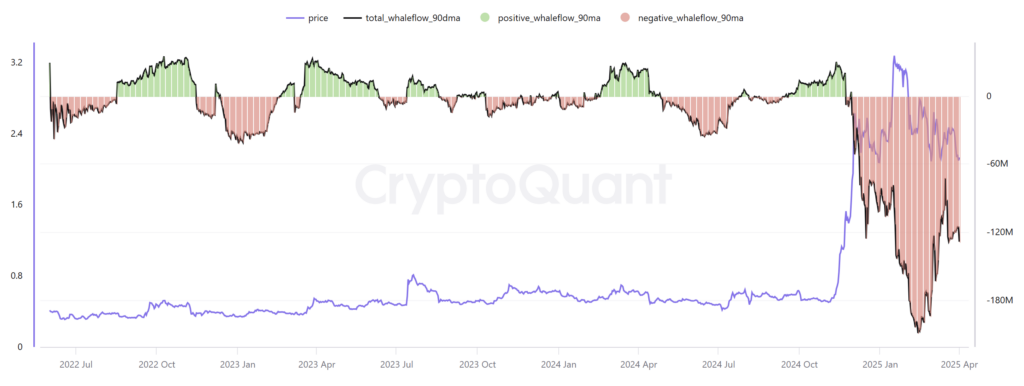

Whales Exit, But $2 Remains Critical Level

Large holders appear to be reducing their exposure. Whale outflows topped $1 billion over the past 14 days, with the average exit price around $2.10, CryptoQuant data shows.

Whale flow 30-day moving average. Source: CryptoQuant

Whale flow 30-day moving average. Source: CryptoQuant

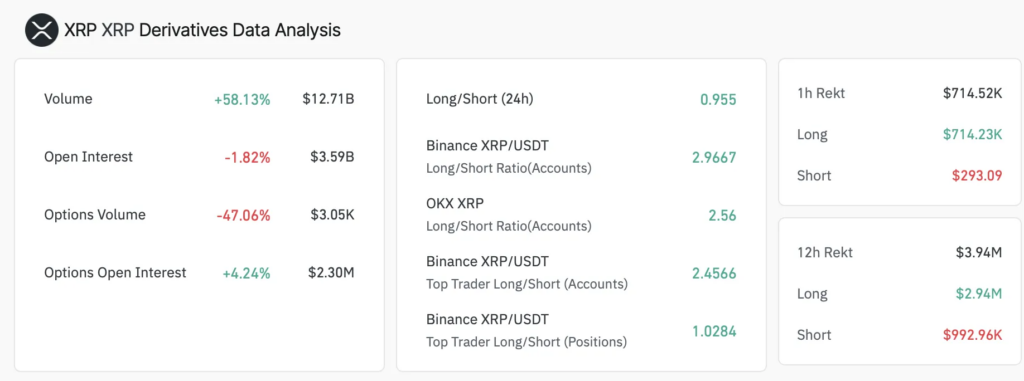

On Apr. 3 alone, XRP saw $3.94 million in liquidations, including $2.94 million in long positions, per Coinglass.

XRP derivatives liquidation. Source: Coinglass

XRP derivatives liquidation. Source: Coinglass

Santiment data also highlights a growing XRP supply, likely linked to Ripple’s monthly token releases.

As supply increases, XRP’s price tends to drop, limiting near-term upside. Still, XRP has tested the $2 mark multiple times and held.

Traders now watch the 200-day moving average near $1.80 as the next key support, with the $1.95–$1.90 zone emerging as a make-or-break level.

Source: CoinMarketCap

Source: CoinMarketCap

As of writing, XRP trades at $2.05, down 8.5% in the past week. Despite bearish signals, the technical setup suggests a breakout may be on the horizon—if bulls can defend $2.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Rally Mirrors 12% Surge in Global M2

Bitcoin’s latest rally aligns with a 12.1% rise in global M2, highlighting growing investor concerns over fiat debasement.Understanding the Global M2-Bitcoin LinkMore Printing, More Bitcoiners

Bitcoin Search Trends Remain Low Despite ETF Hype

Google searches for Bitcoin are still far below 2017 and 2021 levels, even with ETF approvals and institutional interest.Institutions Are In, But Retail Is AbsentWhat This Means for the Market

Ethereum Staking Hits Record 29.44% – Smart Money Holds Strong

Ethereum staking reaches an all-time high of 29.44%, signaling strong confidence among long-term holders.Smart Money Signals Long-Term ConfidenceWhat This Means for Ethereum’s Future

El Salvador Adds 8 BTC, Holdings Now Top $735M

El Salvador buys 8 more Bitcoin, raising its total to 6,236 BTC worth over $735 million.A Long-Term Vision for BitcoinImpact on Global Crypto Sentiment