Bitcoin Futures have reached record highs as Bitcoin (BTC) price traded below $85,000. While the rise reflected renewed interest from both institutions and retail traders, the larger bearish undertone took over the market.

Early this week, while prices had increased, whales started establishing short-term positions which unlike retail traders indicate an approaching market correction.

Different indicators across on-chain and derivative platforms indicate that market momentum will remain positive even though this recent whale trend may point towards an upcoming market adjustment.

Market-leading whales actively use futures platforms to create short positions at present, reflecting their expectation of limited price growth.

Even though retail traders maintain their long-position investments, they signal optimism for rising Bitcoin prices. Market volatility may occur during the short term because investor sentiment is at cross purposes between retail and whale investors.

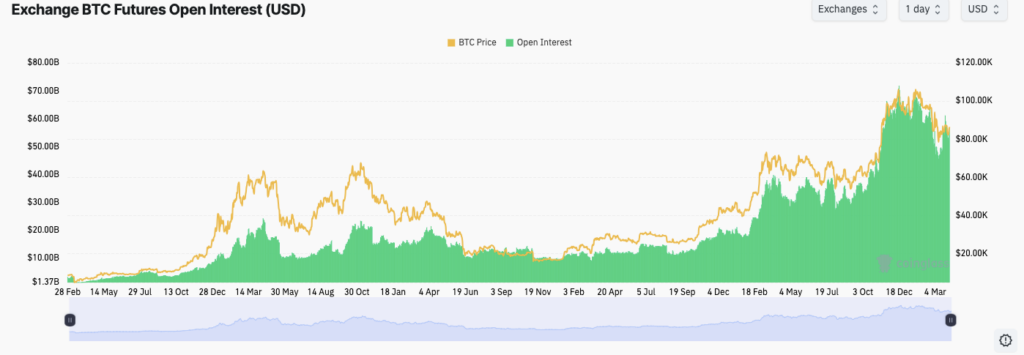

The current increase in Bitcoin Futures open interest shows significant trader activity, particularly in leveraged positions.

The ongoing increase of open interest (OI) stands above $100 billion to trigger capital inflow into derivative markets. The anticipated price swings become stronger because of unexpected contract Holder liquidations during periods of swift market fluctuations.

Source: Coinglass

Source: Coinglass

Altcoin Futures Show Mixed Sentiment as Whales Close Longs

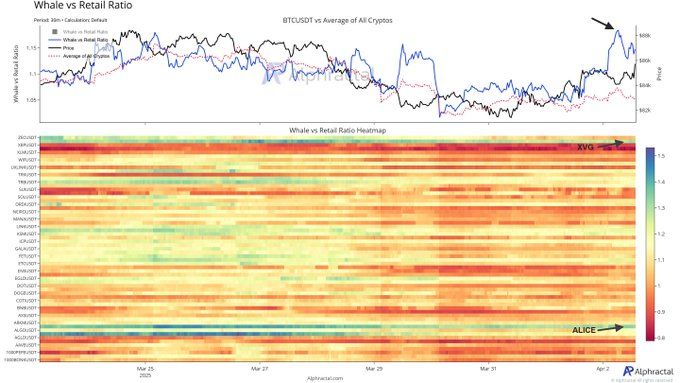

The altcoin market remains under control of whale traders who prefer to end their long positions while keeping their short positions on major contracts.

Whales show declining favorable views toward most alternative coins as they approach uncertain price potentials in the near future. Among the tokens, only XVG and ALICE demonstrate preference towards long positions from whales at this time.

Source: X

Source: X

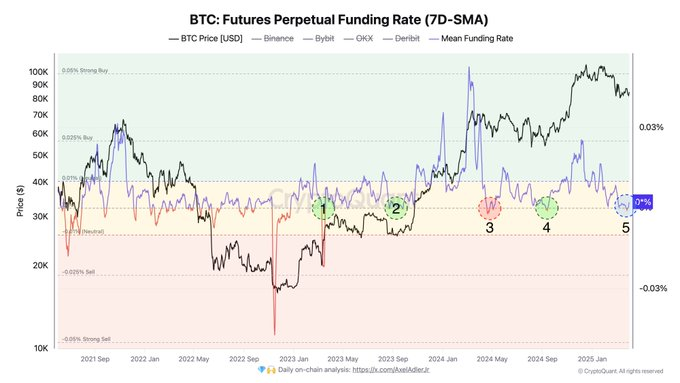

The recent movement in altcoin market sentiment occurred while funding rates for altcoins at Binance, ByBit, OKX, and Deribit cooled down across the board.

Actively used leverage reflects the current trader sentiment, which shows itself through nearly zero funding rates and occasional negative funding rates.

Negative market rates indicate that short trading positions have gained strength alongside high-volume traders who bet against the positions held by retail investors.

Source: X

Source: X

However, Bitcoin Futures continue to maintain momentum, drawing attention away from smaller coins. Traders are reallocating capital into Bitcoin Futures due to its more favorable risk-reward ratio. Volatility within the altcoin market will probably decrease until investors regain stability in the overall market direction.

Bitcoin Exchange Reserves Hit New Low

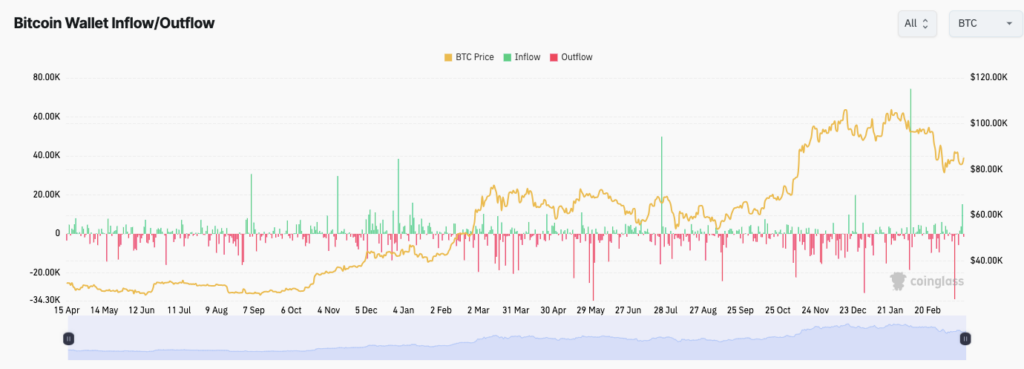

The amount of Bitcoin held by trading platforms has reached its minimum point since the beginning of 2021 because users are keeping their coins out of active exchange inventories.

Market participants withdraw coins from exchanges at rising rates since they believe long-term holding generates better results. Institutional investors maintain both buying and selling activities, which forms a stable support system for demand.

Source: Coinglass

Source: Coinglass

This trend aligns with Bitcoin Futures growth, where rising open interest suggests that traders expect higher prices ahead.

The reduction of circulating supply resulted from spot market selling slowing down and long-term holders resuming their purchase activities. The net effect of these conditions develops into an upward trend because rising demand meets shrinking supply.

Economic indicators and macro uncertainty reduce market optimism during times of financial uncertainty. Positive announcements from the Federal Reserve or U.S. leadership can improve market risk tolerance and drive substantial funds into ETFs.

Market developments might boost Bitcoin prices to the next $130,000 price target, which speculators already project for this current quarter.

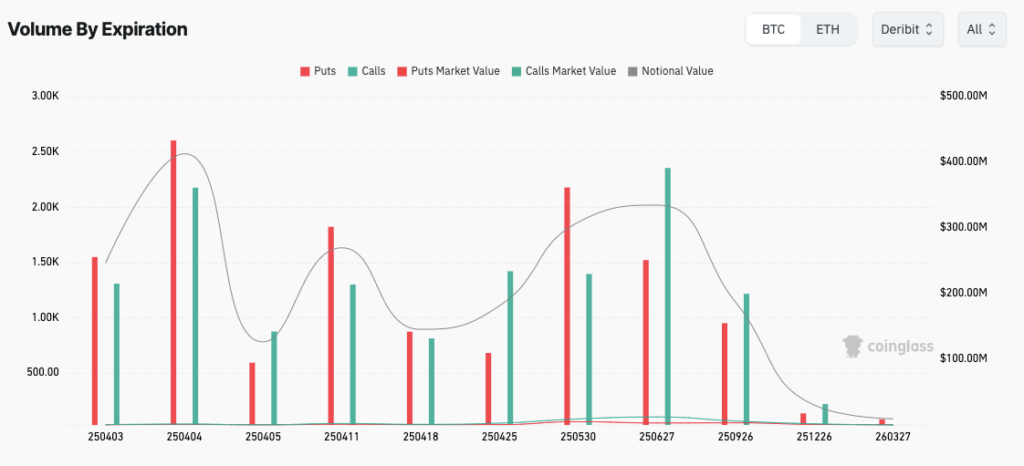

Bitcoin Futures Volumes Rise Ahead of Key April Expirations

Bitcoin Futures trading volumes have increased significantly as traders prepare for upcoming expirations on April 4 and April 30, 2025. Investors have been active in trading notional values since the issuance of call-and-put options across different platforms. Most traders prefer calls for long-term contracts but they favor puts for contracts that expire soon.

Source: Coinglass

Source: Coinglass

The market activity indicates extreme volatility may be on the way because futures markets will process additional capital through directional bets.

The contracts that expire between mid-April and late April have become popular among traders because they anticipate market price changes within this period.

The success of bullish forecasts would likely create additional gains, which would be enhanced by both contract renewal mechanisms and market speculations.

The increase in open interest documentation across these futures contracts demonstrates that traders who utilize leverage remain confident about their market predictions.

Rising open interest enhances rally gains, yet any transformation in market sentiments might result in quick price corrections. Tracking future movement is paramount to determining Bitcoin’s short-term market trends.