Bitcoin ETFs Slip Back Into Outflow Trend With $100 Million Exit

Bitcoin ETF Outflows Resume as $100 Million Leaves Funds, Ether ETFs Extend Losses

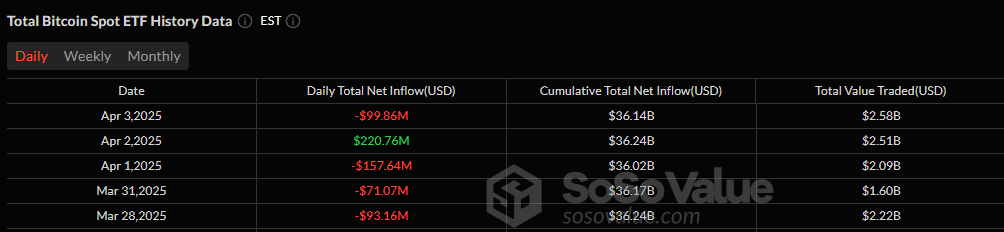

The brief resurgence of bitcoin exchange-traded funds (ETFs) was short-lived. After a substantial $221 million inflow on Wednesday, April 2, funds reversed course, shedding $99.86 million on Thursday, April 3, as investor sentiment wavered again.

Grayscale’s GBTC led the downturn with a hefty $60.20 million outflow, followed by Bitwise’s BITB, which saw $44.19 million exit. Fidelity’s FBTC and Ark 21Shares’ ARKB weren’t spared either, with outflows of $23.27 million and $20.05 million, respectively.

Even Vaneck’s HODL and Wisdomtree’s BTCW couldn’t escape the sell-off, posting exits of $12.18 million and $5.22 million. Despite Blackrock’s IBIT pulling in a significant $65.25 million, it wasn’t enough to offset the bearish trend.

Source: Sosovalue

At the close of trading, bitcoin ETFs had a total trading volume of $2.58 billion, with net assets sinking to $92.18 billion.

Ether ETFs continued their steady decline, logging a $3.59 million outflow, entirely driven by Bitwise’s ETHW. The rest of the funds remained untouched, offering no inflows to counterbalance the losses. Trading volume stood at $238.09 million, with net assets slipping further to $6.07 billion.

With bitcoin ETFs stuck in a cycle of inflows and outflows and ether ETFs showing no signs of recovery, market watchers are bracing for more volatility ahead. Will bitcoin ETFs see another sharp reversal, or is this the start of a prolonged downturn?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mantra Partners with Agri-Tech Leader Dimitra for Scalable Blockchain Solutions in Global Agriculture and Sustainability Projects

ChatGPT Identifies Cryptos for 900% Gain by 2026

Ripple Urges SEC for Clear Cryptocurrency Regulations

ZKsync Unveils Institutional Blockchain Platform Prividium