Bitcoin shows signs of decoupling from US equities, could reclaim $100K

Key Takeaways

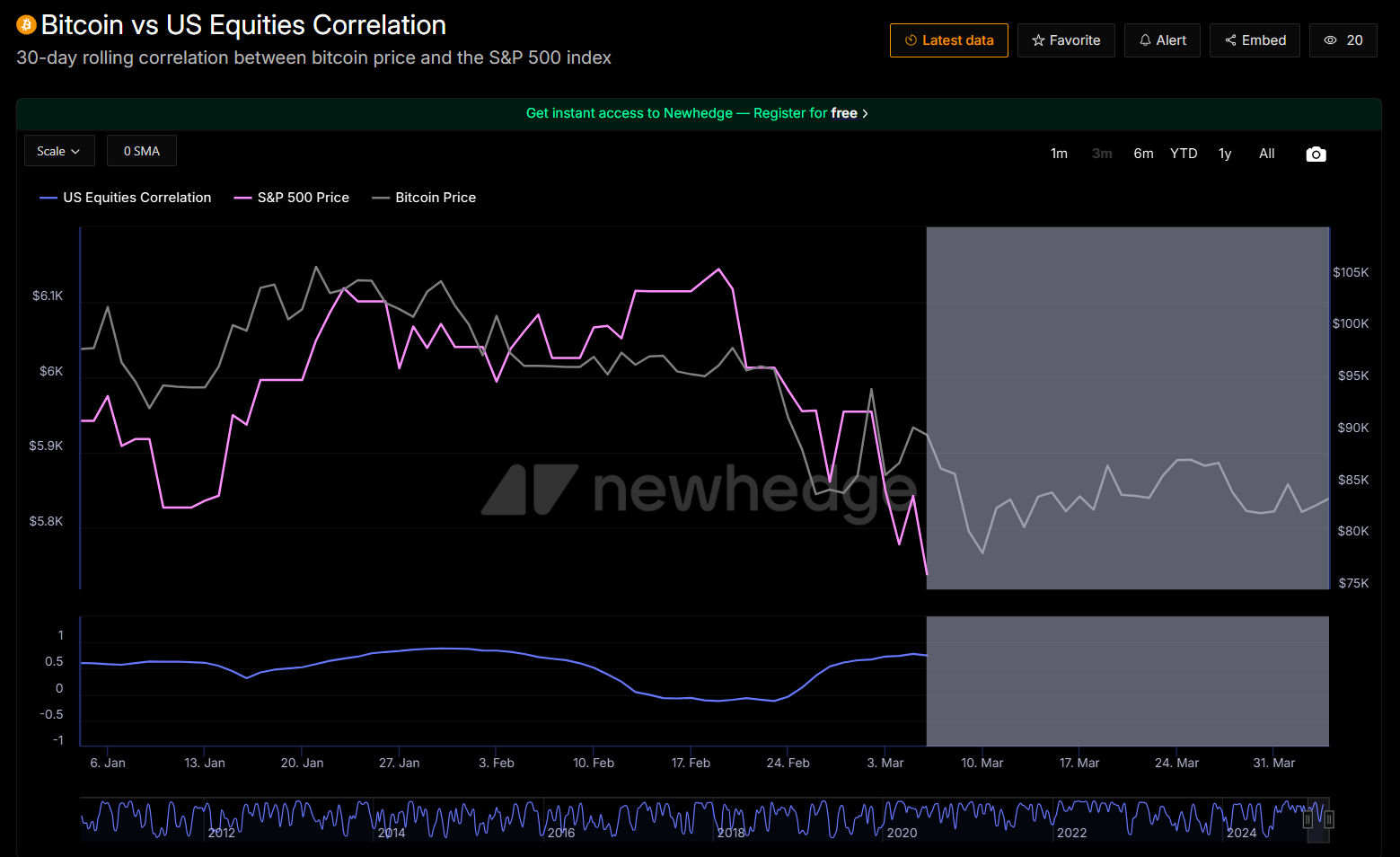

- Bitcoin’s resilience hints at a structural break from stock market movements.

- The emerging pattern of independent price action positions Bitcoin towards the $100,000 level.

Stocks dipped, gold slipped, but Bitcoin bounced. That’s the big story from this week’s tariff shake-up.

Bitcoin is exhibiting early signs of breaking its correlation with US equities as it remained resilient above the $82,000 mark during a Friday downturn that erased $2.5 trillion from the S&P 500 Index.

Markets reeled Thursday in the first full session after President Trump’s tariff announcement, setting the stage for a two-day sell-off that wiped out over $5 trillion of US equities.

By the end of Friday, the S&P 500 and Nasdaq Composite had both tumbled nearly 6%, and the Dow plunged 5.5%—its biggest one-day loss since June 2020.

Bitcoin did show some pullbacks as soon as tariffs were announced, falling to $81,500 in the wake of the announcement. However, it swiftly rebounded to reach $84,600 by Friday.

On Friday, despite facing renewed pressure in the early hours, the digital asset demonstrated resilience—stabilizing and climbing back above $84,000 during intraday trading.

At the time of writing, Bitcoin was changing hands at around $83,700, with a slight decrease over the past 24 hours, according to TradingView.

Commenting on Bitcoin’s recent break from stocks, Blockstream CEO Adam Back stated that the prior correlation between Bitcoin and traditional markets might have been more of a byproduct of market dynamics, possibly driven by market maker activity exploiting liquidity conditions.

“[I] was thinking the coupling was fake. Maybe market makers [were] using Bitcoin market shortage of fiat liquidity to auto-correlate Bitcoin, noticeable on US market [opening],” he said.

The divergence in behavior may signal that Bitcoin is entering a phase of independent price action, which could support Bitcoin’s movement toward the $100,000 price level earlier than previously anticipated.

Market analyst Macroscope suggests Bitcoin’s price trajectory could follow gold’s historical trends. If Bitcoin reclaims $100,000, it could trigger a shift of capital from gold to Bitcoin and a repeat of historical outperformance over other assets, according to the analyst.

“In previous cycles, a reclaim of the recent high has kicked off a new period of outperformance,” he said.

Tariffs as a potential catalyst for Bitcoin’s growth

Trump’s aggressive tariffs are aimed at correcting global economic imbalances, and while these measures are causing pain in traditional markets, they might be the catalyst that allows Bitcoin to finally decouple from its association with risk-on tech stocks, said BitMEX co-founder Arthur Hayes in a recent statement.

“$BTC hodlers need to learn to love tariffs, maybe we finally broke the correlation with Nasdaq, and can move onto the purest form of a fiat liquidity smoke alarm,” Hayes stated .

The analyst noted in an earlier statement that the negative consequences of these tariffs will force governments and central banks to respond by printing more money to stabilize the economy and the Treasury market.

This, in turn, enhances Bitcoin’s appeal as a scarce and decentralized alternative, acting as a hedge against fiat currency debasement.

That said, despite the fear surrounding tariffs, Hayes, as well as many crypto investors and analysts, see them as potentially a positive development for the long-term value of Bitcoin.

“Today’s market reaction to tariffs is a reminder: inflation is just the tip of the iceberg,” said Strategy’s co-founder Michael Saylor in a Friday statement . “Capital faces dilution from taxes, regulation, competition, obsolescence, and unforeseen events. Bitcoin offers resilience in a world full of hidden risks.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List Almanak (ALMANAK). Come and grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

CandyBomb x US: Trade to share 5,400,000 US

Earn up to 50 USDT: Make your first USD deposit!