JPMorgan Chase Sees One Stock Market Index Outperforming S&P 500 Over Next 15 Years Amid US Policy Uncertainty, Declining Consumer Confidence

Bank behemoth JPMorgan Chase says one stock market index looks primed to pull off a reversal and outperform the S&P 500 in the next decade.

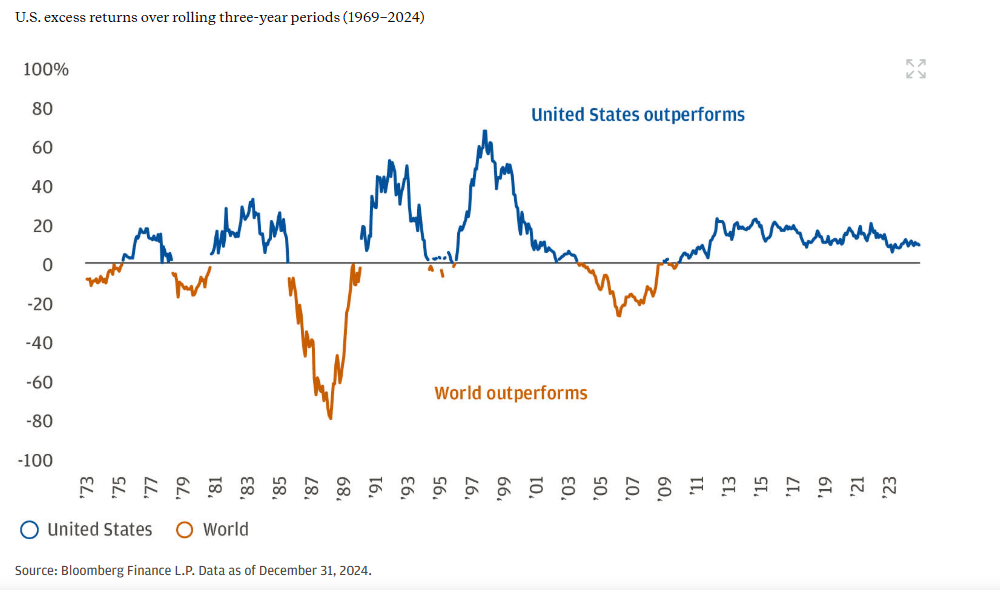

In a new investment strategy note, JPMorgan analysts Andrew VanWazer and William M. Smith say that the S&P 500 has meaningfully outshone the MSCI EAFE Index over a period of about 16 years, but that may start to change.

The MSCI EAFE Index tracks the performance of the stocks of large and mid-cap firms in Europe, Australasia and the Far East. Investors use the index as a benchmark for the performance of international equity portfolios.

VanWazer and Smith say ,

“Since mid-2008, the S&P 500 has beaten the MSCI EAFE Index by a sizable margin, delivering average annual returns of 11.9% versus 3.6% through December 2024.”

Source: JPMorgan

Source: JPMorgan

But JPMorgan says that US market exceptionalism is now starting to crack, particularly in the tech sector, following China’s announcement that artificial intelligence (AI) startup DeepSeek had launched a model that can compete against America’s finest AI platforms.

“As soon as the news about DeepSeek broke, for example, the US market’s relative valuation to EAFE dropped from 55% to 49% – since then, it has declined further, to 39% (as of March 11th).”

According to the JPMorgan analysts, uncertainties surrounding US economic and foreign policies, souring consumer confidence, increasing inflation due to Trump’s tariffs and the potential resolution of the Ukraine war could serve as catalysts for a shift in market leadership.

“JPMorgan Asset Management’s Long-Term Capital Market Assumptions (LTCMAs) forecast that EAFE stocks may outperform US stocks by 1.4% (8.1% versus 6.7%) over a 10- to 15-year investment horizon. Many investors have been skeptical of that prediction, but recent market events have underscored how vulnerable US equities may be to higher tech-stock volatility, the threat of trade tariffs and declining US consumer confidence.”

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

US Labor Department changes tune on crypto in 401(k) plans

Share link:In this post: The US Department of Labor reversed an earlier guidance that discouraged retirement managers from considering crypto as an investment option in 401(k) plans. The government’s stance is now fully neutral, meaning plan providers can offer digital asset exposure. The SEC will hold a major “Emerging Trends in Asset Management” conference on June 5.

Cardano News Today: XRP DeFi on Cardano? Hoskinson Teases Game-Changing Move

The Broken Promise of DeFi

Toncoin Soars Amid Telegram Musk xAI Deal, $1.5 Billion Bond Sale Report