Crypto Fund Outflows Hit $240M, but Blockchain Equities Draw Fresh Inflows

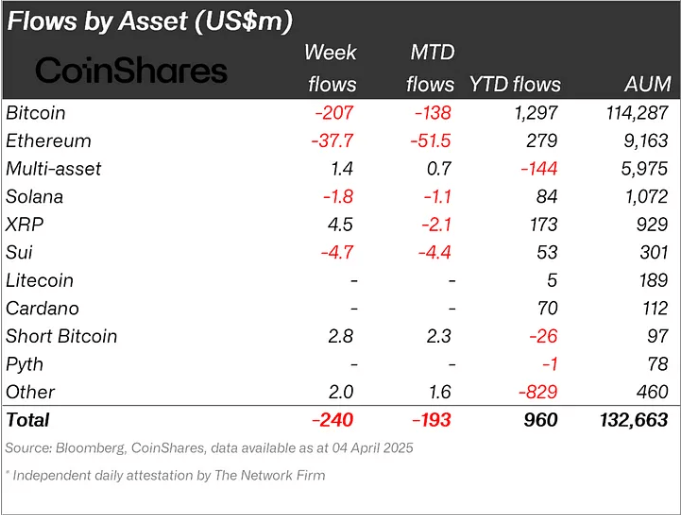

Digital asset funds faced $240 million in outflows last week, with the majority, $207 million, coming from bitcoin products. According to Coinshares’ digital assets weekly report, the downturn appears tied to concerns over new U.S. trade tariffs and their potential impact on global growth.

Despite the outflows, total assets under management (AUM) in the sector rose slightly to $132.6 billion, showcasing relative resilience compared to traditional equities, which saw steeper losses.

Ethereum also experienced notable outflows of $37.7 million, while solana and sui lost $1.8 million and $4.7 million, respectively. In contrast, Toncoin recorded a modest inflow of $1.1 million, highlighting investor interest in alternative assets.

Source: Coinshares

Regionally, the U.S. and Germany led the outflows with $210 million and $17.7 million, respectively. Canadian investors bucked the trend, adding $4.8 million to digital asset holdings amid the market volatility.

One bright spot was blockchain equities, which saw inflows of $8 million for a second consecutive week. The buying suggests some investors are viewing the broader market dip as a long-term opportunity.

While economic uncertainty continues to rattle markets, digital assets appear to be holding firm, maintaining investor interest despite short-term outflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。