Date: Mon, April 14, 2025 | 04:20 AM GMT

The crypto market just witnessed one of the most shocking crashes of the year. On Sunday night, during low-activity hours, top RWA project Mantra (OM)—which had been one of the best-performing assets over the past year—suddenly plunged by 87%, sending shockwaves through the community.

OM’s price crashed from $6.25 to just $0.79 in under an hour, wiping out billions in market cap. At its peak, Mantra was sitting strong at around $6 billion, but following the crash, that number dropped to $771 million at the time of writing—causing major losses for its investors.

Source: Coinmarketcap

Source: Coinmarketcap

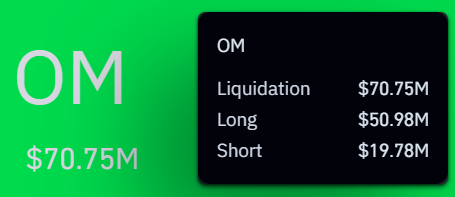

Massive Liquidations

According to live data from Coinglass, the crash triggered massive liquidations—over $70 million in total over the past 24 hours. Of that, $50 million came from long positions, while short sellers lost about $20 million, all primarily from OM positions.

Source: Coinglass

Source: Coinglass

The liquidation list on Coinglass was flooded with OM trades, showing just how isolated—but severe—this event was.

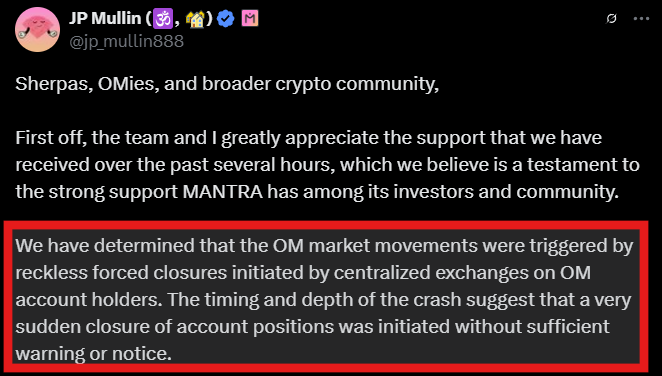

Co-Founder Points Finger at Centralized Exchange

In the aftermath, JP Mullin, Co-Founder of Mantra, broke the silence and placed the blame squarely on centralized exchanges (CEXs).

He claimed that the sudden price drop was triggered by reckless, forced liquidations of OM holders’ accounts—done without proper warning and during low-liquidity hours (Sunday evening UTC / early Monday morning in Asia). Mullin called out this behavior as either gross negligence or intentional market manipulation, hinting that one or more exchanges might have used the opportunity to profit from the chaos.

Source: @jp_mullin888 (X)

Source: @jp_mullin888 (X)

Importantly, Mullin emphasized that neither the Mantra team nor its advisors or investors were responsible for the crash. He reassured the community that all tokens are still locked according to the vesting schedule and that the team remains committed to building.

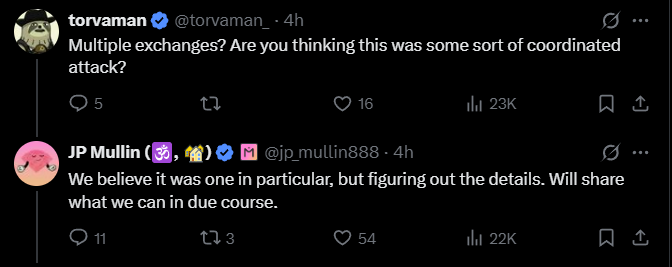

When asked by a user if this could have been a coordinated attack, Mullin replied:

“We believe it was one [exchange] in particular, but figuring out the details. Will share what we can in due course.”

Source: @jp_mullin888 (X)

Source: @jp_mullin888 (X)

He also confirmed that Binance was not involved.

Source: @jp_mullin888 (X)

Source: @jp_mullin888 (X)

What’s Next?

To address the situation and clear the air, JP Mullin will be hosting a community space on X in the coming hours. Investors and followers are encouraged to stay cautious and avoid scam links or fake accounts claiming to be affiliated with Mantra.

Despite the crash, Mullin reminded the community that Mantra has weathered previous storms and continues to build. The team says it’s in it for the long haul.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making investment decisions.