Crypto markets are flashing early signs of a new downturn, as declining venture capital, macroeconomic headwinds, and bearish technicals suggest another crypto winter may be on the horizon, Coinbase Institutional warns.

Weak Market Signals Despite BTC Recovery

The broader cryptocurrency market is flashing signs of renewed weakness despite some resilience from Bitcoin, says Coinbase’s analytics in its monthly outlook .

Sponsored

The total crypto market cap, excluding Bitcoin, has seen a steep 41% decline from its December 2024 high of $1.6T to $950B as of mid-April.

Meanwhile, VC funding is down 50-60% from 2021-22 levels, even lower than almost the entire period from August 2021 through April 2022. This significantly limits the onboarding of new capital into the ecosystem, particularly on the altcoin side.

These structural pressures come from a shaky macro environment, where fiscal tightening and tariffs have stalled investment decisions across risk assets.

Bearish Technical Indicators

A series of bearish technical indicators also suggests growing weakness in the cryptocurrency market.

Bitcoin’s fall below its 200-day moving average in March is a key bearish signal, indicating weakening long-term momentum, according to Coinbase.

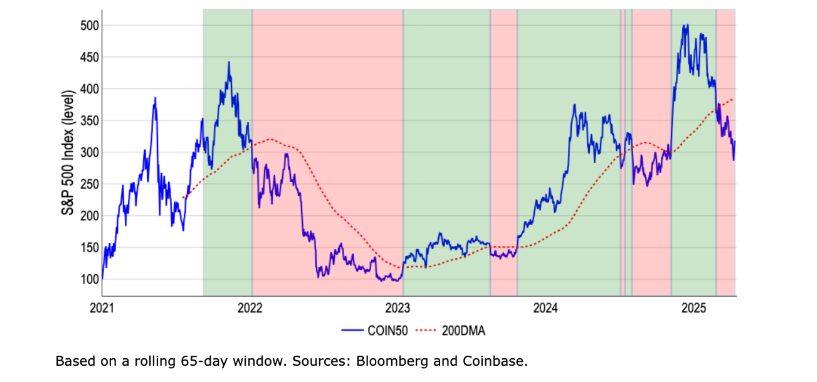

Bull and bear cycles in COIN50 as identified by the 200DMA. Source: Coinbase

Bull and bear cycles in COIN50 as identified by the 200DMA. Source: Coinbase

At the same time, the COIN50 Index, which tracks the top 50 crypto assets, has remained in bear territory since February, signaling broader market stress.

Both technical indicators suggest that despite brief rallies, the crypto market is facing sustained downward pressure.

Cautious Optimism for Second Half of 2025

Despite bearish signals dominating the current landscape, Coinbase Institutional sees room for cautious optimism heading into the second half of 2025.

Analysts suggest that market sentiment could begin to stabilize by mid-to-late Q2, potentially laying the groundwork for a broader recovery in Q3.

While the exact timing remains uncertain, the report advises long-term investors to remain vigilant.

Historically, major market reversals in crypto have occurred quickly and without much warning—making readiness a key factor.

On the Flipside

- High interest rates, tariffs, and global uncertainty continue to weigh on all risk assets, including crypto.

- U.S. regulation and institutional adoption are progressing, but they haven’t yet reversed the market trend.

Why This Matters

Early signs of a crypto winter could shape how investors allocate capital and manage risk in the months ahead.

Read DailyCoin’s hottest crypto news:

Donald Trump Plans Crypto Monopoly Game? Here’s What We Know

Ripple (XRP) ETF: Here’s Latest Status Updates On 9 Fillings