3 US Crypto Stocks to Watch Today

Core Scientific slumps to 2024 lows while MicroStrategy rides investor confidence and Coinbase benefits from a tech-led market bounce.

Crypto US stocks are showing mixed signals this morning, with Core Scientific (CORZ), MicroStrategy (MSTR), and Coinbase (COIN) all in focus. CORZ leads the downside, trading at its lowest level since June 2024 after a steep year-to-date drop.

MSTR is outperforming Bitcoin so far this year, reflecting investor confidence in its BTC-focused strategy. Meanwhile, COIN is bouncing in the pre-market alongside tech stocks, with a key resistance level now in sight.

Core Scientific (CORZ)

Core Scientific (CORZ) closed Tuesday with a 3.80% loss, the sharpest drop among major US crypto stocks. The stock is down 53% in 2024 and is now trading at its lowest level since June last year.

The company provides infrastructure for Bitcoin mining, running large-scale data centers across the U.S. It offers both self-mining and hosting services for institutional clients.

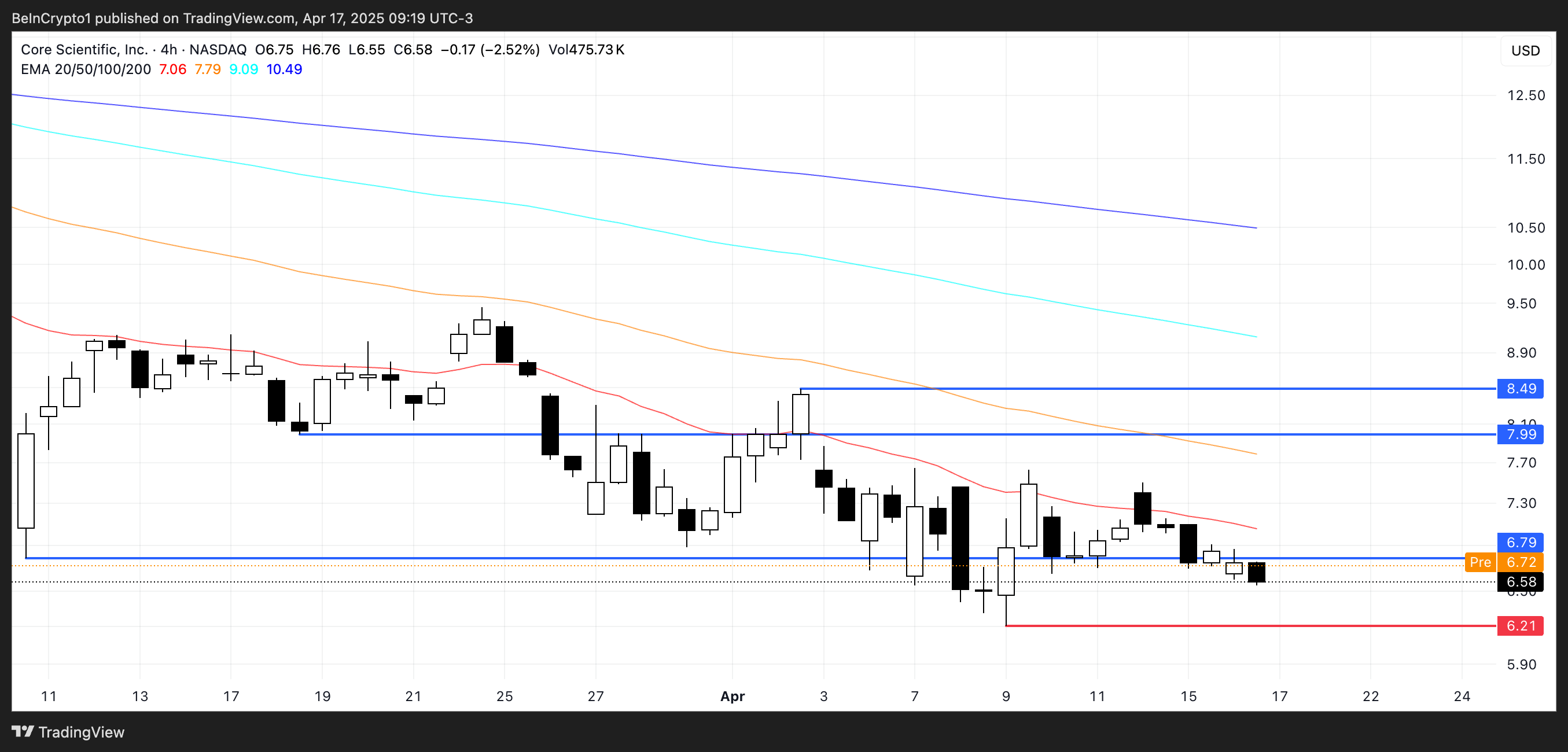

CORZ Price Analysis. Source:

TradingView.

CORZ Price Analysis. Source:

TradingView.

CORZ is up 1.97% in pre-market trading but recently lost the key $6.79 support. The breakdown signals continued weakness in the current trend.

If the downtrend holds, the next support is at $6.21. If broader market sentiment doesn’t improve, a drop to that level could materialize.

Strategy Incorporated (MSTR)

MicroStrategy (MSTR) is a business intelligence firm best known for its massive Bitcoin holdings, driven by Executive Chairman Michael Saylor. Under his leadership, the company has become one of the largest corporate holders of BTC.

The stock closed yesterday with a modest 0.30% gain but is up 1.53% in pre-market trading. MSTR continues to trade with high sensitivity to Bitcoin price movements.

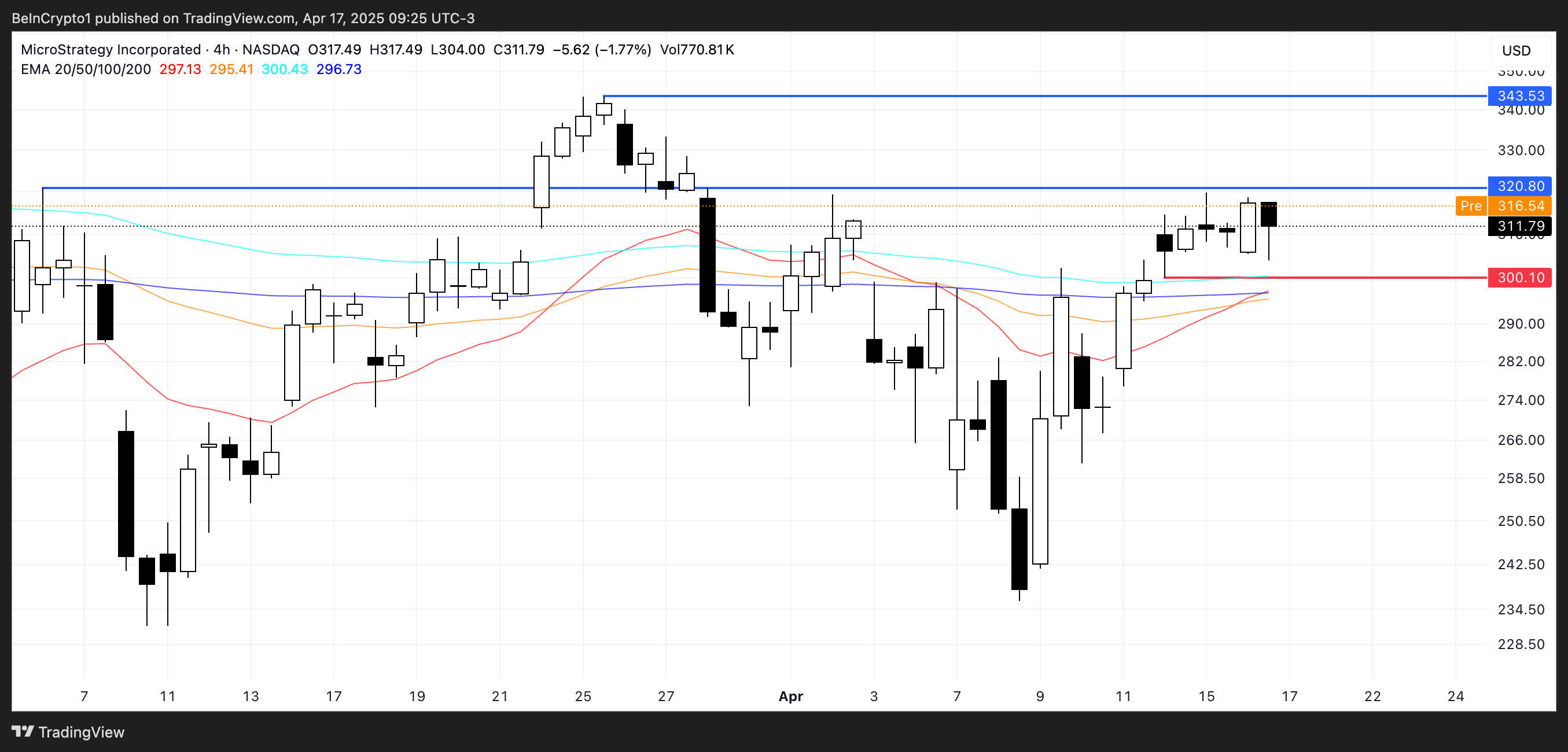

MSTR Price Analysis. Source:

TradingView.

MSTR Price Analysis. Source:

TradingView.

Interestingly, while Bitcoin is down 9% in 2024, MSTR has gained 7.6%. This divergence suggests investors may be pricing in future BTC strength or valuing the company’s strategic positioning around Bitcoin.

MSTR is now approaching key resistance at $320. A break above that level could trigger an uptrend toward the next target at $343.

Coinbase (COIN)

Coinbase (COIN) often trades like both a crypto and a tech stock. Yesterday, major tech names took a hit—META fell 3.68%, GOOG 2.00%, AMZN 2.93%, AAPL 3.89%, and NVDA 6.87%. COIN followed the trend, dropping 1.91%.

Today, however, tech stocks are rebounding in the pre-market, and COIN is up 1.31% so far. A positive open could help shift short-term momentum, with the company predicting stability in Q2 and growth in Q3.

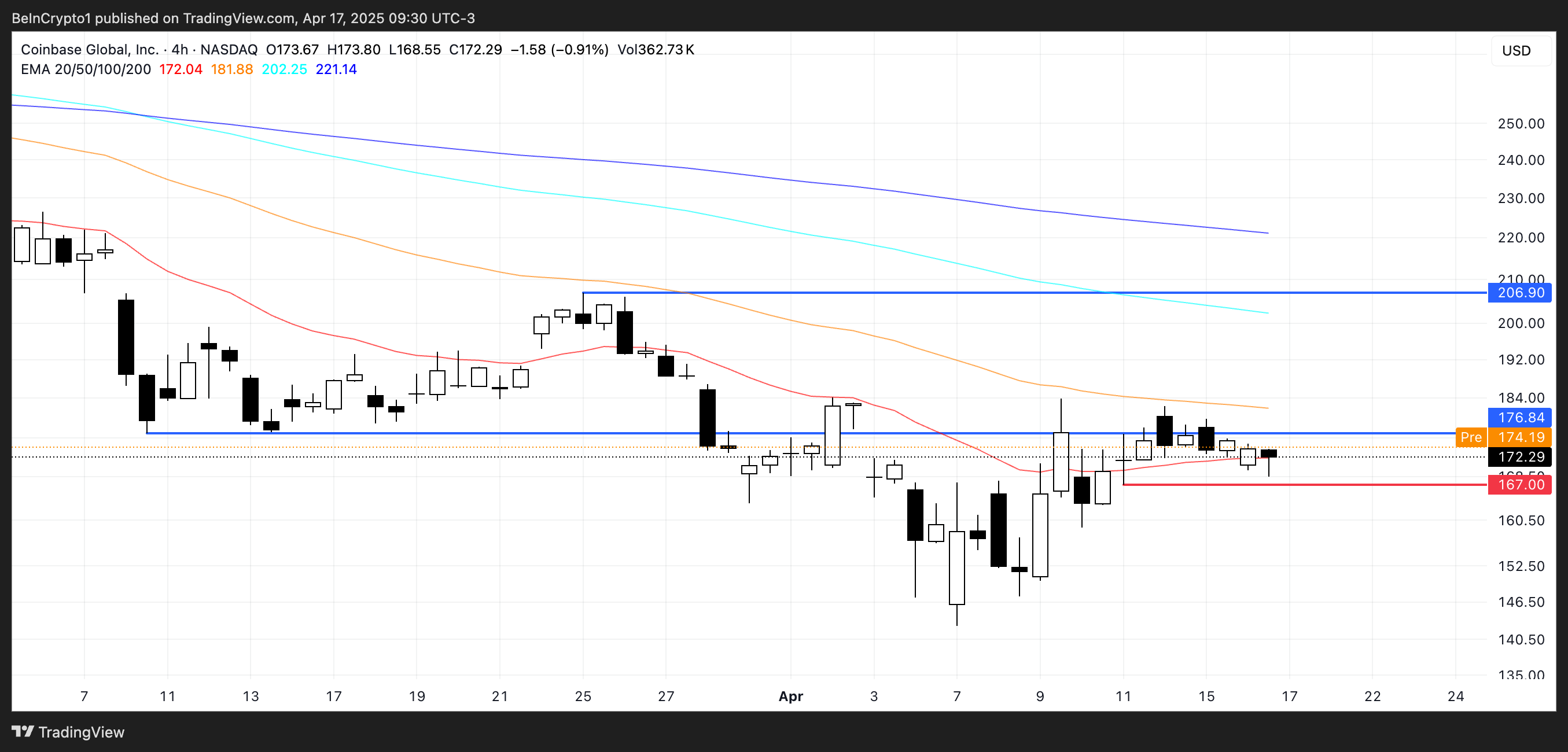

COIN Price Analysis. Source:

TradingView.

COIN Price Analysis. Source:

TradingView.

As the top US crypto exchange, Coinbase sits at the intersection of crypto and tech narratives. This dual exposure makes it sensitive to both sectors, especially during macro events like the tariff war.

COIN is now approaching resistance at $176.84. A break above that level could open the door for a stronger rally ahead.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List DePHY (PHY). Come and grab a share of 6,600,000 PHY

New spot margin trading pair — ES/USDT!

Bitget Trading Club Championship (Phase 1) – Make spot trades daily to share 50,000 BGB

SLPUSDT now launched for futures trading and trading bots