Cardano Faces Renewed Pressure as Key Metrics Point to Bearish Outlook

Cardano is navigating a rough patch as bearish market sentiment continues to weigh on its price. With recent trading activity failing to produce meaningful gains, short-term investors are showing signs of fatigue — and potentially preparing to cash out.

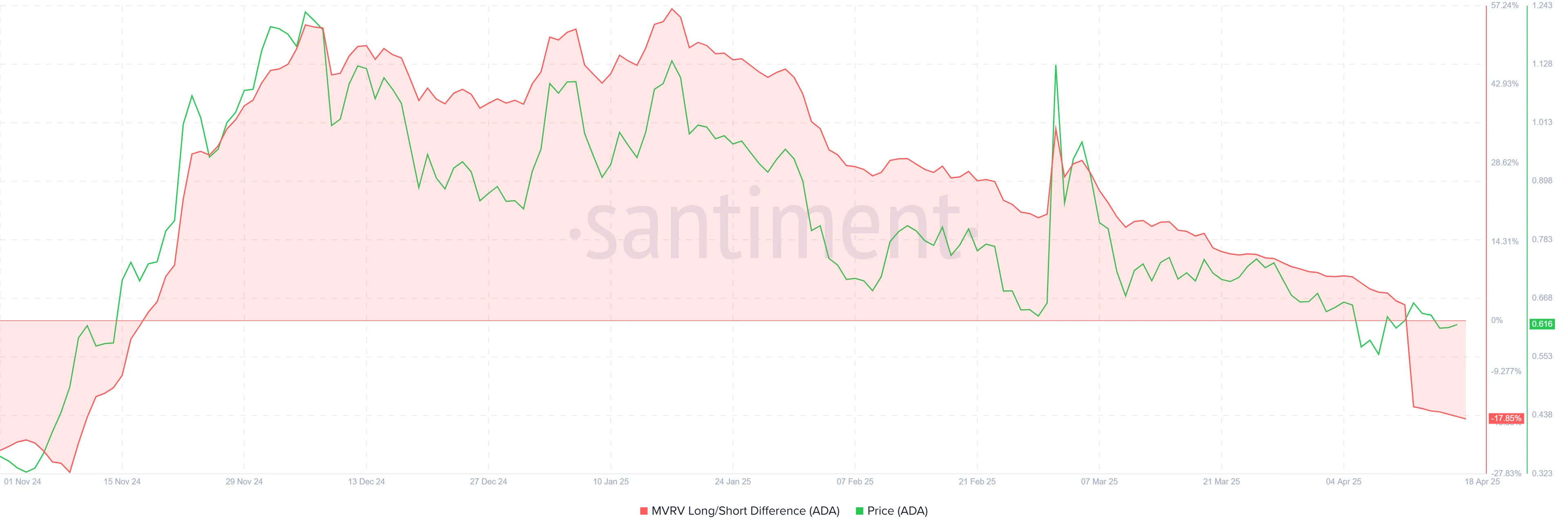

Data from on-chain analytics suggests that holders who recently entered the market are now sitting on the largest unrealized profits since late 2024. The Market Value to Realized Value (MVRV) Long/Short Difference has fallen to its lowest point in five months, dropping to -18%. Historically, when this metric enters negative territory, short-term holders are more likely to sell, adding to downward pressure on price.

The situation could spell trouble for ADA if selling accelerates, especially as confidence across the broader market remains shaky. One of the clearest indicators of this waning enthusiasm is the Chaikin Money Flow (CMF), which has remained below the neutral line since November. Persistent outflows and a lack of fresh capital entering the ecosystem reflect investor hesitation and growing disinterest in risk assets like ADA.

READ MORE:

New Proposal Aims to Resolve Solana’s Inflation DisputeCardano has also failed to recover key technical levels. Despite multiple attempts, the price remains pinned below the $0.63 resistance. Currently trading near $0.61, ADA has been unable to reverse a month-long downtrend. If the bearish sentiment persists, there’s a risk of retesting lower support around $0.57 — a level that, if breached, could deepen the losses and delay any potential recovery.

Still, a reversal isn’t entirely off the table. Should the overall crypto market regain momentum and confidence return, a breakout above $0.63 could flip that resistance into a new support level. In such a scenario, ADA might aim for a push toward $0.70 — a move that would mark a significant shift in trend.

For now, though, caution continues to define investor behavior, and Cardano’s outlook remains fragile as key indicators lean heavily toward the bears.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Launches PLUME On-chain Earn With 4.5% APR

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Subscribe to UNITE Savings and enjoy up to 15% APR