-

XRP is experiencing a bullish wave driven by significant market activities and technical indicators, creating optimism among investors.

-

Despite a recent price drop, on-chain metrics and liquidity inflows suggest a potential rally as traders position themselves for upward movement.

-

As noted by COINOTAG experts, the rapid increase in open interest in options trading reflects growing confidence in XRP’s performance.

XRP shows bullish signals as market activity and patterns suggest a potential rally, despite recent declines in on-chain metrics.

Market Dynamics: Analyzing XRP’s Bullish Sentiment

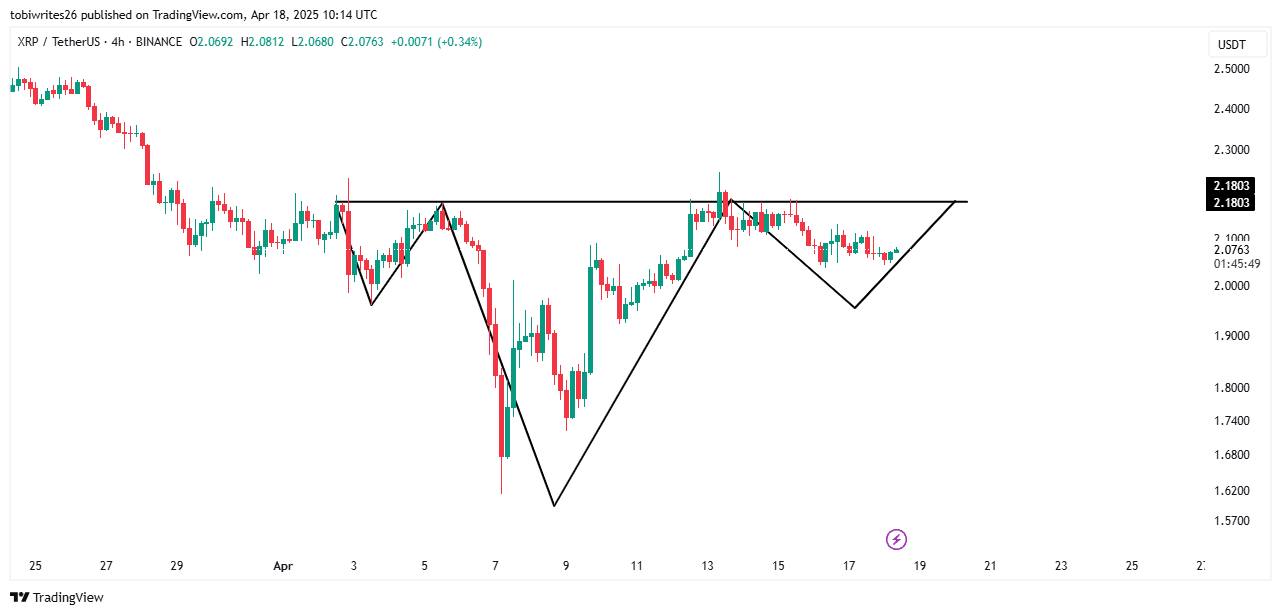

At present, one of the critical factors contributing to XRP’s resurgence is its formation of a bullish inverted head and shoulders pattern. This technical formation, recognized for signaling upward price movements, has been identified on the 4-hour chart for XRP, suggesting that a significant price rise could be in sight.

The bullish expectations are further buoyed by liquidity inflows, with traders having recently acquired substantial amounts of XRP. This activity could propel the asset towards a target price point of $2.5, a level not achieved since March 24.

Source: TradingView

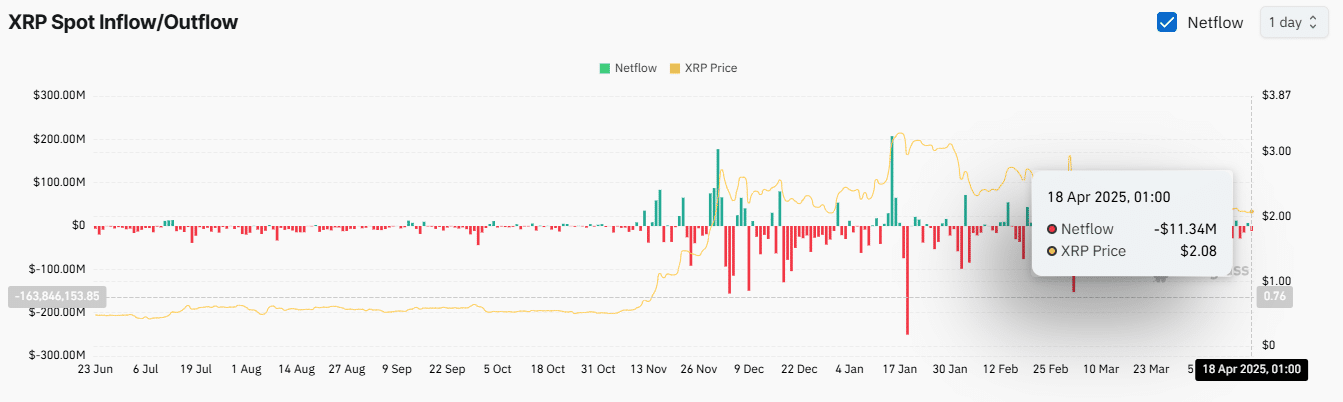

The surge in options trading volume by 256% also underscores the growing bullish sentiment around XRP. This increase has pushed the Open Interest in options to around $220,860, as traders engage more actively in acquiring contracts. Simultaneously, spot market transactions have seen significant participation, with approximately $11 million worth of XRP purchased and transferred into private wallets, indicating increased conviction from investors.

Source: Coinglass

These activities indicate a strong belief in XRP’s potential upside. However, the movement towards a bullish market is tempered by current low on-chain activity.

Challenges: On-chain Activity Decline Poses Risks

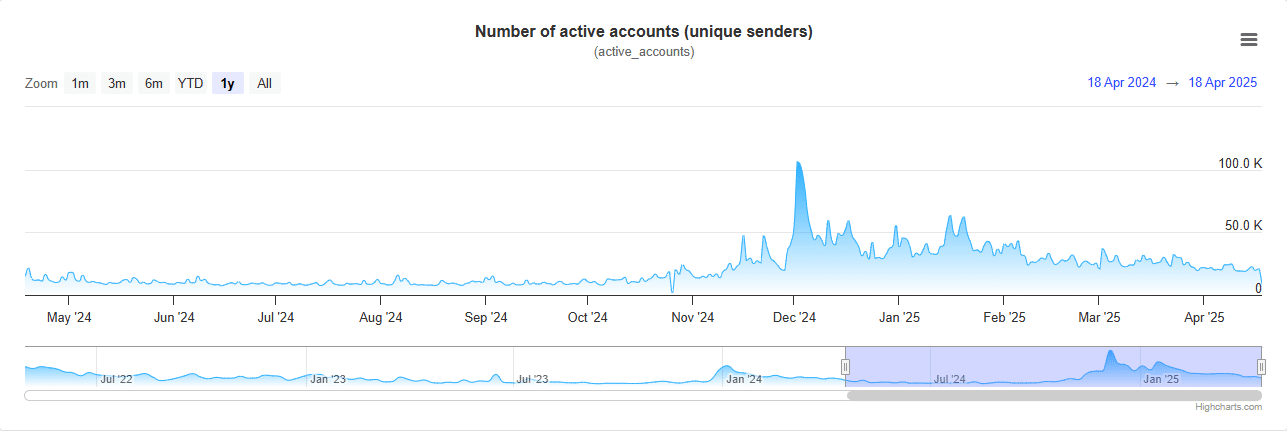

Counteracting the bullish sentiment is a notable decline in essential on-chain metrics, such as the executed transaction count and the number of active accounts using XRP. In the last 24 hours, the executed transaction count fell sharply from 1.56 million to 660,000, reflecting decreased engagement on the XRP network.

Moreover, the significant reduction in active sender accounts, dropping from 20,700 to 8,500, highlights reduced trading and transaction activity among XRP users. These metrics suggest a worrying trend of diminishing on-chain utility for XRP, which could hinder any forthcoming price rallies.

Source: XRPScan

If these trends continue without a revival in activity levels, XRP’s ability to capitalize on bullish market patterns will be significantly compromised.

Conclusion

In summary, while XRP demonstrates signs of a potential rally driven by bullish trading patterns and significant acquisitions, the decline in on-chain activity poses a challenge for the cryptocurrency’s upward movement. Investors should remain cautious and monitor market trends closely, as strong technical indicators may not necessarily align with fundamental usage metrics.