According to Cryptopotato, the latest analysis of Chicago Mercantile Exchange (CME) Bitcoin futures suggests a shift in market dynamics, as a group of traders appears to be reducing their positions, potentially indicating profit-taking after a strong rally. The data shows a divergence in behavior between asset management companies and other participants. Asset managers' net long positions peaked at $6 billion at the end of 2024 but have since been significantly reduced to around $2.5 billion. On the other hand, the "others" category, which may include retail investors and smaller institutions, has seen a sharp increase in net long positions, currently reaching approximately $1.5 billion, the highest level in over a year, indicating renewed bullish sentiment among non-institutional market participants.

Analysis: CME Bitcoin Futures Open Interest Shows Net Long Positions of Retail Traders are Increasing

PANews2025/04/20 13:33

Show original

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

An Early Bitcoin Holder Deposits 400 BTC into HyperLiquid and Purchases ETH on the Spot Market

ForesightNews•2025/08/21 07:42

CryptoQuant Analyst: Bitcoin Transfers Between $0 and $10,000 Drop to 0.6%

ForesightNews•2025/08/21 07:42

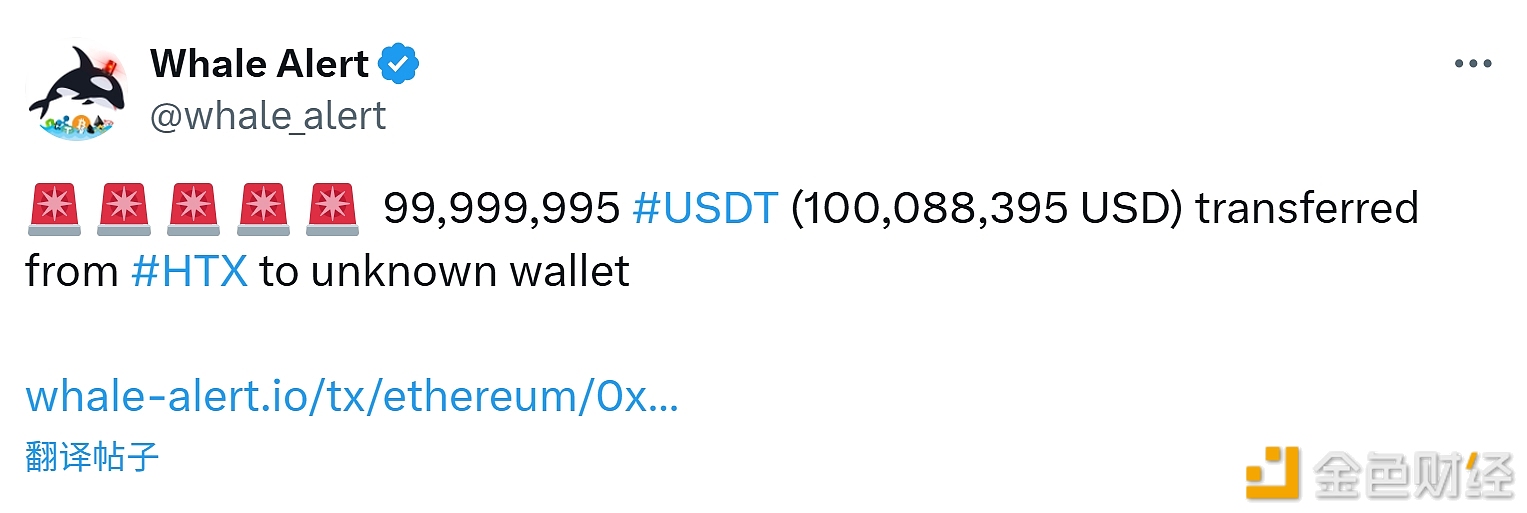

99,999,995 USDT Transferred from an Exchange to an Unknown Wallet

金色财经•2025/08/21 07:34

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$113,414.08

-0.38%

Ethereum

ETH

$4,263.27

+0.79%

XRP

XRP

$2.89

-0.50%

Tether USDt

USDT

$0.9999

+0.01%

BNB

BNB

$851.56

+2.17%

Solana

SOL

$184.53

+1.42%

USDC

USDC

$1.0000

+0.04%

TRON

TRX

$0.3531

+0.84%

Dogecoin

DOGE

$0.2186

+1.83%

Cardano

ADA

$0.8680

+0.90%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now