-

XRP has encountered significant turbulence recently, evidenced by a decline of 5% over the past week, amidst mixed technical indicators.

-

Despite this volatility, the cryptocurrency continues to trade within a narrow band, highlighting uncertainty about its short-term trajectory.

-

According to COINOTAG, technical analysis shows that XRP’s momentum could be critical in determining its immediate price direction.

This analysis delves into the current state of XRP, focusing on technical indicators and market sentiment as it hovers between critical support and resistance levels.

XRP Faces Pressure with Indicators Showing Mixed Signals

XRP’s momentum has been called into question as the asset’s Relative Strength Index (RSI) rests at 44.54, reflecting a **neutral momentum**. This reading indicates a lack of significant buying interest, particularly troubling as the RSI has consistently struggled to rally above the 50 threshold in recent trading sessions.

Despite fluctuations, the price remains stuck within a tight range of $2.05 to $2.09, suggesting that market participants are uncertain about the next major directional move. The RSI slipped below the critical 50 mark this week, reflecting a market that is indecisive and potentially on the verge of breaking out from its confinement.

XRP RSI. Source: TradingView.

The combination of a lowered RSI and tight price movement indicates that without a substantial shift in momentum, XRP may either experience continued consolidation or a downward trend towards its next support level.

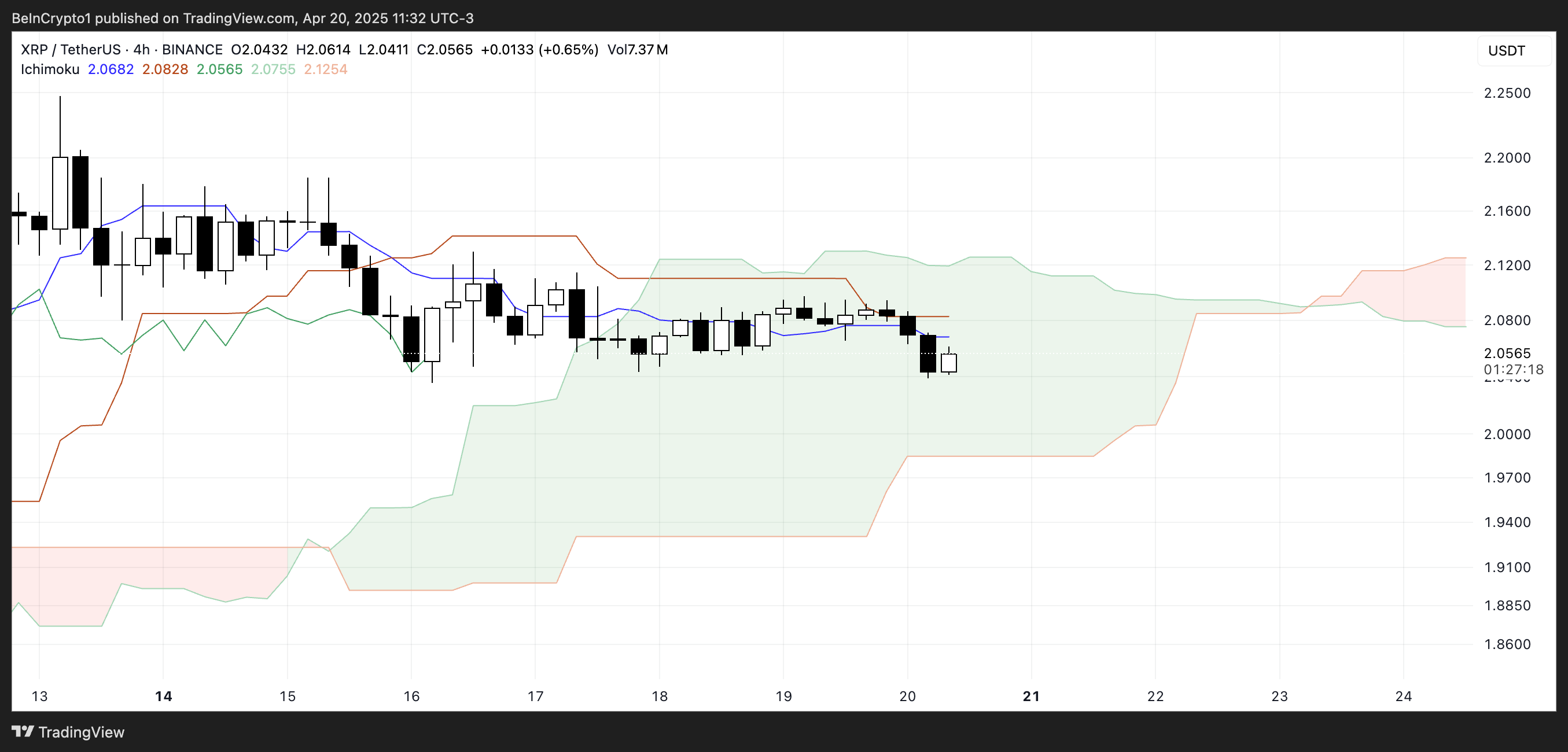

Analyzing the Ichimoku Cloud for Bearish Trends

The Ichimoku Cloud indicator has also provided concerning signals, having shifted from a previous bullish stance to bearish. The cloud’s transition to red illustrates a market under increasing bearish pressure. The cloud’s thickening suggests that there is significant selling resistance likely to hold prices down.

XRP Ichimoku Cloud. Source: TradingView.

A bearish cross where the Tenkan-sen has moved below the Kijun-sen further adds to the downward sentiment, signaling a potential continuation of the bearish trend if XRP fails to reclaim its position above the cloud.

Critical Price Levels to Watch in XRP Trading

XRP’s price movements are currently tightly restricted, moving within $2.05 as the established support and $2.09 as resistance. Market analysts note that a significant price movement beyond these levels could dictate the future direction. If XRP were to break below the $2.05 support, the next significant support level to monitor would be at $1.96, which could lead to further downside toward $1.61, a level that has not been tested since late 2024.

Conversely, should XRP decisively move above $2.09, targets would shift to $2.17 and potentially $2.50. A breakthrough past these levels would require robust buying interest and volume, a scenario that currently seems cautious at best.

With recent predictions suggesting a potential correction on the horizon, traders are advised to remain vigilant as they monitor price developments in the coming sessions.

Conclusion

In summary, XRP is navigating through a complex technical landscape characterized by mixed signals from key indicators like the RSI and Ichimoku Cloud. Traders should remain aware of critical price levels, as a breakout or breakdown could substantially impact market sentiment. Vigilance and strategic planning will be paramount for anyone looking to engage with XRP in the weeks ahead.