US dollar, stocks tumble and crypto gains as Trump amps up pressure on Fed

Crypto markets avoided the fallout caused by US President Donald Trump’s latest salvo against Federal Reserve Chair Jerome Powell, which saw the US stock market slump and the dollar continue to weaken over uncertainty.

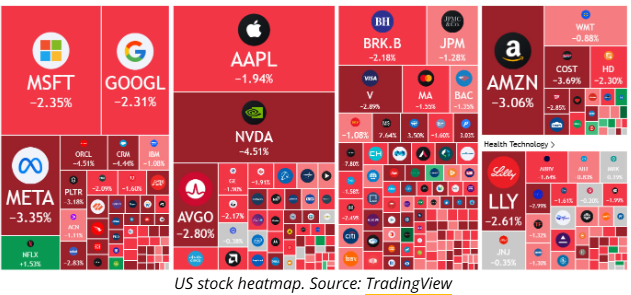

Stock markets across the United States ended April 21 in the red, with the SP 500 dropping 2.4%, the tech-heavy Nasdaq slipping 2.5%, and the Dow Jones losing 2.5%, or nearly 1,000 points, according to Google Finance.

The SP 500 has now declined by more than 12% since the beginning of the year, and the Nasdaq is down almost 18% in the US tech stock exodus.

The stock slide follows escalating tension between Donald Trump and Jerome Powell and growing concern over the impact of trade tariffs.

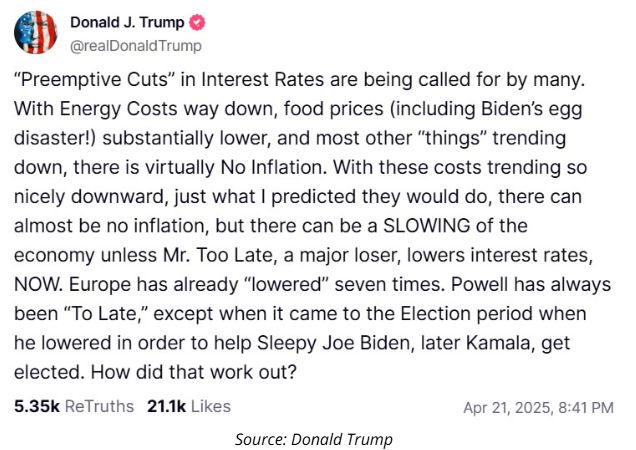

“‘Preemptive Cuts’ in Interest Rates are being called for by many,” Trump wrote on his social media platform Truth Social on April 21.

“With Energy Costs way down, food prices […] substantially lower, and most other ‘things’ trending down, there is virtually No Inflation,” he added.

Trump has reiterated his call for lowering interest rates, which Powell, who has been labelled as “Mr. Too Late” and a “major loser” by the POTUS, has kept high at 4.5%.

Last week, Powell took a swipe at Trump’s trade tariffs, saying they could lead to a dangerous economic mix of rising prices and slowing growth, or “stagflation.”

Trump responded with a call to fire the central bank chair, stating at the time that his “termination cannot come fast enough.”

The Fed is expected to maintain its wait-and-see policy approach at its May 7 meeting, with interest rate markets predicting just a 13% chance of a rate cut, according to CME Fed Watch.

US dollar devaluation continues

The US Dollar Index (DXY) — a measure of the strength of the greenback against a basket of leading currencies — has also slipped more than 10% so far this year. This week it fell to a three-year low below 98 on April 21, according to TradingView.

“Everyone needs and wants a weaker dollar to service their dollar debts,” commented Real Vision founder and CEO Raoul Pal on April 22. “This is the purest form of global liquidity and is the largest driver of global M2 [money supply] currently,” he added.

Meanwhile, crypto markets have held on to weekend gains with total capitalization remaining at $2.83 trillion at the time of writing.

Bitcoin is keeping digital asset markets buoyed, hitting a four-week high of $88,500 on April 22.

“Amid one of the most turbulent periods for global markets in years, Bitcoin is showing impressive resilience,” commented Bitfinex analysts in a recent market update.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List DePHY (PHY). Come and grab a share of 6,600,000 PHY

New spot margin trading pair — ES/USDT!

Bitget Trading Club Championship (Phase 1) – Make spot trades daily to share 50,000 BGB

SLPUSDT now launched for futures trading and trading bots