Key Insights

- U.S. Bitcoin ETFs hit $381.4M in daily inflows, a 3-month high.

- Trump’s Powell threats and rate-cut push drive Bitcoin, gold demand.

- ARK’s ARKB led inflows; Ethereum ETFs saw $25.42M outflows.

- Trade tensions and dollar weakness boost Bitcoin, gold as safe havens.

The crypto market ignited this week as Bitcoin price rocketed past $88,500 on Tuesday, propelled by $381.4 million in net inflows to U.S. spot Bitcoin ETFs—the highest in three months.

Investors are piling into the digital asset amid a perfect storm of market chaos, sparked by former President Donald Trump’s threats to oust Federal Reserve Chair Jerome Powell and worsening U.S.-China trade tensions.

With the U.S. dollar sliding and stocks tumbling, Bitcoin and gold are stealing the spotlight as safe-haven bets.

Bitcoin ETFs Rally with $381.4 Million in Inflows

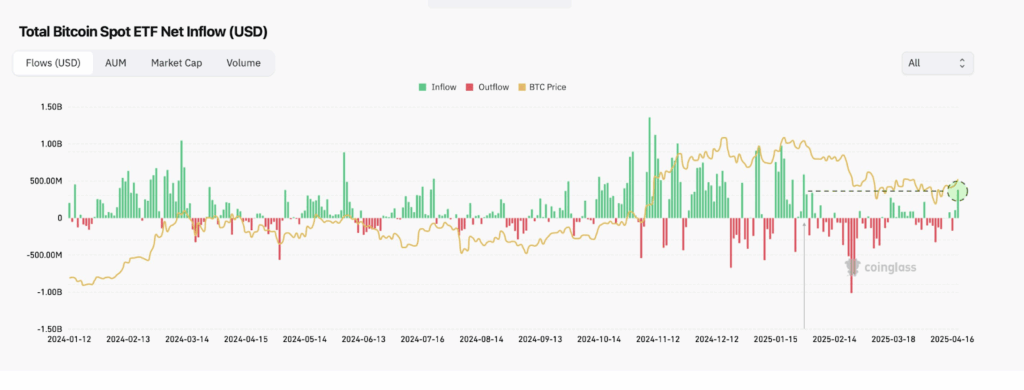

Data from SoSoValue reveals that on April 21, the 12 U.S. spot Bitcoin ETFs raked in $381.4 million in net inflows—a 250% jump from the prior day and the biggest haul since January 30.

Bitcoin ETF Net Inflow| Source: Coinglass

Bitcoin ETF Net Inflow| Source: Coinglass

ARK 21Shares’ ARKB topped the list with $116.13 million, while Fidelity’s FBTC followed with $87.61 million. Bitwise’s BITB and BlackRock’s IBIT added $45.08 million and $41.62 million, respectively.

Smaller players like VanEck’s HODL and Franklin Templeton’s EZBC pulled in $11.72 million and $10.1 million. Grayscale’s GBTC and BTC funds chipped in $36.6 million and $32.55 million. This influx snapped a two-week outflow trend, with last week’s net inflows totaling just $15.85 million.

The ETF boom aligned with Trump’s latest salvo against Powell. On April 21, Trump took to Truth Social, declaring Powell’s “termination can’t come fast enough” after the Fed Chair signaled delays in rate cuts.

Reports indicate Trump’s team is weighing legal moves to unseat Powell, amplifying fears of monetary upheaval. This clash has rattled investors, pushing them toward Bitcoin and gold.

Ethereum ETFs Lag Behind

Bitcoin’s gains stand in stark contrast to Ethereum’s woes. On April 21, Ethereum ETFs bled $25.42 million in outflows, stretching an eight-week decline to nearly $910 million.

This splits underscores Bitcoin’s edge as a go-to asset during uncertainty, while Ethereum struggles to keep pace.

Broader market jitters are fueling the rush to Bitcoin and gold. U.S.-China trade friction and inflation fears sent gold soaring past $3,450 per ounce on April 22 during Asian trading, marking consecutive record highs.

U.S. markets reopened post-Good Friday on April 21, with the SP 500 sliding 2.4% and the Nasdaq and Dow each shedding 2.5%.

Bitcoin Dominance Hits New Cycle High

Bitcoin’s dominance has surged to 64.38%, marking its highest level since February and showing a clear shift of investment from altcoins back to Bitcoin.

The CMC Altcoin Season Index, which tracks how the top 100 altcoins perform against Bitcoin over 90 days, currently sits at 16/100. A score near 100 signals an altcoin season, while a low score points to Bitcoin’s dominance. At 16, it’s firmly Bitcoin’s moment.

This data underscores Bitcoin’s growing grip on the crypto market as investors lean toward it over altcoins. Analyst Benjamin Cowen has observed that Bitcoin’s market share typically increases during Quantitative Tightening (QT) periods and hits its peak when monetary policies relax.

Based on current trends, if this pattern holds, Bitcoin’s dominance might reach 66% or more in the coming weeks. The U.S. dollar hit multi-year lows against major currencies, accelerating the pivot to non-traditional assets.

Bitcoin’s market cap reclaimed $1.75 trillion this week—its first time above that threshold since late March. As Trump’s Fed feud and global risks escalate, Bitcoin and gold are cementing their roles as havens in a turbulent financial landscape.