Glassnode: The BTC Spot Price Rises, but Negative Funding Rates in the Futures Market Indicate Rising Short Interest

According to Odaily, Glassnode reports that driven by expectations of eased US-China tariffs, the price of Bitcoin once rose to $94,700, briefly surpassing the critical Short-Term Holder Cost Basis (STH Cost Basis) of $92,900. This level is typically seen as the tipping point from a bear to a bull market.

The report highlights that the Short-Term Holder Profit/Loss Ratio (STH P/L Ratio) has returned to 1.0, indicating that recent buyers are generally at a breakeven point, posing a risk of profit-taking. Currently, 87.3% of Bitcoin's supply is in a state of profit, up from 82.7% when prices were at similar levels previously, indicating that approximately 5% of the supply has changed hands at lower levels recently.

On April 22nd, U.S. Bitcoin spot ETF net inflows reached a record high of $1.54 billion, showing strong institutional demand. Nevertheless, the negative funding rates in the futures market indicate rising short interest, and market sentiment remains cautious.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Southwest Securities: No Stablecoin-Related Business Operations at Present

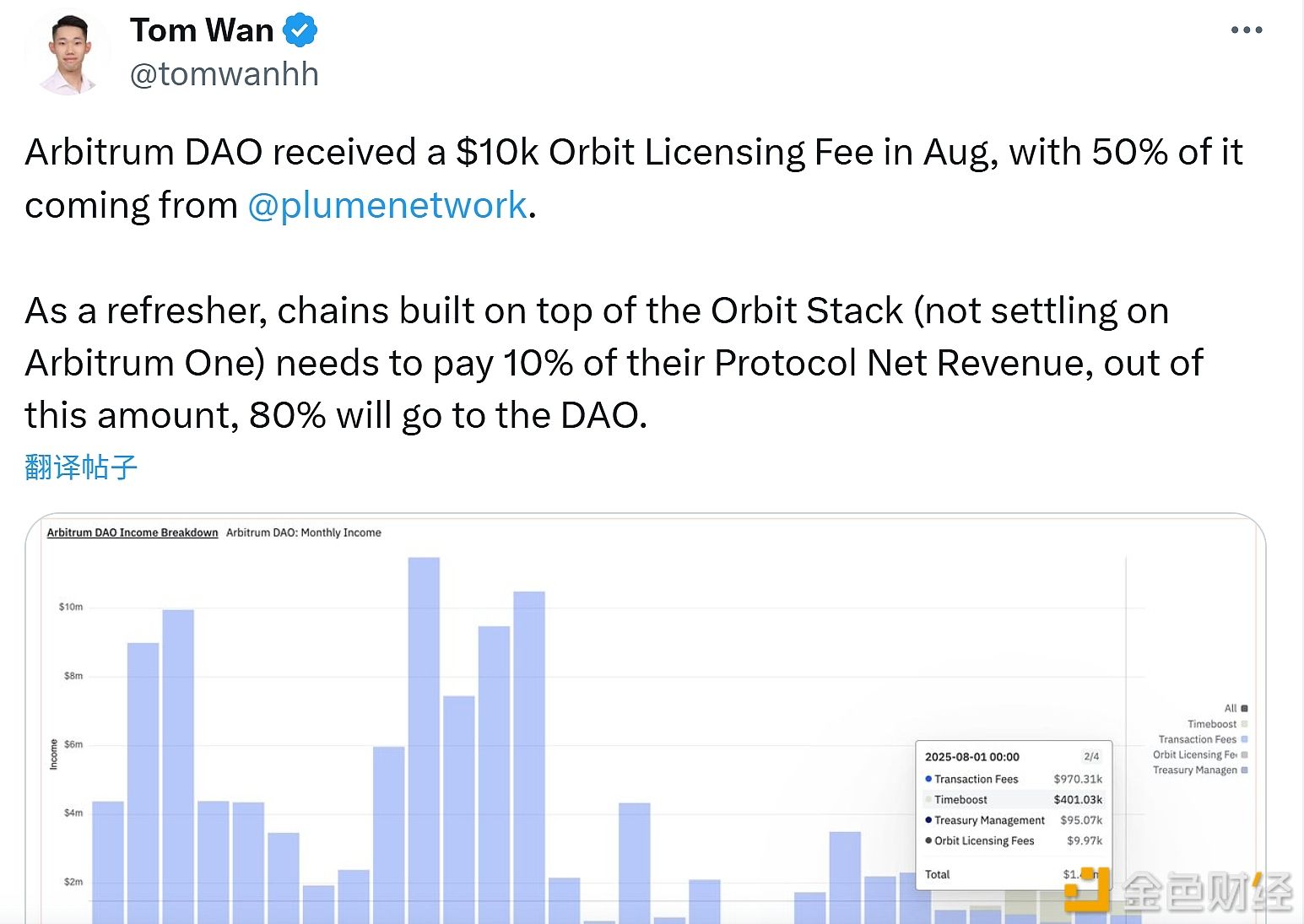

Arbitrum DAO received $10,000 in Orbit licensing fees in August

All Three Major U.S. Stock Index Futures Turn Positive

ProCap CEO: Bitcoin’s Pullback Indicates the Asset Is Maturing