-

Bitcoin is nearing $95,700, driven by extreme greed and high optimism in social media sentiment.

-

The Profit/Loss ratio is approaching 1.0, signaling potential for continued growth but also the risk of profit-taking.

-

A break above $95,761 could propel Bitcoin towards $100,000, but failure to hold support at $93,625 risks a drop to $89,800.

Bitcoin rallies as social media sentiment surges, positioning it for potential growth above $95,700, balancing profit-taking risks.

Bitcoin Investors Are Greedy

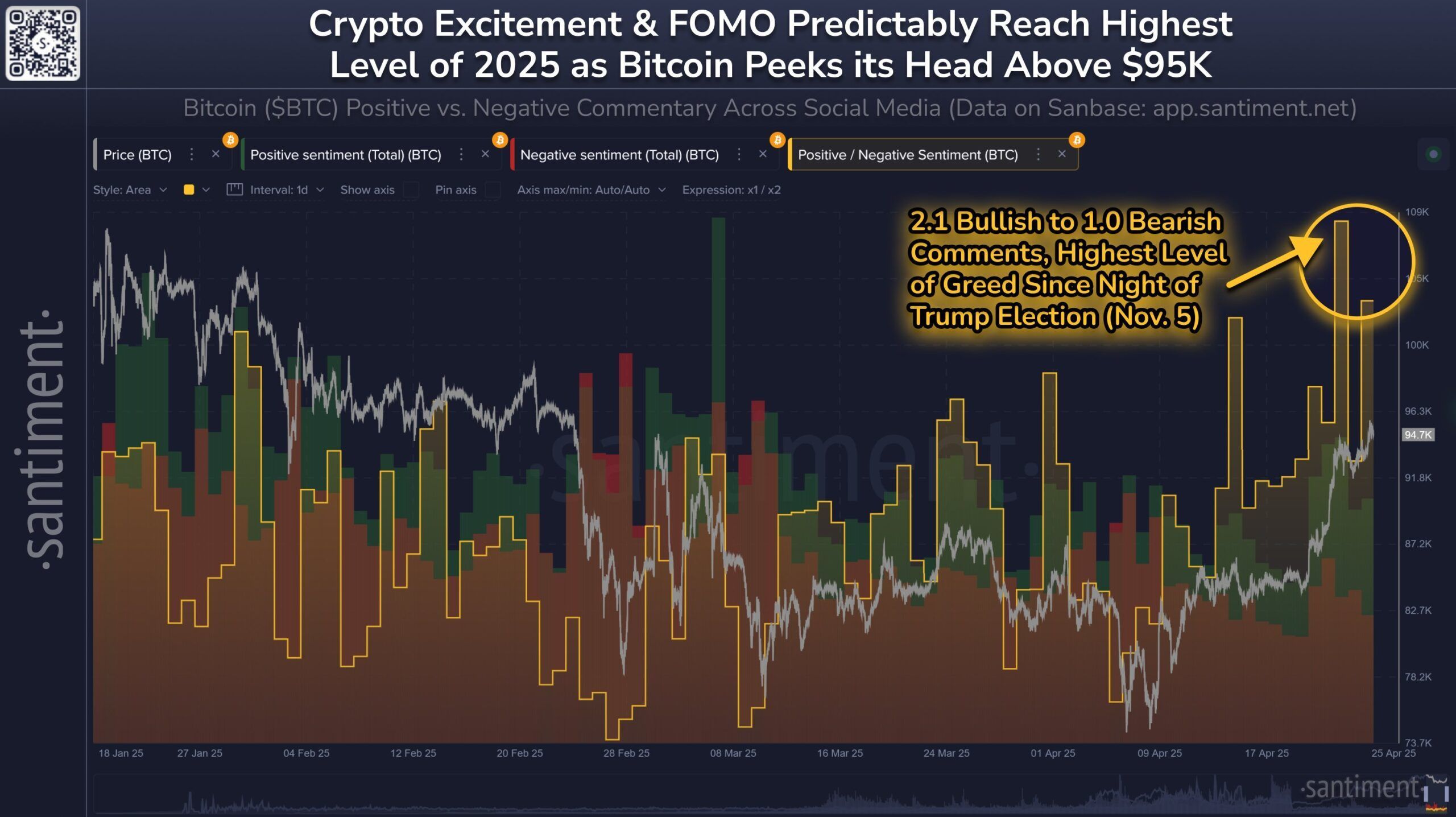

The market sentiment surrounding Bitcoin remains overwhelmingly positive, with investors showing high levels of optimism for further price gains. Social media posts indicate a sharp spike in bullish sentiment, with the number of optimistic (versus bearish) posts reaching levels not seen since the night of Donald Trump’s election on November 5, 2024. This surge in positivity suggests that many investors are poised to capitalize on Bitcoin’s potential growth, further fueling its rally.

However, the extreme level of greed in the market raises questions about the sustainability of this upward movement. As investor sentiment becomes increasingly optimistic, there is a risk that this could lead to a local top if too many traders become overly greedy.

Bitcoin Sentiment. Source: Santiment

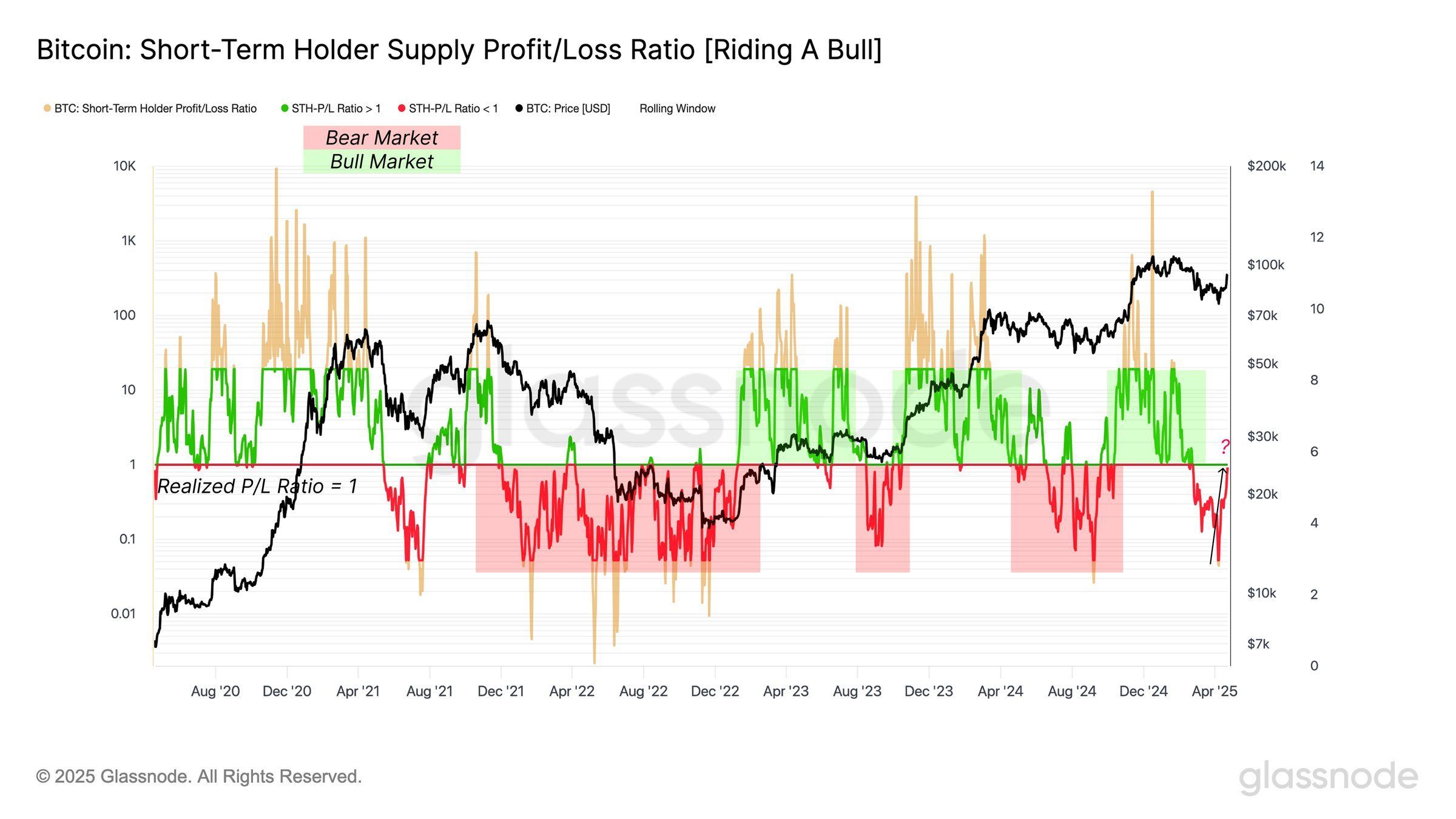

The broader macro momentum for Bitcoin is signaling a rebound, particularly in the Profit/Loss (P/L) ratio, which is nearing a neutral 1.0 level. This shift indicates a balance between coins in profit and those in loss. Historically, the 1.0 threshold has acted as resistance during bear phases, but a sustained move above this level could signal a stronger recovery and continued upward momentum for Bitcoin.

While the shift towards a neutral P/L ratio suggests potential strength, it also opens up the possibility of selling pressure as investors look to lock in profits. Therefore, Bitcoin’s ability to maintain momentum will depend on how investors react to price movements and whether they decide to sell or hold their positions.

Bitcoin STH Supply Profit/Loss Ratio. Source: Glassnode

BTC Price Needs A Push

Bitcoin’s recent price action shows a 10% increase in the last seven days, trading at $94,401. The crypto king is now just below the significant $95,761 resistance level, which has been holding steady for some time. A break above this level would set Bitcoin on track to reach new highs, with $100,000 as the next major milestone.

Should Bitcoin breach $95,761, the growing greed within the market will likely encourage investors to hold their positions rather than sell. This will likely feed the altcoin’s bullish momentum, pushing Bitcoin further toward $100,000 as demand remains strong among traders eager to capitalize on potential gains.

Bitcoin Price Analysis. Source: TradingView

However, if Bitcoin fails to maintain its position above $93,625, the price could fall toward the $91,521 support. A deeper decline to $89,800 could put the bullish momentum at risk, delaying any immediate recovery and increasing the chances of a consolidation phase.

Conclusion

In conclusion, Bitcoin’s current valuation is a reflection of high investor optimism, marked by a significant rise in social media sentiment and a neutral P/L ratio. While the market shows signs of potential bullish momentum with the pivotal $95,761 resistance level in sight, careful observation of investor behavior and market reactions is essential to gauge the sustainability of this rally. As the landscape continues to evolve, informed decision-making will remain crucial for investors navigating the exciting yet volatile world of cryptocurrency.