Bitcoin ETFs Celebrate a Week of Wins, But Trouble Brews in the Derivatives Market | ETF News

Bitcoin ETFs have experienced a remarkable week of consistent inflows, with BlackRock's IBIT leading the charge. However, a bearish sentiment in the futures market suggests caution as investors eye potential pullbacks.

Bitcoin exchange-traded funds (ETFs) continued their inflow streak on Monday, raking in over $500 million in fresh capital and marking seven consecutive days of positive flows.

The sustained momentum reflects the resurgence in investor appetite for BTC exposure through regulated investment vehicles, even amid broader market volatility.

BTC ETFs See Steady Inflows

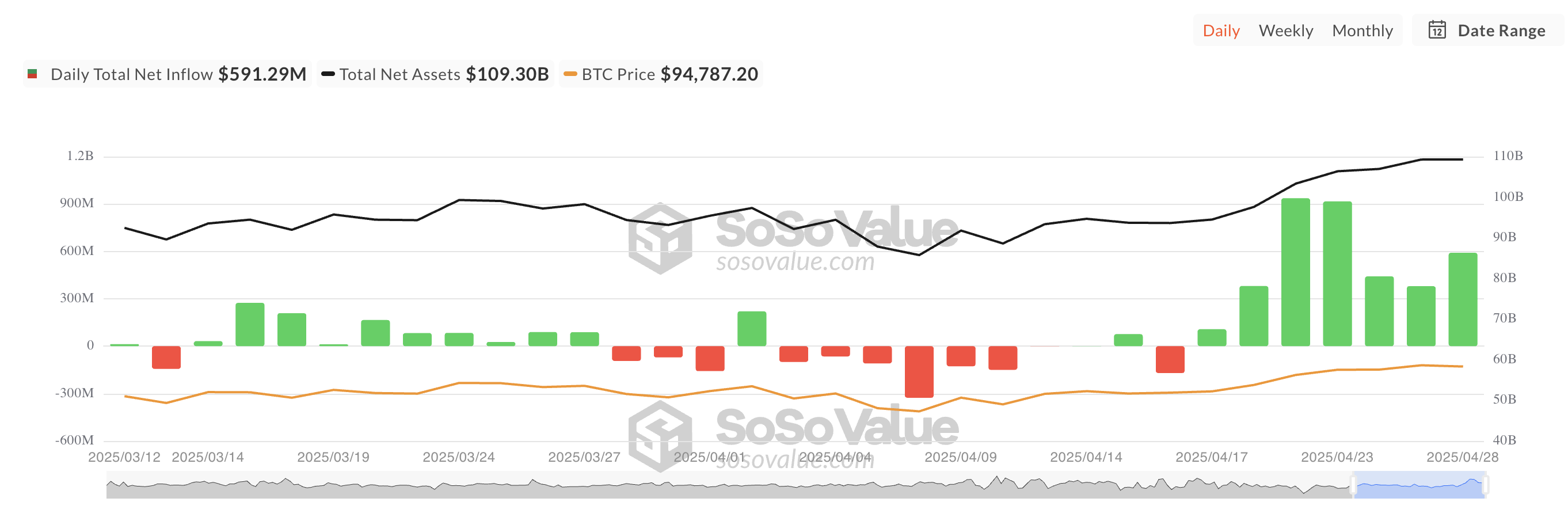

On Monday, BTC spot ETFs attracted fresh investor demand, recording $591.29 million in net inflows and extending their winning streak to a seventh consecutive day. This happened as the leading coin sought stable support above the $94,000 price.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Once again, BlackRock’s iShares Bitcoin Trust (IBIT) led the charge, recording the largest inflow among its peers. The fund saw inflows totaling $970.93 million, bringing its total cumulative net inflows to $42.17 billion.

ARKB, the BTC spot ETF managed by Ark Invest and 21Shares, recorded the largest net outflow yesterday. On Monday, $226.30 million exited the fund. Despite this setback, ARKB’s total historical net inflow remains at $2.88 billion.

Rising Open Interest and Bearish Options Sentiment Set the Stage

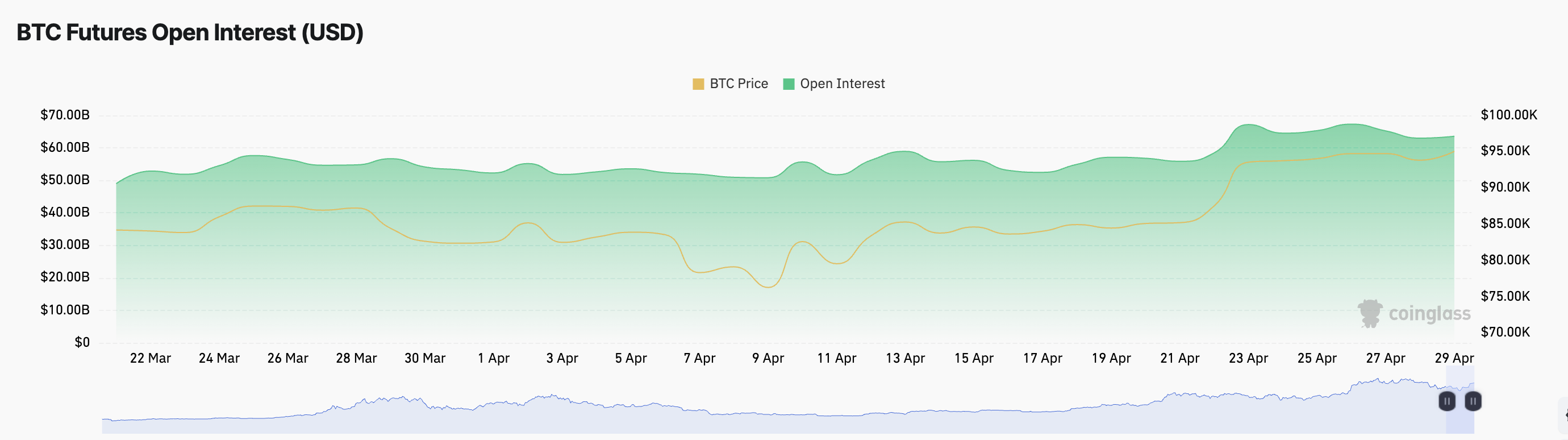

Open interest across BTC’s futures market has risen by 2% over the past day, signaling an increase in outstanding futures contracts. The coin’s price has noted a modest 0.14% uptick during the same period.

BTC Futures Open Interest. Source:

Coinglass

BTC Futures Open Interest. Source:

Coinglass

A rise in open interest indicates that more traders are opening new positions rather than closing existing ones. This bullish signal can strengthen BTC’s price rally in the short term.

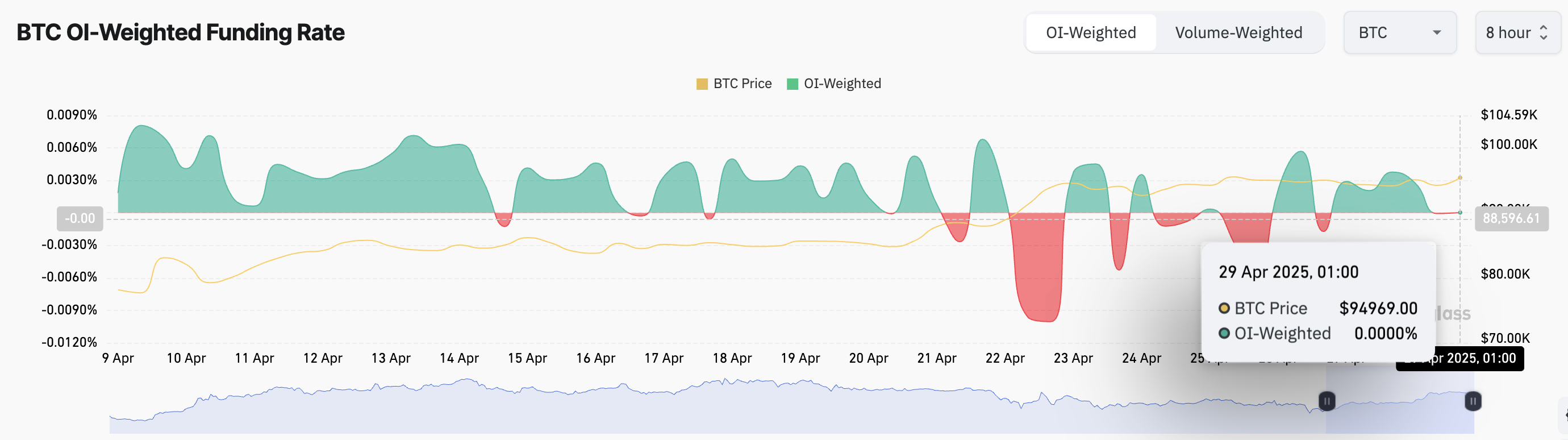

Meanwhile, as of this writing, BTC’s funding rate is 0%, indicating a balanced market between long and short positions. A neutral funding rate like this suggests no immediate dominance by bulls or bears in the coin’s perpetual futures market.

BTC Funding Rate. Source:

Coinglass

BTC Funding Rate. Source:

Coinglass

This reduces the likelihood of sudden liquidations, meaning any major price movement would likely need fresh momentum rather than being triggered by leverage-driven squeezes.

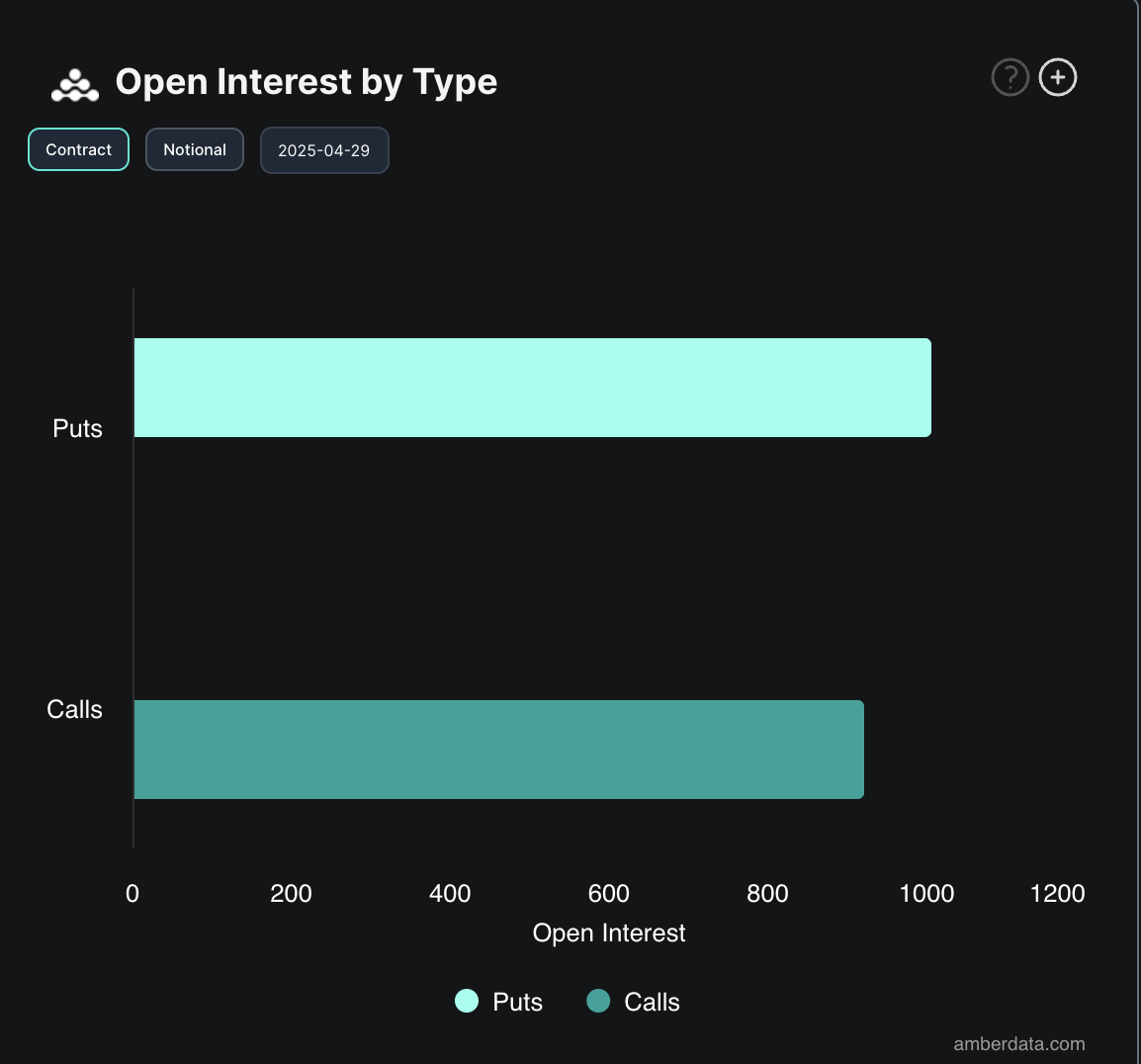

However, the sentiment among BTC options traders is clear. Today’s high demand for puts indicates a more cautious or bearish outlook among BTC options traders.

BTC Options Open Interest. Source:

Deribit

BTC Options Open Interest. Source:

Deribit

The growing interest in these bearish contracts suggests that many investors anticipate a potential pullback in BTC’s price, despite the recent inflows into Bitcoin ETFs.

Until a clear breakout or breakdown occurs, BTC may continue to consolidate within the narrow range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SEC says liquid staking and tokens are NOT securities; no registration needed

Share link:In this post: The SEC clarified that certain liquid staking activities in cryptocurrency do not qualify as securities offerings, providing clearer guidance on digital asset regulation. Under SEC Chair Paul Atkins, the agency is adopting a more proactive approach to cryptocurrency regulation, away from the previous “regulation by enforcement” regime. While many now praise the SEC under Atkins for its pro-crypto stance, the agency is effectively divided, with one faction in support of Gary Gensler

OpenAI releases GPT-OSS, its first open-source AI model

Share link:In this post: OpenAI released two open-weight models, gpt-oss-120b and gpt-oss-20b, for public use. The models are downloadable under Apache 2.0 and run on platforms like GitHub, Hugging Face, and LM Studio. OpenAI filtered sensitive data and tested against malicious fine-tuning before release.

New Zealand jobless rate hits 5-year high as economic slowdown deepens

Share link:In this post: New Zealand’s jobless rate rose from 5.1% in Q1 to 5.2% in Q2 2025, marking the highest level since Q3 2020. Total employment declined by 0.1% quarter-on-quarter, matching forecasts, and by 0.9% compared to last year’s quarter. Despite the annual slowdown, wages rose 0.6% over the quarter, and average hourly earnings jumped 1.9%.