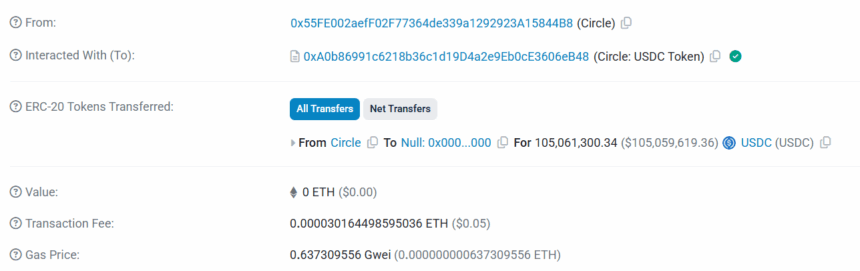

The issuer behind USDC stablecoin, Circle has burned 105,061,300 USDC, valued at approximately $105,060,249 at the time, in a latest move. The transaction – recorded on the Ethereum blockchain at 18:12 UTC – follows a strategic move from the firm, which is planned to reduce the circulating supply of the dollar-pegged stablecoin.

According to Whale Alert, a blockchain transaction tracking platform, the transaction initiated by the USDC Treasury, with it sending the amount to Ethereum’s Null Address, aka the Black Hole address, from where recovering crypto assets is impossible.

Circle Burns $105M USDC – Source: Etherscan

Circle Burns $105M USDC – Source: Etherscan

Market observers note that this supply contraction could impact USDC’s liquidity and trading volumes, particularly in DeFi ecosystems where it holds a strong presence.

With a circulating supply of over 61.57 billion tokens in the market now, USDC remains a key player in the stablecoin market after Tether USD (USDT). Its presence in the DeFi ecosystem is steadily growing, with it available across multiple blockchain networks like Ethereum, Solana, Avalanche, Arbitrum and a number of others.

Why and How are USDC burned?

The burn process involves redeeming USDC for US dollars through Circle Mint accounts, which effectively removes USDC tokens from circulation. This follows Circle’s pattern of supply management, coming after a notable minting of 250 million USDC on Solana in August 2024.

The reduction in USDC supply could reflect efforts to balance liquidity, address market demand, or navigate regulatory pressures, especially given recent concerns over illicit transactions involving stablecoins.

While it is a standard procedure, the burning of USDC stablecoin raises questions about whether a major holder cashed out USD during this process. Given Circle’s redemption mechanism, it’s plausible that a large entity – potentially a business or institutional investor – exchanged the respective amount of USDC for USD, triggering the burn to maintain the stablecoin’s 1:1 peg with the dollar.

Circle’s reserves, backed by US dollar-denominated assets and managed by BlackRock, ensure such redemptions are fully supported.