Top 5 Altcoins to Watch in May 2025 After April's Explosive Gains

The crypto market closed April 2025 on a high note, with several altcoins in the top 20 delivering stellar monthly returns. From ETF filings to ecosystem growth, projects like Sui and Hyperliquid captured investor attention. As May begins, all eyes are on whether these tokens can sustain their momentum or face a correction. Let’s take a closer look at the Top 5 Performing Altcoins from April 2025 and what the coming month may hold for each.

By TradingView - Top Performers (1M)

By TradingView - Top Performers (1M)

🥇 Sui (SUI): Riding the ETF Wave

April Performance: +61.56%

Market Cap Rank: #11

Sui led the altcoin pack in April after 21Shares filed for the first-ever spot SUI ETF with the U.S. SEC. This bold move not only legitimised the Layer 1 blockchain in the eyes of institutions but also sparked speculative interest among traders. Sui’s growing ecosystem and active developer base further boosted its appeal.

By TradingView - SUIUSD_2025-05-01 (1M)

By TradingView - SUIUSD_2025-05-01 (1M)

May 2025 Outlook:

SUI could continue pushing higher, especially if ETF-related optimism persists. However, after such a steep monthly rally, the token may undergo short-term consolidation before another leg up.

🥈 Hyperliquid (HYPE): DeFi Traders’ New Favourite

April Performance: +55.43%

Market Cap Rank: #20

Hyperliquid , a rising star in the decentralised perpetuals market, gained serious traction in April. Its innovative model as a decentralised derivatives exchange drew users looking for alternatives to centralised platforms. The surge in DeFi trading volume also played a role in HYPE’s rally.

By TradingView - HYPEHUSD_2025-05-01 (1M)

By TradingView - HYPEHUSD_2025-05-01 (1M)

May 2025 Outlook:

HYPE remains in the spotlight, and if on-chain volumes stay elevated, the token could push higher. However, given its high volatility, expect sharp pullbacks and profit-taking phases.

🥉 Solana (SOL): Back in the Game

April Performance: +20.96%

Market Cap Rank: #6

Solana rebounded strongly in April amid renewed interest in meme coins and NFT activity on its high-speed chain. Talks of a potential Solana-based ETF also sparked optimism. The ecosystem has continued to grow despite earlier headwinds.

By TradingView - SOLUSD_2025-05-01 (1M)

By TradingView - SOLUSD_2025-05-01 (1M)

May 2025 Outlook:

SOL may experience sideways movement or mild gains early in the month, but any concrete news about ETF approvals or major launches could trigger a breakout.

🏅 Bitcoin Cash (BCH): The Comeback Asset

April Performance: +19.67%

Market Cap Rank: #19

Bitcoin Cash quietly rallied in April, drawing attention from investors seeking faster and cheaper transactions. It benefited from a rotation into older, undervalued coins and a growing narrative around digital cash utility.

By TradingView - BCHUSD_2025-05-01 (1M)

By TradingView - BCHUSD_2025-05-01 (1M)

May 2025 Outlook:

Without strong ecosystem developments, BCH’s momentum could fade. However, it may still benefit from retail-driven trades and speculative capital rotation.

🏅 Hedera (HBAR): Enterprise Tokenisation Leader

April Performance: +15.53%

Market Cap Rank: #17

HBAR climbed steadily in April thanks to strategic enterprise partnerships with global players like IBM, Dell, and initiatives in carbon credit tokenisation. The focus on real-world use cases continues to strengthen its fundamentals.

By TradingView - HBARUSD_2025-05-01 (1M)

By TradingView - HBARUSD_2025-05-01 (1M)

May 2025 Outlook:

If Hedera secures more corporate integrations or expands its tokenisation use cases, HBAR could see sustainable long-term growth through May and beyond.

May 2025 Outlook: Momentum or Correction?

April was a powerful month for altcoins, but the question now is whether these rallies can hold. With ETF developments, ecosystem upgrades, and DeFi usage driving narratives, the top altcoins are poised for potential continuation — but volatility remains high. Investors should keep an eye on macroeconomic shifts and news catalysts to stay ahead in May 2025.

The crypto market closed April 2025 on a high note, with several altcoins in the top 20 delivering stellar monthly returns. From ETF filings to ecosystem growth, projects like Sui and Hyperliquid captured investor attention. As May begins, all eyes are on whether these tokens can sustain their momentum or face a correction. Let’s take a closer look at the Top 5 Performing Altcoins from April 2025 and what the coming month may hold for each.

By TradingView - Top Performers (1M)

By TradingView - Top Performers (1M)

🥇 Sui (SUI): Riding the ETF Wave

April Performance: +61.56%

Market Cap Rank: #11

Sui led the altcoin pack in April after 21Shares filed for the first-ever spot SUI ETF with the U.S. SEC. This bold move not only legitimised the Layer 1 blockchain in the eyes of institutions but also sparked speculative interest among traders. Sui’s growing ecosystem and active developer base further boosted its appeal.

By TradingView - SUIUSD_2025-05-01 (1M)

By TradingView - SUIUSD_2025-05-01 (1M)

May 2025 Outlook:

SUI could continue pushing higher, especially if ETF-related optimism persists. However, after such a steep monthly rally, the token may undergo short-term consolidation before another leg up.

🥈 Hyperliquid (HYPE): DeFi Traders’ New Favourite

April Performance: +55.43%

Market Cap Rank: #20

Hyperliquid , a rising star in the decentralised perpetuals market, gained serious traction in April. Its innovative model as a decentralised derivatives exchange drew users looking for alternatives to centralised platforms. The surge in DeFi trading volume also played a role in HYPE’s rally.

By TradingView - HYPEHUSD_2025-05-01 (1M)

By TradingView - HYPEHUSD_2025-05-01 (1M)

May 2025 Outlook:

HYPE remains in the spotlight, and if on-chain volumes stay elevated, the token could push higher. However, given its high volatility, expect sharp pullbacks and profit-taking phases.

🥉 Solana (SOL): Back in the Game

April Performance: +20.96%

Market Cap Rank: #6

Solana rebounded strongly in April amid renewed interest in meme coins and NFT activity on its high-speed chain. Talks of a potential Solana-based ETF also sparked optimism. The ecosystem has continued to grow despite earlier headwinds.

By TradingView - SOLUSD_2025-05-01 (1M)

By TradingView - SOLUSD_2025-05-01 (1M)

May 2025 Outlook:

SOL may experience sideways movement or mild gains early in the month, but any concrete news about ETF approvals or major launches could trigger a breakout.

🏅 Bitcoin Cash (BCH): The Comeback Asset

April Performance: +19.67%

Market Cap Rank: #19

Bitcoin Cash quietly rallied in April, drawing attention from investors seeking faster and cheaper transactions. It benefited from a rotation into older, undervalued coins and a growing narrative around digital cash utility.

By TradingView - BCHUSD_2025-05-01 (1M)

By TradingView - BCHUSD_2025-05-01 (1M)

May 2025 Outlook:

Without strong ecosystem developments, BCH’s momentum could fade. However, it may still benefit from retail-driven trades and speculative capital rotation.

🏅 Hedera (HBAR): Enterprise Tokenisation Leader

April Performance: +15.53%

Market Cap Rank: #17

HBAR climbed steadily in April thanks to strategic enterprise partnerships with global players like IBM, Dell, and initiatives in carbon credit tokenisation. The focus on real-world use cases continues to strengthen its fundamentals.

By TradingView - HBARUSD_2025-05-01 (1M)

By TradingView - HBARUSD_2025-05-01 (1M)

May 2025 Outlook:

If Hedera secures more corporate integrations or expands its tokenisation use cases, HBAR could see sustainable long-term growth through May and beyond.

May 2025 Outlook: Momentum or Correction?

April was a powerful month for altcoins, but the question now is whether these rallies can hold. With ETF developments, ecosystem upgrades, and DeFi usage driving narratives, the top altcoins are poised for potential continuation — but volatility remains high. Investors should keep an eye on macroeconomic shifts and news catalysts to stay ahead in May 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin is still in a good place, but short-term holders might be a problem

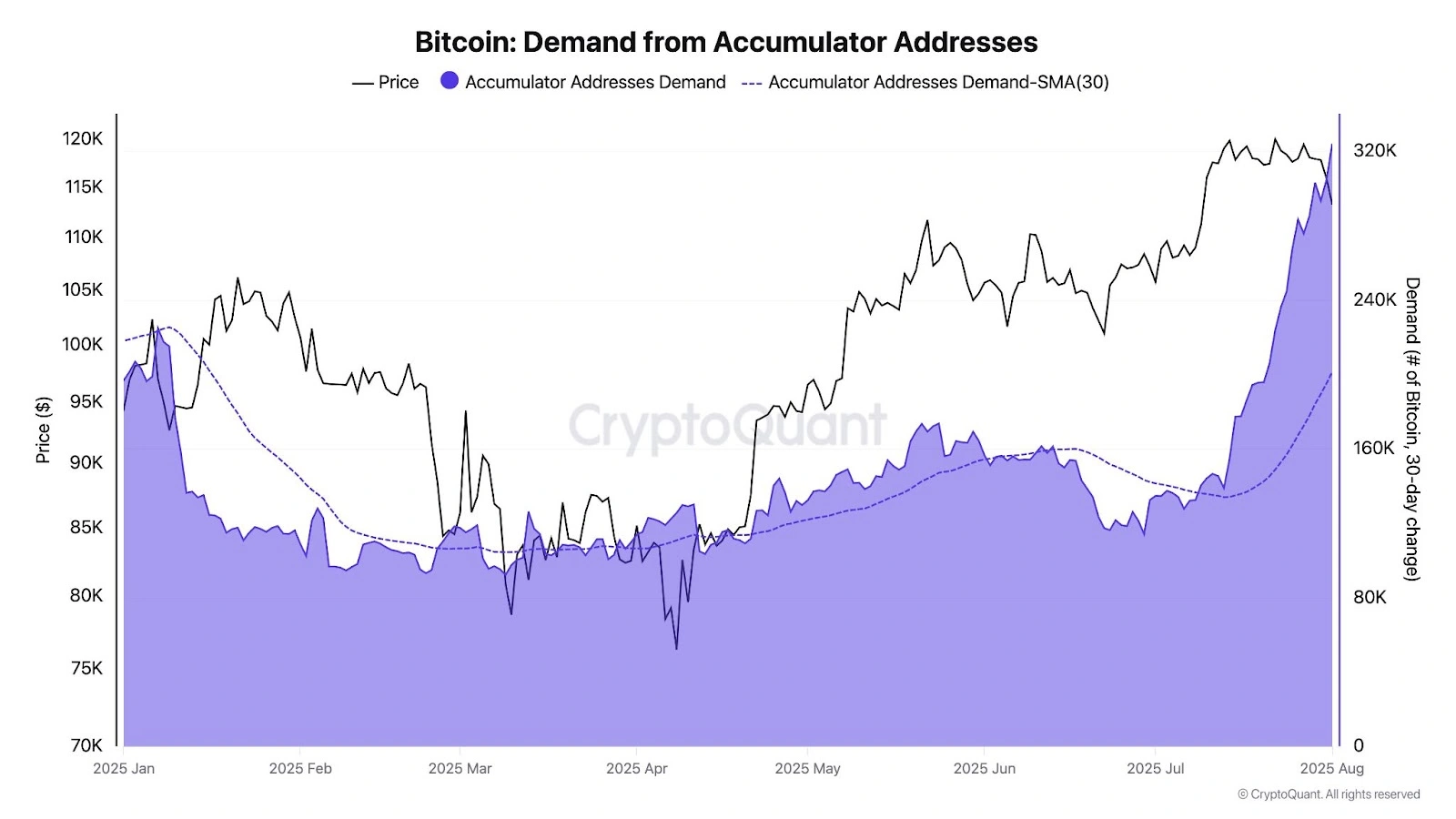

Share link:In this post: Accumulator wallets continue to buy without selling, reinforcing the bullish sentiment around the Bitcoin market. Declining OTC reserves hint at tightening supply and rising institutional demand. Short-term holders are nearing breakeven, increasing the risk of panic selling.

Sharplink and The Ether Machine lead as whales continue to stack ETH

Share link:In this post: Whales had a field day today, as on-chain data revealed that two Whale addresses received nearly 43K Ether worth over $153M. SharpLink Gaming also bought 18.68K ETH worth over $66.6M, while The Ether Reserve LLC acquired 10.6K ETH valued at around $40M. The Kobeissi Letter noted that ETH added a market cap of over $150 million since July 1.

Google to limit AI data center power usage during peak demand periods

Share link:In this post: Google has signed its first formal agreements to reduce AI data center power usage during peak electricity demand. The agreements with U.S. utilities, Indiana Michigan Power and Tennessee Valley Authority, address the rising energy demand from AI workloads straining power grids. Google’s agreement has introduced AI into demand-response programs and may set a precedent for other tech companies to deal with blackout concerns and higher electricity bills.

SEC Appeals in Ripple XRP Case Nears Deadline