Bitcoin (BTC) Rally Divides Market: Miners Bullish, Traders Cautious

Bitcoin’s surge above $95K has miners stocking up on coins, signaling bullish faith—yet traders hedge with bearish futures bets. The divide hints at high-stakes tension in BTC’s next price move.

Bitcoin’s decisive break above the psychologically significant $95,000 mark has injected fresh optimism into the market, at least among miners.

This key milestone has triggered a shift in miner sentiment, with on-chain data showing a noticeable uptick in BTC miner reserves over the past few days.

Miners Bet on BTC Upside as Reserve Jumps from Yearly Low

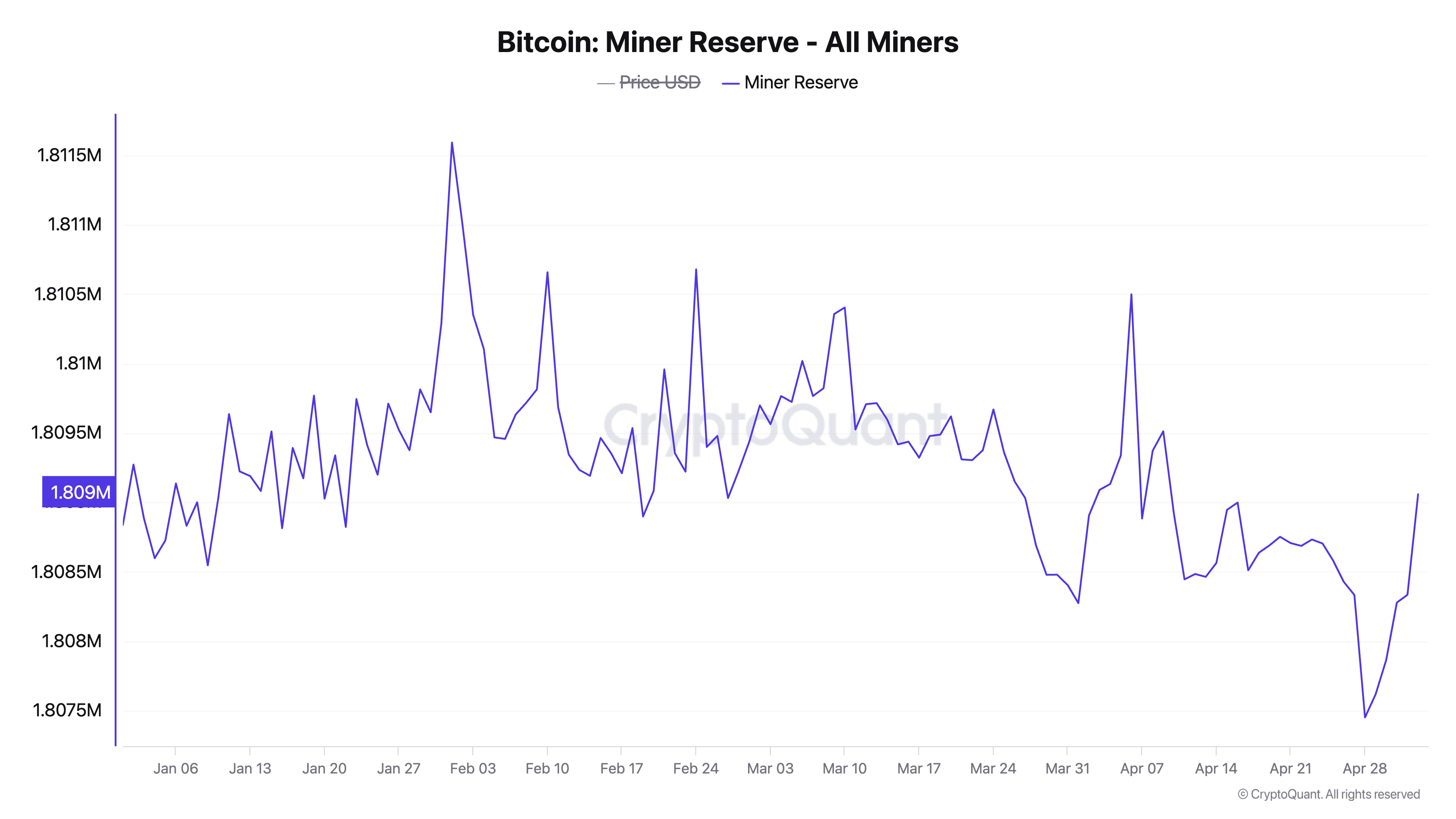

According to CryptoQuant, Bitcoin’s miner reserve, which had been in a sustained downtrend, began to rise on April 29, shortly after BTC closed above the $95,000 threshold.

For context, the reserve had dropped to a year-to-date low of 1.80 million BTC just a day earlier before reversing course and showing signs of accumulation.

Bitcoin Miner Reserve. Source:

CryptoQuant

Bitcoin Miner Reserve. Source:

CryptoQuant

Bitcoin’s miner reserve tracks the number of coins held in miners’ wallets. It represents the coin reserves miners have yet to sell. When it falls, miners are moving coins out of their wallets, usually to sell, confirming growing bearish sentiment against BTC.

Conversely, when this metric rises, as it is now, it suggests miners are holding onto more of their mined coins, often reflecting growing confidence in the BTC’s future price appreciation.

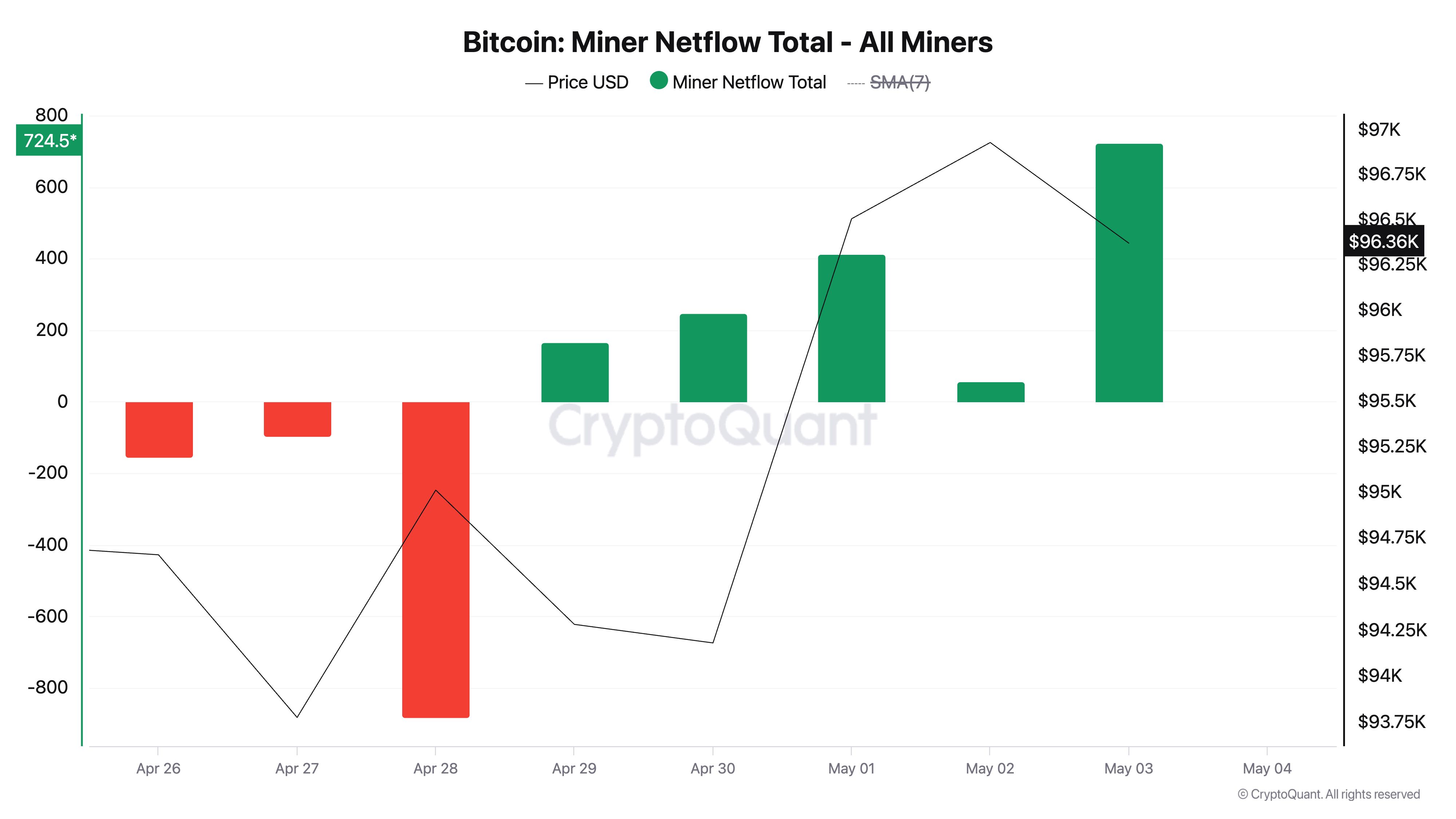

Moreover, the bullish shift in miner sentiment is further supported by the positive miner netflow recorded since April 29. This signals that more coins are being put into miner wallets rather than offloading to exchanges.

Bitcoin Miner Netflow. Source:

CryptoQuant

Bitcoin Miner Netflow. Source:

CryptoQuant

Such behavior reflects confidence in further upside, as miners, often seen as long-term holders, are choosing to accumulate rather than liquidate.

There Is a Catch

However, the sentiment is not universally bullish. While BTC miners are stepping back from selling, derivatives data tells a different story.

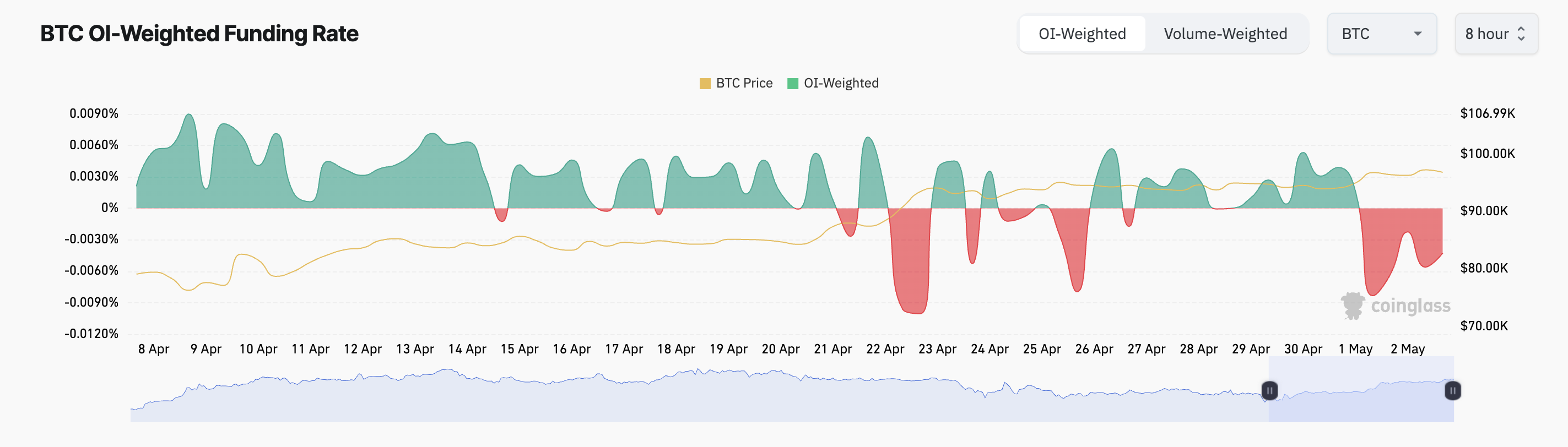

In the futures market, BTC’s funding rate has remained negative since the beginning of May, a sign that a significant portion of traders are betting on a near-term price correction. At press time, the coin’s funding rate is -0.0056%.

BTC Funding Rate. Source:

Coinglass

BTC Funding Rate. Source:

Coinglass

The funding rate is a periodic payment exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot price.

When it is positive, it means traders holding long positions are paying those with short positions, indicating that bullish sentiment dominates the market.

On the other hand, a negative funding rate like this signals more short bets than long ones, suggesting bearish pressure on BTC’s price.

Breakout or Breakdown as Traders and Miners Diverge

While miner behavior may point to renewed confidence, the steady bearish sentiment in derivatives suggests that traders remain wary of a potential pullback.

If coin accumulation strengthens, BTC could extend its gains, break above the resistance at $98,515, and attempt to regain the $102,080 price mark.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, if the bearish bets against the leading coin win and witness a shortfall in demand, its price could fall below $95,000 to reach $92,910.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fernando Nikolic Departs Blockstream After Four Years

The Largest BTC Theft in History: After 5 Years of Silence, the Involved Amount Reached $14.5 Billion

LuBian Pool was hacked in December 2020, with over 127,000 BTC stolen, valued at $3.5 billion at the time, now worth approximately $14.5 billion.

Visa, Mastercard Report Negligible Impact From Stablecoins

Arthur Hayes Sells Altcoins Amid Tariff Concerns