Hedera (HBAR) Approaches Year-To-Date Low Amid Bearish Indicators

Hedera's native token HBAR has faced a 5% decline, diverging from the broader market's uptick. Bearish momentum suggests a potential drop to its year-to-date low of $0.12.

Despite the broader market uptick this week, Hedera’s native token HBAR has bucked the trend, registering a 5% decline over the past seven days.

With bearish momentum building, the HBAR token now risks a return to its year-to-date low.

HBAR Slides Below Key Indicators

HBAR’s decline comes as many top cryptocurrencies post modest gains this week, reflecting its divergence from general market sentiment.

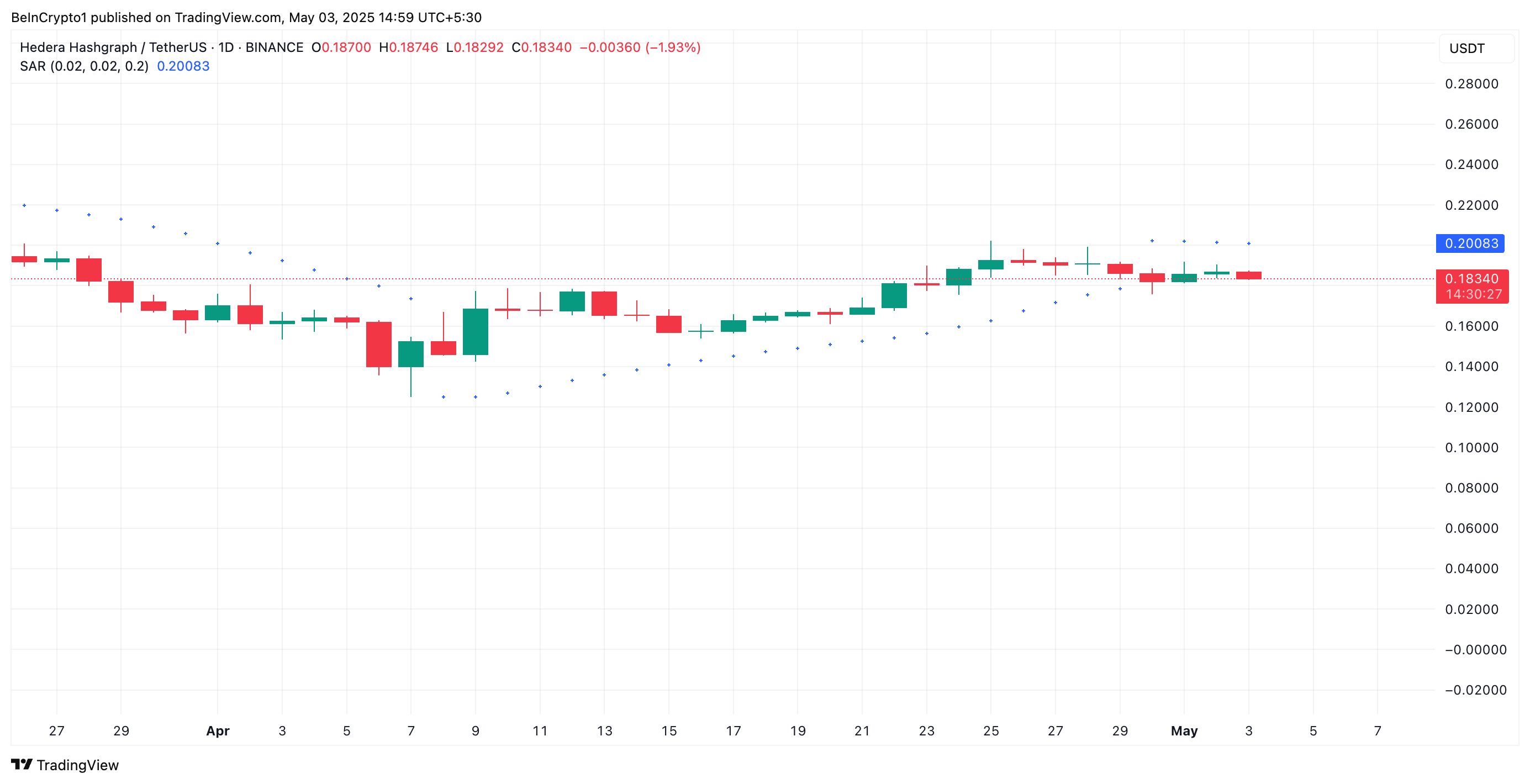

Readings from the HBAR/USD one-day chart suggest that this bearish trend could persist in the short term. For example, as of this writing, HBAR trades below the dots that make up its Parabolic SAR (Stop and Reverse) indicator.

HBAR Parabolic SAR. Source:

TradingView

HBAR Parabolic SAR. Source:

TradingView

This indicator measures an asset’s price trends and identifies potential entry and exit points. When an asset’s price trades below the SAR, it indicates a downtrend. It suggests the market is in a bearish phase, with the potential for further price dips.

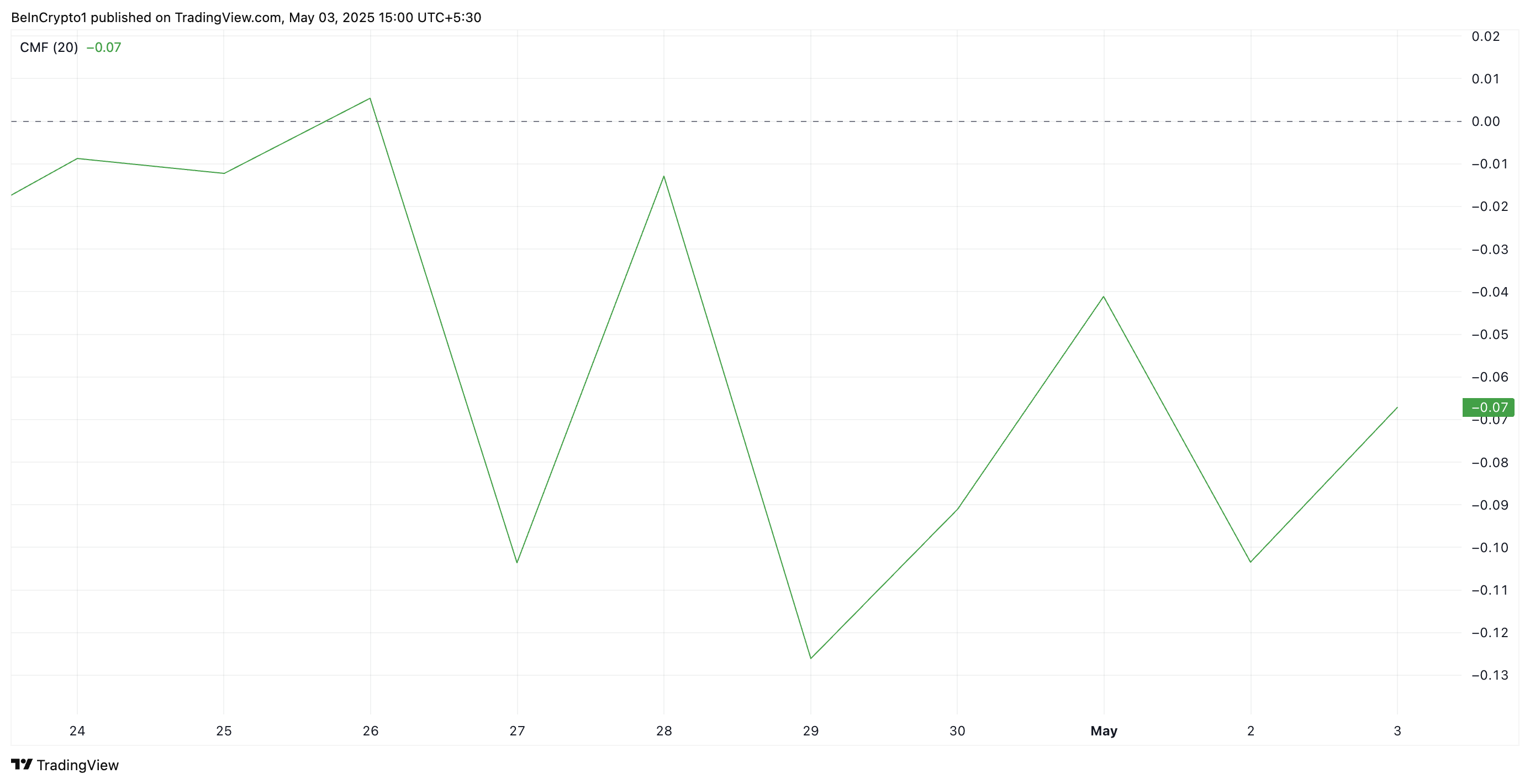

Supporting this bearish outlook, HBAR’s Chaikin Money Flow (CMF) remains in the negative territory, signaling a decline in buying volume and a growing presence of sellers in the market. It currently stands at -0.07.

HBAR CMF. Source:

TradingView

HBAR CMF. Source:

TradingView

This key momentum indicator measures money flows into and out of an asset. A negative CMF reading, like HBAR’s, signals that selling pressure dominates the market. This means that more investors are offloading the token than accumulating it, a pattern associated with a weakening price trend.

HBAR Tests 20-Day EMA: Will It Hold or Break Toward $0.12?

The daily chart shows HBAR’s decline has pushed it near the 20-day exponential moving average (EMA). This key moving average measures an asset’s average price over the past 20 trading days, giving weight to recent changes.

When the price falls near the 20-day EMA, it signals a potential support level being tested. However, if the price breaks decisively below the EMA, it may confirm sustained bearish momentum and further downside risk.

Therefore, HBAR’s break below the 20-day EMA could lower its price to its year-to-date low of $0.12.

HBAR price Analysis. Source:

TradingView

HBAR price Analysis. Source:

TradingView

However, if demand rockets and HBAR bounces off its 20-day EMA, its price could rally above $0.19.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List DePHY (PHY). Come and grab a share of 6,600,000 PHY

New spot margin trading pair — ES/USDT!

Bitget Trading Club Championship (Phase 1) – Make spot trades daily to share 50,000 BGB

SLPUSDT now launched for futures trading and trading bots