Analyst Says BTC Dominance Soars, Volatility May Arise Before FOMC

View original

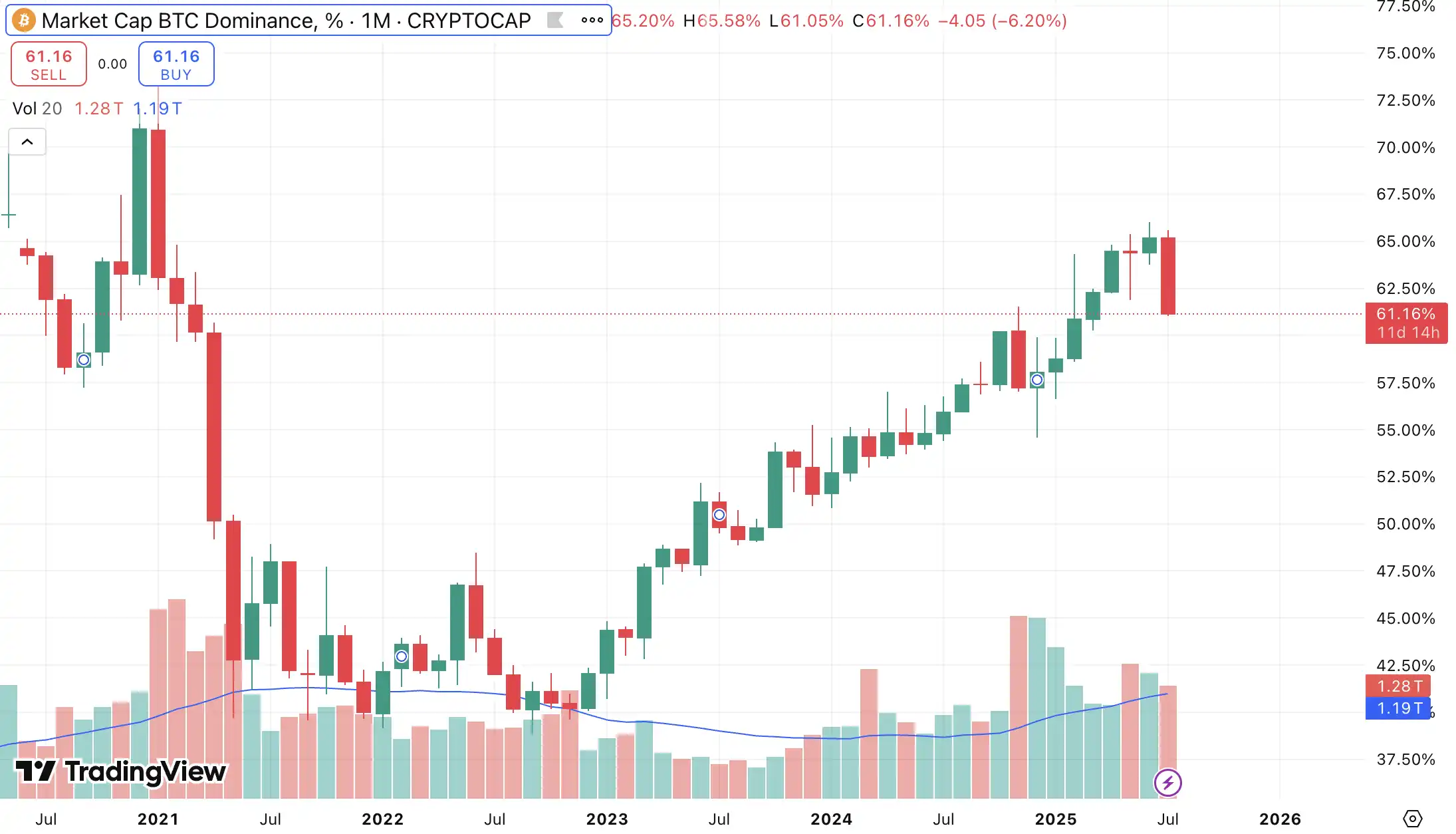

Bitcoin continues to maintain its dominance in the cryptocurrency market, with its dominance index reaching the highest level since 2018. As investors await the impact of the U.S. Federal Reserve's policy meeting, Bitcoin's price remains stable between $94,000 and $95,000. In contrast, the CoinDesk 20 index has slightly declined, and other cryptocurrencies like Ethereum, Sui, and Aptos have underperformed. Traditional market stocks have also experienced consecutive declines. Despite the relatively stable Bitcoin market price, Bitcoin's dominance has reached its highest point since early last year as the focus shifts to its share in the overall cryptocurrency market.

The Federal Reserve is set to hold a policy meeting on May 7, with current expectations to keep interest rates unchanged, raising concerns among investors about the potential impact on risk appetite. Given Bitcoin's recent extremely stable price movement, the upcoming FOMC meeting is expected to trigger significant volatility. Bitcoin's short-term volatility is unusually low, which typically leads to substantial fluctuations in the short term. Therefore, Lunde predicts that Bitcoin is unlikely to experience a large-scale decline in the short term and suggests adopting an active spot investment strategy.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Locked for new tokens.

APR up to 10%. Always on, always get airdrop.

Lock now!

You may also like

SlowMist Cosine: Beware of Phishing Emails to Prevent X Account Hijacking

ForesightNews•2025/07/20 16:53

ETH Surpasses $3,800

金色财经•2025/07/20 16:47

Bitcoin's market dominance has fallen below its 2024 annual peak

BlockBeats•2025/07/20 16:14

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$118,611.77

+0.43%

Ethereum

ETH

$3,809.55

+7.00%

XRP

XRP

$3.53

+2.41%

Tether USDt

USDT

$1

+0.00%

BNB

BNB

$755.46

+3.22%

Solana

SOL

$182.42

+2.73%

USDC

USDC

$0.9999

-0.00%

Dogecoin

DOGE

$0.2652

+9.24%

Cardano

ADA

$0.8731

+5.76%

TRON

TRX

$0.3195

+0.06%

How to sell PI

Bitget lists PI – Buy or sell PI quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now