Bitcoin Institutional Investors Trim Exposure Ahead of FOMC as BTC ETFs See Outflows

Institutional investors are pulling back from Bitcoin ETFs amid uncertainty surrounding the Federal Reserve's upcoming policy decision, but spot market inflows remain strong.

On Tuesday, Bitcoin spot ETFs recorded net outflows, snapping a three-day streak of inflows that had brought in over $1 billion.

With uncertainty surrounding the Federal Reserve’s upcoming policy decision, institutional investors appear to be reducing their exposure in anticipation of increased market volatility.

Institutions Pull Back from BTC ETFs as Fed Decision Looms

BTC spot ETFs saw net outflows of $85.64 million on Tuesday, marking a shift in sentiment among institutional investors just ahead of today’s US Federal Reserve’s latest policy meeting.

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

Total Bitcoin Spot ETF Net Inflow. Source:

SosoValue

The outflows came after three consecutive days of strong inflows, totaling over $1 billion, into these BTC-backed funds. This suggests a pullback as market participants prepare for potential volatility surrounding today’s FOMC announcement.

It can also be seen as a strategic step to avoid short-term losses in the event of an unfavorable policy signal or unexpected market reaction.

Despite the ETF outflows, on-chain data reveals a spike in spot net inflows today. This indicates that while institutional players may be reducing their ETF exposure, they could be rotating capital into direct spot positions, possibly to capitalize on short-term price swings both before and after the Fed’s announcement.

According to Coinglass, BTC’s spot net inflows sit at $9.72 million. When an asset sees spot inflows, the number of its coin or tokens purchased and moved into spot markets has increased, indicating rising demand.

BTC Spot Inflow/Outflow. Source:

Coinglass

BTC Spot Inflow/Outflow. Source:

Coinglass

This points to surging accumulation among BTC spot market participants, a trend which can drive price appreciation if buying pressure remains.

Bitcoin Rises on Buyer Strength

BTC trades at $96,679 at press time, noting a 2% surge over the past day. The coin’s positive Balance of Power (BoP) reflects the steady rise in spot buying activity ahead of the FOMC meeting. As of this writing, this is at 0.10.

This indicator measures the strength of buyers versus sellers by comparing the closing price to the trading range over a specific period. When its value is positive, buyers dominate the market, suggesting bullish momentum and upward pressure on an asset’s price.

If BTC demand rockets and market conditions remain favorable post-FOMC meeting, it could climb toward $102,080.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, if market volatility triggers a move to the downside, BTC could shed recent gains, breach support at $96,187, and fall to $92,048.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Rise in Fed and interest rate chatter may pose risks to crypto, Santiment warns

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

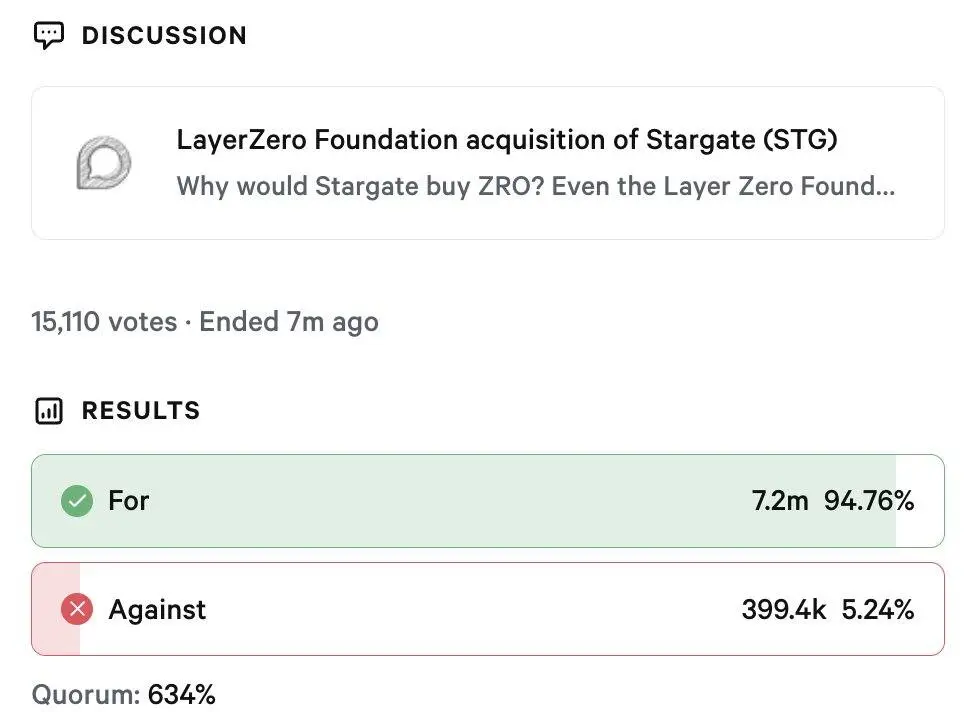

LayerZero wins Stargate takeover with 94% DAO approval in rare $120 million deal

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Why emerging markets will beat developed economies in 2025

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

US Fed Signals Rate Cut: Crypto Shorts Liquidated