Litecoin (LTC) Gains 10%, Yet Bearish Signals Could Indicate Possible Short-Term Selling Pressure

-

Litecoin (LTC) continues to exhibit volatility, recently surging 10% despite the SEC’s delay on the Litecoin ETF, currently trading at $91.68 and maintaining a robust daily volume.

-

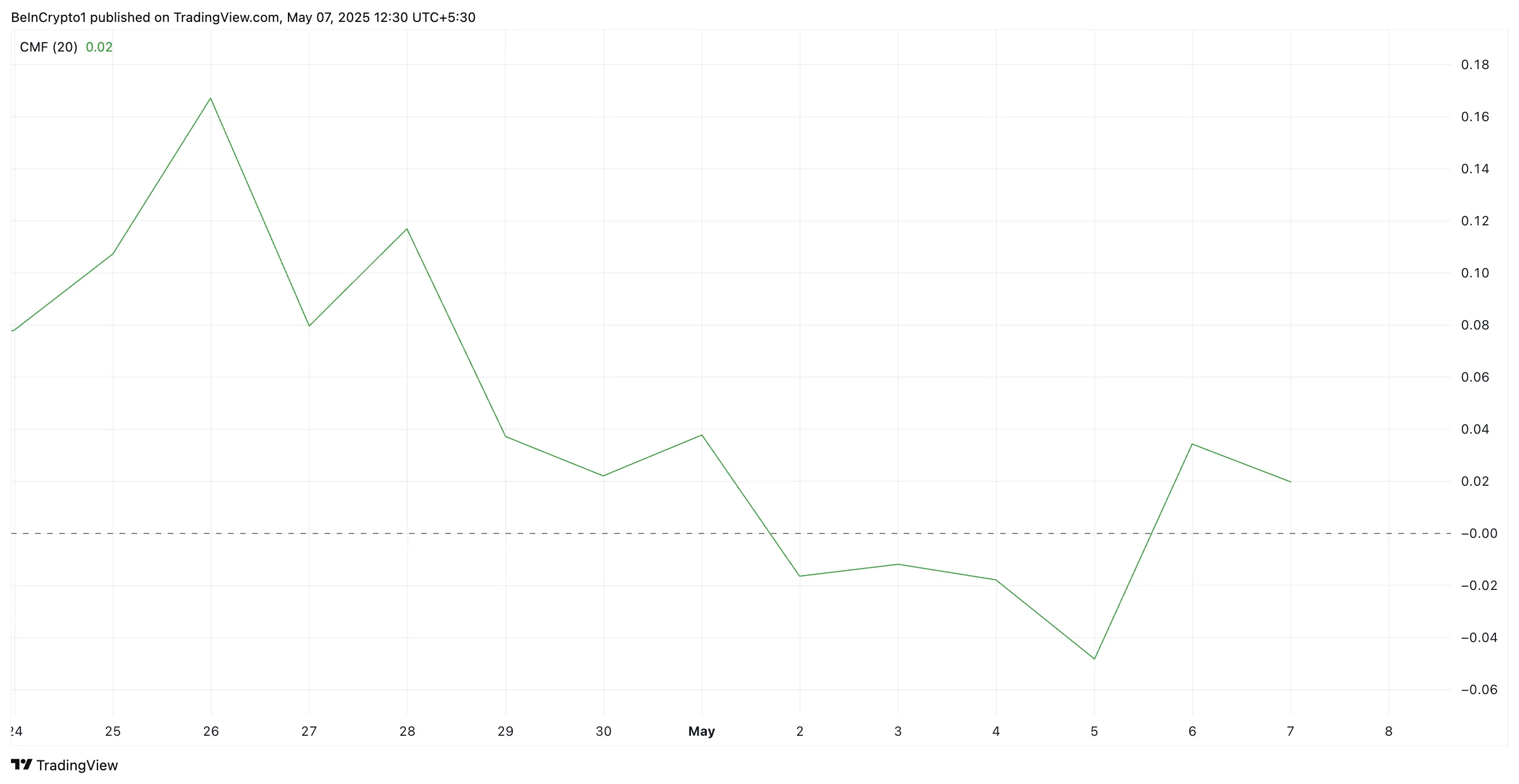

Key indicators are signaling a potential bearish reversal, notably with a decline in the Chaikin Money Flow (CMF), suggesting a decrease in buying pressure.

-

On-chain metrics indicate increasing profit-taking among holders, raising the likelihood of imminent short-term selling pressure.

Litecoin’s recent surge showcases market resilience, but potential bearish signs suggest a precarious path ahead for investors and traders.

LTC Bounces Back, Yet Profit-Taking Threatens Upside

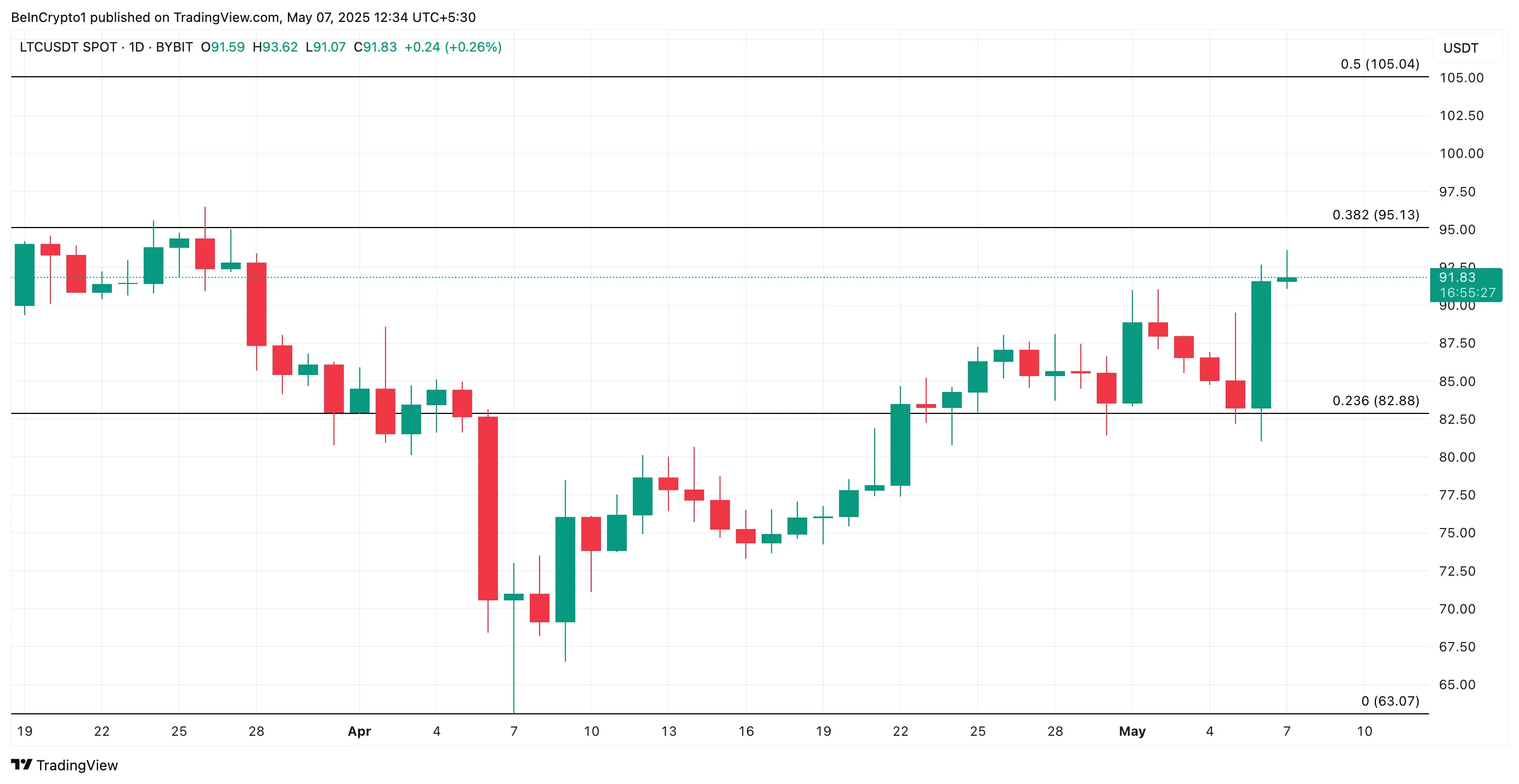

On Tuesday, following the SEC’s request for public comments regarding Canary Capital’s application for a spot Litecoin ETF, LTC plummeted to a two-week low of $81.03. This development raised concerns among investors about regulatory scrutiny.

However, the trading activity across the broader crypto market saw a resurgence, enabling LTC to rebound and currently trade at $91.68, with daily trading volume exceeding $850 million.

Despite this rally, indicators are signaling caution. There is a potential for a bearish reversal in the short term as signs of buyer exhaustion are evident.

For instance, although LTC has surged, its Chaikin Money Flow (CMF), a critical measure of buying and selling pressure, has shown a decline, forming a bearish divergence. The daily chart readings reveal that this momentum indicator is nearing a critical breach of the center line.

A bearish divergence in CMF occurs when the asset’s price records higher highs while the indicator registers lower highs. This situation infers that buying pressure is diminishing even as prices rise, indicating a potential loss of upward momentum in the LTC market.

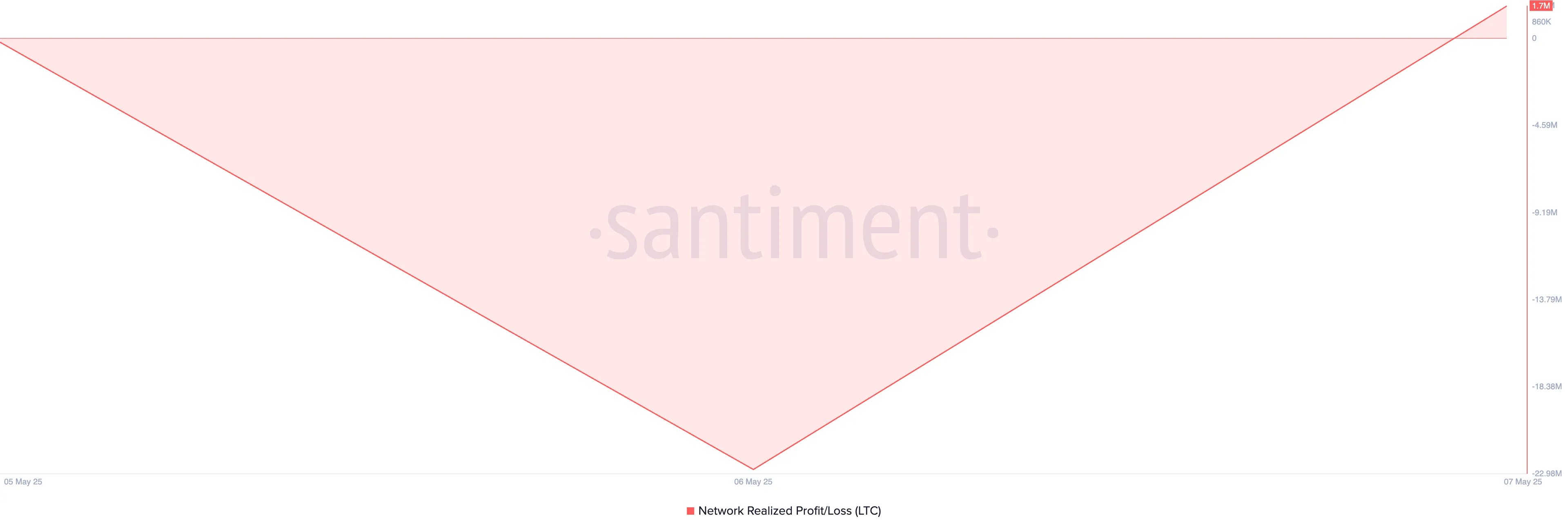

Moreover, current on-chain data reveals that Litecoin’s Network Realized Profit/Loss (NPL) is trending upwards, suggesting that coin holders are experiencing unrealized gains, prompting a possible sell-off. At the moment, the NPL stands at 1.7 million.

This metric reflects the net profitability or loss from all coins transacted on-chain, based on their last transaction price. An upward trend in NPL indicates broader profitability across the Litecoin network.

Combined with the waning buy pressure indicated by the CMF, these factors elevate the risk of short-term selling as traders may seek to secure their profits.

Can Litecoin Hold Its Gains?

As bearish pressures strengthen, LTC buyers may soon face exhaustion. Should new demand not materialize in the spot markets to sustain the current rally, LTC risks retreating to a support level of $82.88.

Conversely, a shift towards bullish market sentiment could alter this trajectory. An upsurge in buying activity could propel LTC’s price to an enhanced resistance at $95.13. A successful breach of this level might set the stage for a move toward $105.04, fostering renewed optimism among traders.

Conclusion

In conclusion, while Litecoin has shown remarkable resilience with its recent gains, the underlying indicators suggest potential volatility ahead. Investors should remain vigilant regarding market dynamics and consider both fundamental and technical analyses as they navigate this evolving landscape. Staying informed will be crucial for capitalizing on opportunities and mitigating risks in the unpredictable crypto market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Price: CryptoQuant Unveils Critical Undervaluation vs. Bitcoin

Arthur Hayes Bitcoin Shock Prediction: US Treasury Fuels Path to $1 Million

90 Days Later, Bitcoin Returns to $100,000: Is the Bull Market Here?

Multi-Factorial Benefit

Metaplanet’s Daring Move: Japan Firm Invests $25M More in Bitcoin, Acquires Additional 555 BTC

Metaplanet Strengthens Institutional Demand with Bitcoin Strategy - Leads to Stock Gains and Expands Global Crypto Investment