Avalanche (AVAX) price together with its blockchain could be on the verge of a turn around following the recent data on the charts and its chain.

Avalanche Crypto Price Action

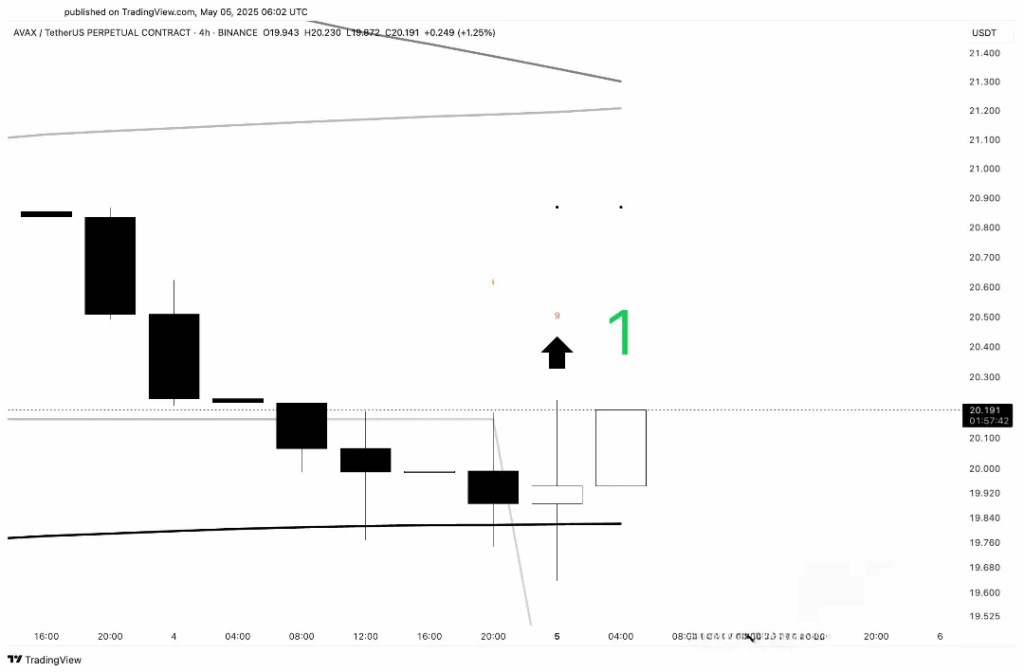

Looking at the 4-hour chart, AVAX price encountered resistance at the 200SMA near $19.75.

The altcoin created a bullish engulfing candle that triggered a “1” buy signal from the TD Sequential indicator after completing the “9” countdown pattern.

Market indications pointed toward an early price reversal due to the continuous decline.

A breakout above $20.30 would likely drive prices toward $21.00 with a sign of broader upward potential emerging around $21.30.

AVAX price chart | Source: Trading View

AVAX price chart | Source: Trading View

A decline below the $19.85 mark would reverse the bullish signal thus causing price to drop back to reach $19.60 support.

Support at 200SMA had previously held important levels but confirmation of the reversal of TD Sequential indicator will wait for next candle action.

Initial indications of likely bounce appear when prices cross above $20.50 but a fall below $19.60 indicates fresh selling pressure could appear.

AVAX Price Analysis and Prediction

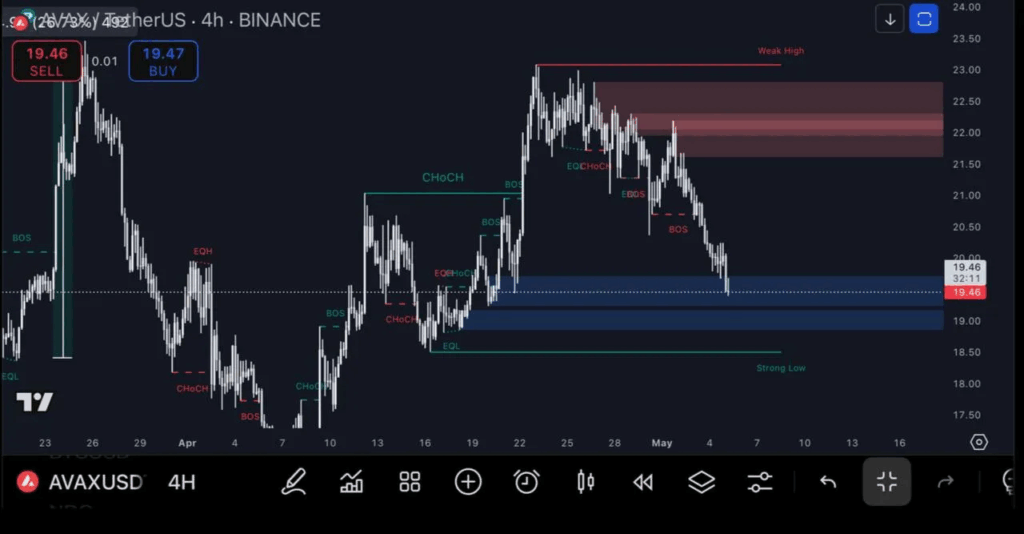

Deeper analysis of AVAX price showed the $19.00–$19.50 zone formed a strong low which previously triggered a breakout rally up to $23.10.

The blue demand block proved able to resist price movement slightly which indicated buyers might continue to support that area.

The most recent Break of Structure (BOS) reached $20.50 which validated a bearish trend and price had established consecutive descending highs.

A successful rally above $20.50 would likely alter current price patterns to push the exchange upwards towards $22.50.

AVAX price chart | Source: Trading View

AVAX price chart | Source: Trading View

Two pivotal indicators within current chart structure pointed to CHoCH at $21.60 and BOS at $20.90. The price needed to break through these points to verify a continuing upward trend.

A clean break of $19.00 support could push AVAX price toward its significant support area at $18.30. An equal low resistance zone at this level could serve as the last potential barrier before a new decline begins.

Holding within this current blue zone could potentially drive price upward to challenge the $21.00–$22.00 price imbalance.

The current red zone above $22.00 still showed evidence of being a weak price high region. The sell zone could persist but would only give way after an established breakdown occurs.

AVAX’s price reaction at this demand block could determine its upcoming swing direction.

Avalanche Crypto Flows

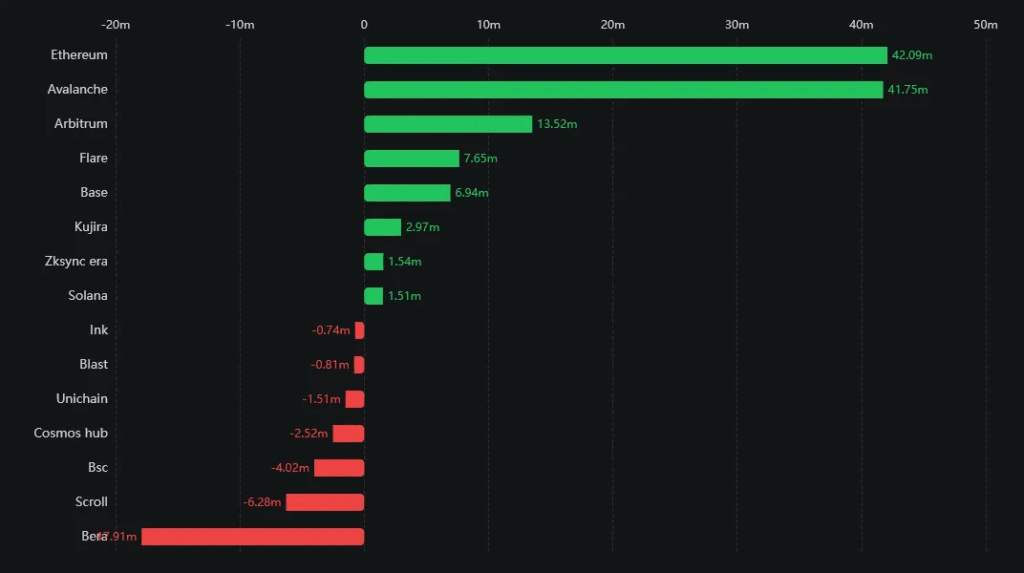

Meanwhile, Avalanche blockchain secured $41.75 million in daily inflows following behind Ethereum’s record $42.09 million—the highest figure.

The significant boost in liquidity reflected investors’ strong interest which may produce ongoing upward price trends.

Arbitrum network scored $13.52 million worth of invoices over the last day followed by Flare with $7.65 million and Base exchanging $6.94 million.

Positive transaction levels were recorded by blockchain networks Solana and Kujira, which received $1.51 million and $2.97 million, respectively.

Chain flows | Source: X

Chain flows | Source: X

Bera chain saw the biggest exits, reaching $7.91 million, while Scroll and BSC’s rolled trades came to $4.02 million and $6.28 million, respectively.

Significant user inflows in AVAX signal potential to improve network operation and Decentralized Financial services (DeFi) use which could lead to a rise in price.

The perpetual stream of value necessitates persistent interest and demand upkeep to avoid reversals or a reversal of action.

While market conditions and overall sentiment caused ultimate price motion, this transaction information painted a good short-term scenario for AVAX price.