Rootstock Bitcoin Mining Hits Record High Despite Drop in TVL

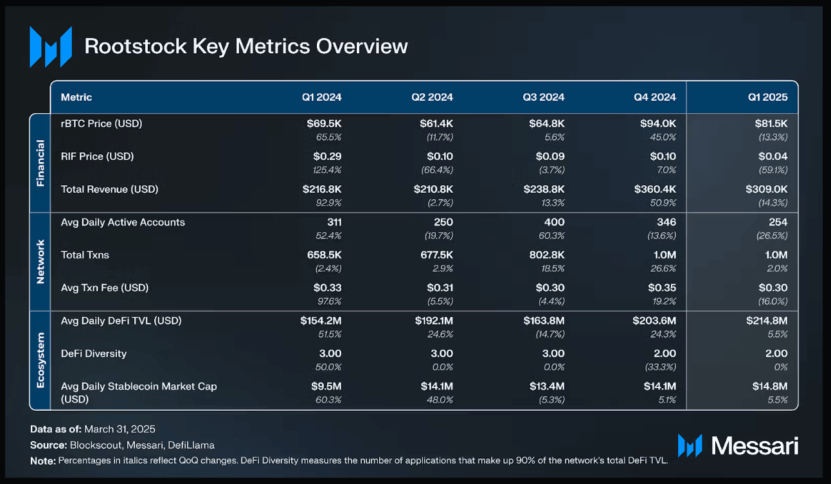

Rootstock, a smart contract platform built on Bitcoin, saw an increase in mining activity and network security in the first quarter of 2025, even as overall user activity slowed.

According to Messari’s “ State of Rootstock ” Q1 2025 report, merged mining participation reached an all-time high of 81%, up from 56.4% in the previous quarter, thanks to support from top mining pools Foundry and SpiderPool. This helped boost Rootstock’s hash power to more than 740 exahashes per second, beating the total Bitcoin network hashrate recorded back in October 2024.

Rootstock over for first half of 2025 | Source: Messari

Rootstock over for first half of 2025 | Source: Messari

Messari described this growth as a sign that Rootstock is now in a “mature phase” of its merged mining journey, with stronger security and broader miner support. The report also revealed that the rise in mining happened alongside a 60% drop in transaction fees, which makes the platform more affordable and easier for users to access.

“As BTCFi continues to grow, Rootstock is well-positioned for broader adoption through core upgrades like a 60% reduction in transaction fees,” said Messari analyst Andrew Yang.

The platform’s total value locked (TVL), which measures how much crypto is stored in DeFi apps, fell during the same period despite the mining success.

Bitcoin-denominated TVL dropped 7.2%, and TVL measured in US dollars fell 20% to $179.9 million, according to Messari’s data. TVL had briefly reached $244.6 million in January during a Bitcoin price surge but started dropping in March as the market cooled off.

Ethereum also saw a 27% TVL decline in Q1, influenced by the $1.4 billion Bybit hack and global market uncertainty, according to data from DappRadar . Stablecoins on Rootstock also shifted, with USDT (Tether) staying on top at $3.8 million and 27.5% market share, down from 41.3% the previous quarter.

By the end of the quarter, no single stablecoin held more than 30% of the total market on the platform. Whilst, user activity slowed down too. Active addresses dropped by 26.5%, and new address creation plunged by 54.7%. But daily transactions slightly rose by 4.3%, reaching 11,524 on average.

Rootstock also made tech upgrades, launching its Lovell 7.0.0 update for better Ethereum Virtual Machine (EVM) compatibility and faster smart contracts. The platform added integrations with LayerZero and Meson Finance, held a new hackathon, and improved its governance system, RootstockCollective.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Announcement on the completion of pump.fun (PUMP) Token Sale

Update on the pump.fun (PUMP) Token Sale Results

[Initial Listing] Bitget Will List PrompTale AI (TALE). Come and grab a share of 3,480,000 TALE

New spot margin trading pair — LA/USDT!