BlackRock Warns of Quantum Computing Threat in Bitcoin ETF Risk Disclosure

The uodated Bitcoin and Ethereum ETF filings reflect BlackRock’s continued engagement with regulators and evolving market structures in the crypto ETF space.

BlackRock has updated its S-1 registration statement for the iShares Bitcoin Trust (IBIT), introducing new language that outlines the potential risks posed by quantum computing.

This revision, filed on May 9, reflects growing industry awareness of how advanced computing technologies could impact cryptographic systems used in digital assets.

BlackRock Flags Theoretical Quantum Risks to Bitcoin Security

In the filing, the asset manager warned that future advancements in quantum computing may undermine the security framework underpinning Bitcoin.

Should quantum technology evolve far beyond its current state, it could render the cryptographic algorithms used by Bitcoin obsolete.

This could allow malicious actors to exploit vulnerabilities, including gaining unauthorized access to wallets that store Bitcoin for the trust or its investors.

While quantum computing is still developing, BlackRock emphasized that the technology’s full capabilities remain uncertain.

However, the firm considers it important to disclose any theoretical threats that could affect the performance or security of its crypto investment products.

Bloomberg ETF analyst James Seyffart said the update is a key factor that is standard in ETF filings. He explained that issuers routinely list all potential threats, no matter how remote.

“To be clear. These are just basic risk disclosures. They are going to highlight any potential thing that can go wrong with any product they list or underlying asset thats being invested in. It’s completely standard. And honestly makes complete sense,” Seyffart added.

Notably, BlackRock’s filing also covers concerns about regulatory actions, energy consumption, mining concentration in China, network forks, and prior market events like the collapse of FTX.

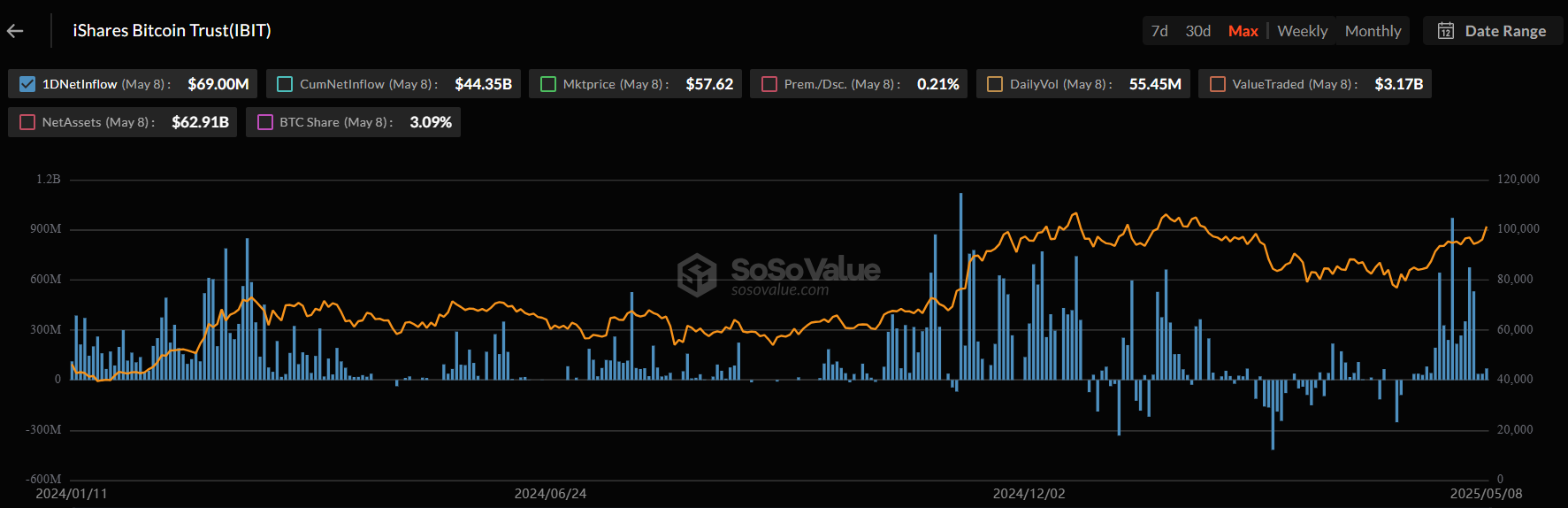

BlackRock’s IBIT Flows. Source:

SoSoValue

BlackRock’s IBIT Flows. Source:

SoSoValue

Despite these warnings, IBIT remains the largest spot Bitcoin ETF on the market. It has recorded 19 consecutive days of inflows, attracting more than $5.1 billion during the reporting period.

Ethereum ETF Filing Adds In-Kind Redemption Structure

In a separate filing, Seyffart revealed that BlackRock also amended its S-1 application for its spot Ethereum ETF.

The new version includes plans to support in-kind creation and redemption—a model allowing investors to swap ETF shares directly for Ethereum, instead of using cash.

This structure could lower transaction costs and reduce market friction. It also avoids converting crypto into fiat currency, which is currently required under the cash-based model. The approach may help issuers minimize price slippage and save on trading fees.

The SEC has yet to approve in-kind redemption models for crypto ETFs, but analysts expect progress this year.

“Eric Balchunas & I expect SEC approval for in-kind at some point this year…Notably, the first application for any of the Ethereum ETFs to allow In-kind create/redeem has a final deadline around ~10/11/25,” Seyffart noted.

BlackRock’s filing follows the firm’s meeting with the US Securities and Exchange Commission (SEC) to discuss crypto ETF staking and securities tokenization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

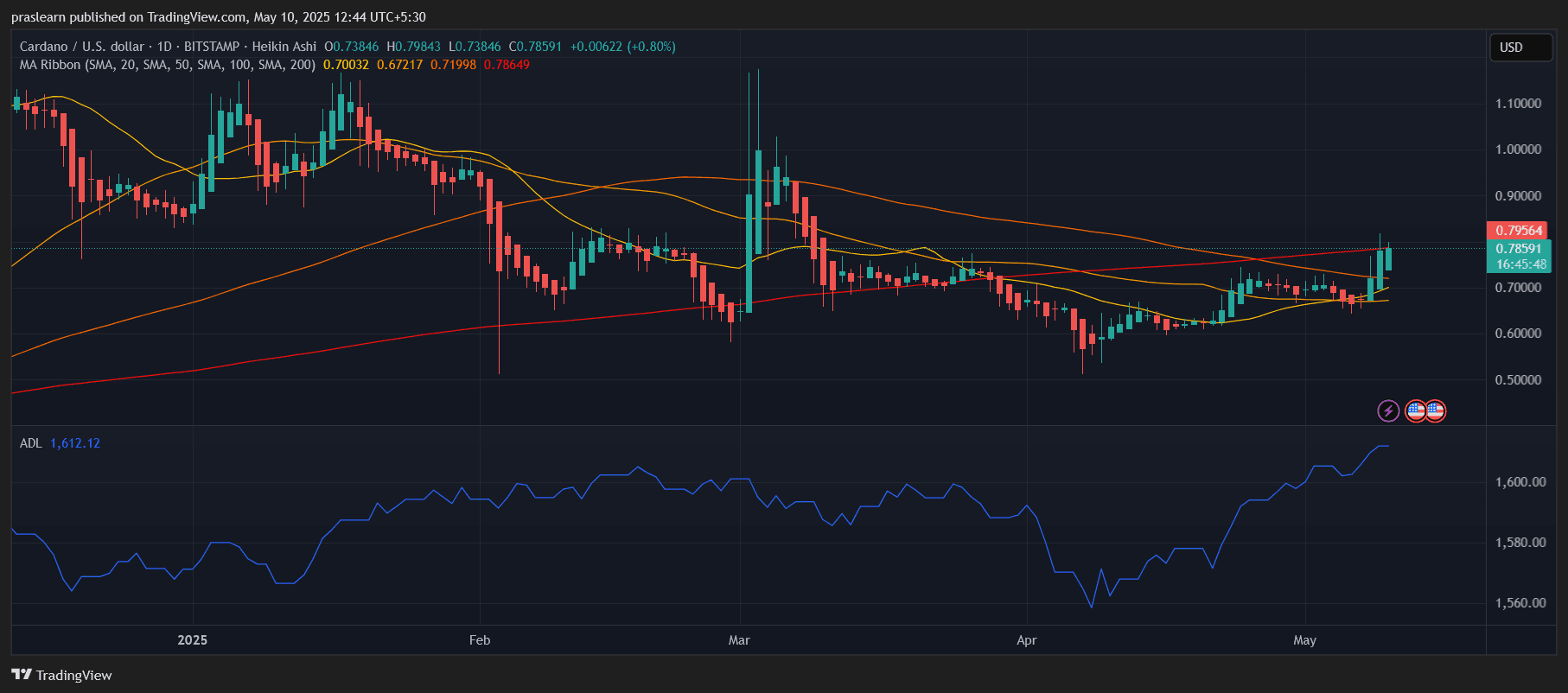

ADA Price Breaks Key Resistance: Is Cardano Set for a Major Rally?

Cardano Poised to Recover 40% Losses From March – Is the ADA Bear Cycle Over?

Cardano’s recent 17% surge signals a potential recovery from March’s 40% loss. The key to further growth lies in breaching the $0.85 resistance and holding support above $0.74.

Pi Network is Inching Towards $1 Thanks to a Major Shift in Holder Behavior

Pi Network’s price has risen 27%, fueled by strong investor sentiment, but it faces a tough resistance at $0.78. A breakout could push the price higher, while failure to hold support at $0.71 risks a decline.

Worldcoin (WLD) Surges Amid Legal Challenges and Speculation on OpenAI Integration