Bitcoin Approaches All-Time Highs as Whales Accumulate While Retail Investors Remain Cautious

Bitcoin nears all-time highs as whales buy big, retail hesitates.

-

Whales have withdrawn 110,000 BTC in 30 days, signaling aggressive accumulation and possible upside momentum.

-

Traders are heavily positioned at key levels, with $496M in longs near $102.8K and $319M in shorts at $104.8K.

Bitcoin [BTC], the world’s largest cryptocurrency, has shifted the overall cryptocurrency market with its impressive recovery over the past few days.

The surge appeared largely driven by whale activity, which has ramped up across both spot and derivative markets.

Whales withdrew 110,000 BTC, time to buy?

Since the day Bitcoin began bleeding, whales and industry giants have seized the opportunity to buy the dip.

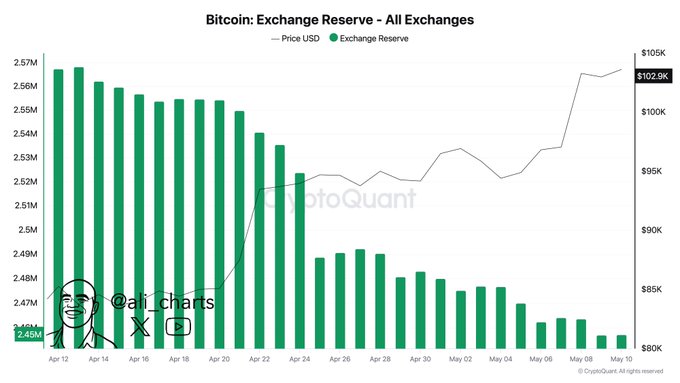

Recently, a prominent crypto expert shared data on Bitcoin exchange reserves over the past 30 days, revealing that whales have withdrawn over 110,000 BTC during this period.

This substantial withdrawal of BTC indicates potential accumulation and could create buying pressure, leading to a further upside rally, which explains Bitcoin’s recent surge.

Meanwhile, whales haven’t stopped yet, they have been continuously accumulating BTC.

In just 48 hours, whales added another 20,000 BTC to their wallets.

This continuous accumulation of BTC reflects the whales’ interest and confidence in the asset for the long term.

Retailers least participation

On the other hand, retail investors were largely absent during this period and were seen offloading their holdings due to panic.

According to on-chain analysts, retail typically returns near market tops, not during recoveries or corrections.

Despite BTC trading just 5% below its previous peak, retail participation stayed muted, possibly limiting frothy speculation—for now.

$500 million worth of bullish bets

Besides all this, traders appear to be aligning with the current market sentiment, as revealed by the on-chain analytics tool Coinglass.

Data shows that traders are currently overleveraged at the $102,819 level on the lower side (support) and $104,871 on the upper side (resistance).

At these levels, traders have built $496.55 million worth of long positions and $319.26 million worth of short positions.

This metric indicates that bulls are currently dominating the market, hoping that the BTC price won’t fall below the $102,819 support level anytime soon.

At press time, BTC traded around $104,300—up 0.75% in 24 hours. However, trading volume dipped 7%, hinting at lower engagement.

Bitcoin price action & technical analysis

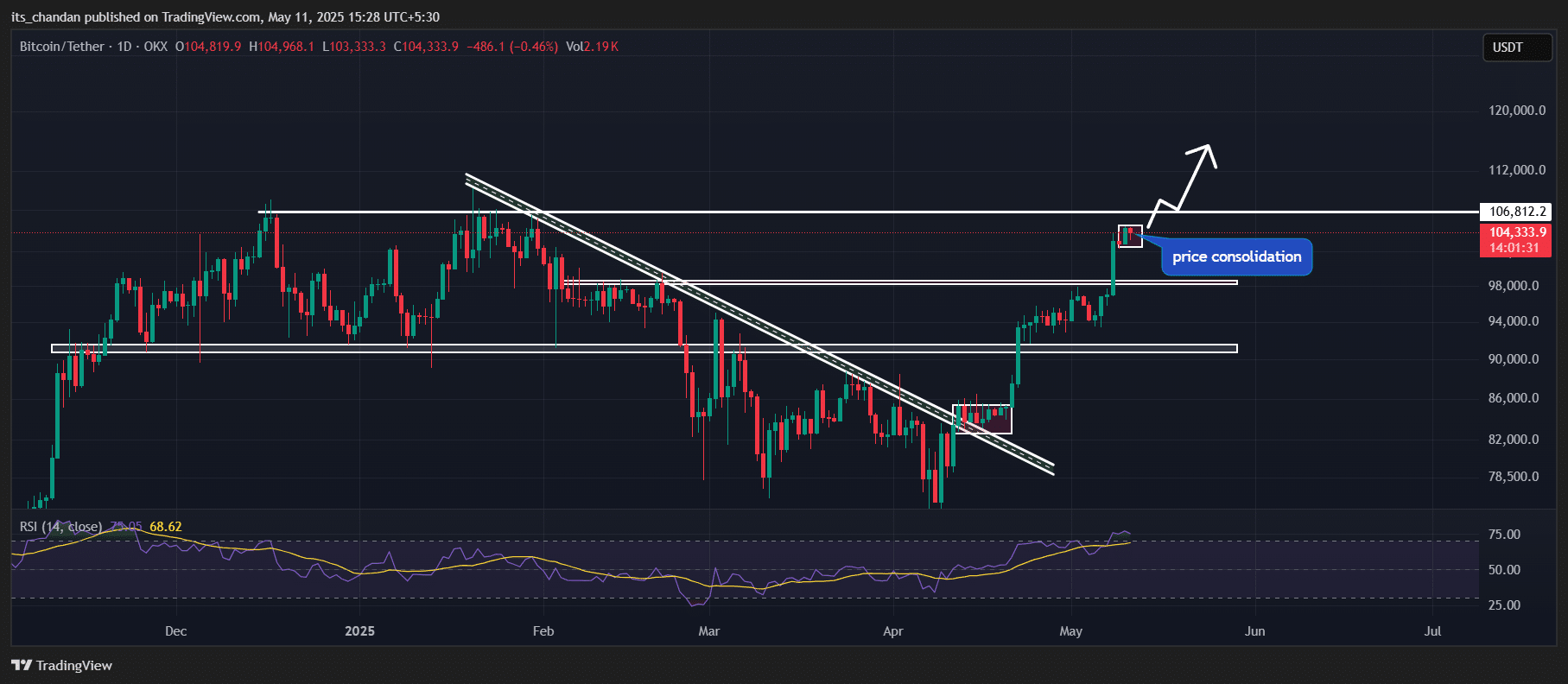

According to COINOTAG’s technical analysis, BTC appears bullish and is poised for a new high. The daily chart reveals that the asset is heading toward the key resistance level of $106,800.

If this upward momentum continues and the price breaks through this resistance, there is a strong possibility that BTC could experience a notable surge and potentially reach a new all-time high.

BTC’s Relative Strength Index (RSI) stood at 74, indicating that the asset is in overbought territory.

There is a strong possibility that it could experience a price correction until the RSI moves out of the overbought zone.

Conclusion

In summary, while whale activity suggests growing confidence in Bitcoin’s potential for further gains, muted retail participation may temper speculative pressures. As the market evolves, it will be essential to monitor these trends to gauge future price movements. With a critical resistance level nearing, market players should remain vigilant while considering their investment strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analyst Predicts 2025 Altcoin Season Amid Divided Market Views

Onyxcoin Unveils Major XCN Upgrade for 2025

Dogecoin Approaches $0.26 Amid Market Speculation

DePAI Revolutionizes Decentralized AI Through Robotics Integration