-

WhiteBIT unlocks 39 million tokens worth $1.19 billion, raising concerns over market impact as its price lags behind major exchange tokens.

-

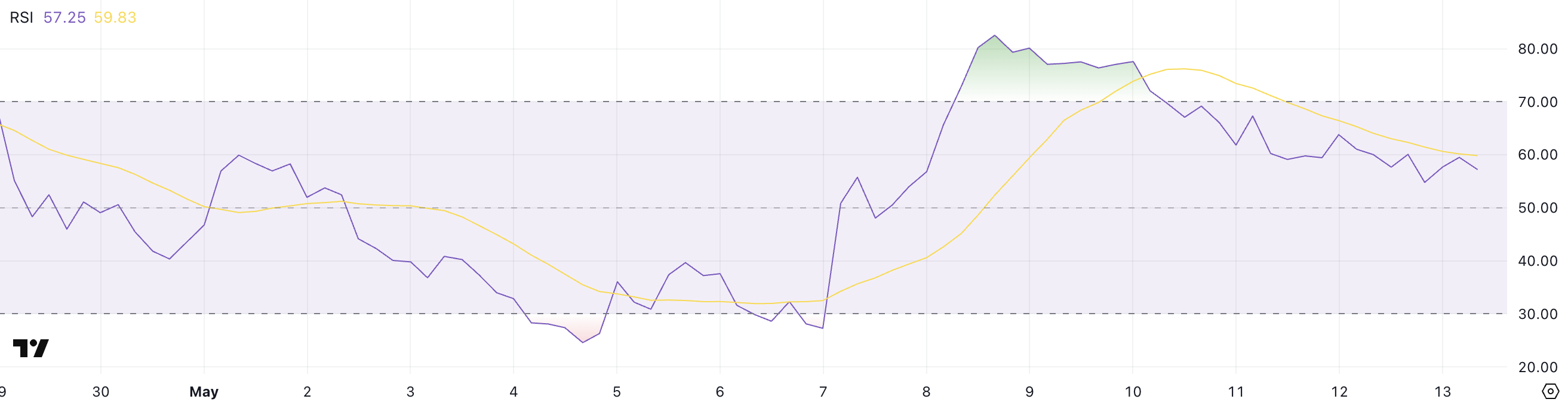

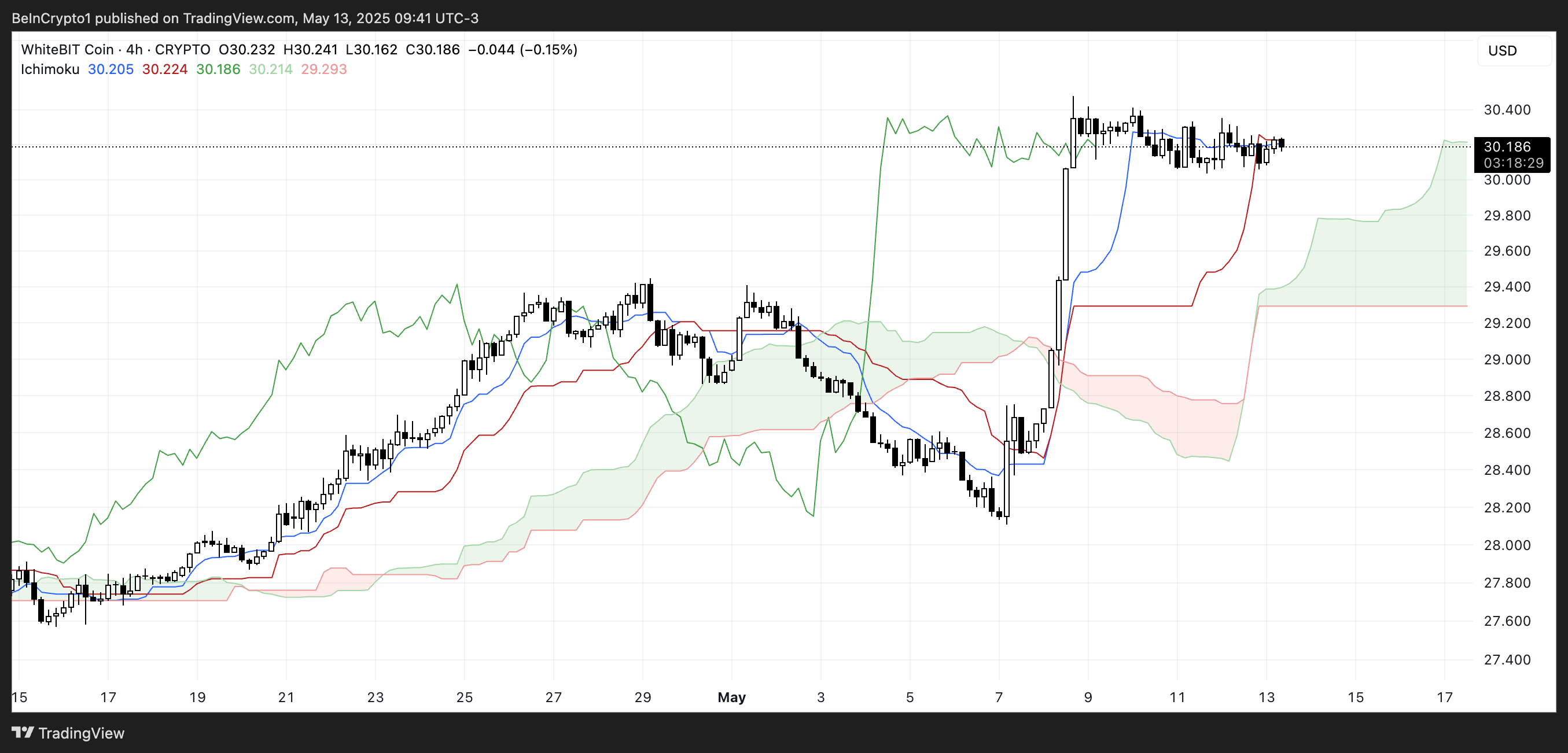

RSI drops to 57.25 from 77.57, signaling fading momentum; Ichimoku Cloud shows consolidation but trend remains neutral to bullish.

-

Key support at $30.06 is holding; a breakout could target $32, while failure risks a slide toward $27.56 amid post-unlock volatility.

WhiteBIT’s unlock of $1.19 billion in tokens raises market concern; performance lags peers amid waning momentum and critical support levels.

WhiteBIT Awaits $1.19 Billion Token Unlock as Performance Lags Behind Peers

WhiteBIT (WBT) faces a pivotal moment today as it unlocks over 39 million tokens worth approximately $1.19 billion.

The team will allocate the unlocked tokens to WhiteBIT Funds, with traders closely monitoring the market for potential price impact or distribution activity.

WBT Unlock Info. Source: CryptoRank.

While WBT has posted a 6.5% gain over the past seven days, that performance trails broader market trends and is notably weaker than key exchange-related tokens. The community remains cautious, as large unlocks often bring increased volatility and potential sell pressure.

Compared with its peers, WBT is underperforming. Binance Coin (BNB) is up 10%, Bitget Token (BGB) gained 9.4%, Cronos (CRO) rose 15%, and Uniswap (UNI) surged an impressive 40% in the same period. This relative lag suggests a lack of strong momentum or investor conviction ahead of the unlock.

WBT Indicators Signal Consolidation Ahead

WhiteBIT’s RSI has dropped to 57.25 from a recent high of 77.57, which indicates a cooling momentum just ahead of the token unlock.

RSI (Relative Strength Index) is a momentum indicator that ranges from 0 to 100. Values above 70 suggest an asset is overbought, while below 30 indicates it may be oversold.

WBT RSI. Source: TradingView.

At 57.25, WBT is now in neutral territory, implying that the recent rally is losing strength but still leaves room for another upward move if sentiment improves post-unlock.

The Ichimoku Cloud for WhiteBIT shows a neutral-to-bullish structure. Price action is currently above the cloud, which is typically a bullish sign.

WBT Ichimoku Cloud. Source: TradingView.

The blue line (Tenkan-sen) and red line (Kijun-sen) are flat and tightly aligned, suggesting consolidation and a lack of short-term momentum.

If price remains above the cloud, the trend remains intact, but a drop into the cloud could shift the short-term outlook to neutral.

WhiteBIT Holds Key Support Near ATHs — Breakout or Breakdown Ahead?

WhiteBIT is trading near its all-time highs, holding steady despite four days of price consolidation. The $30.06 level has served as a key support.

WBT Price Analysis. Source: TradingView.

If that support is tested again and fails, downside targets include $29.40 and $28.86, with deeper levels at $28.10 and $27.56 if selling momentum rises.

Conversely, a break above the current consolidation range could trigger a fresh rally. If bullish momentum builds, WBT could push past $31 and potentially test the $32 level.

Conclusion

As WhiteBIT unlocks significant tokens today, the potential market reactions will be closely scrutinized. The key levels of support and resistance will determine the short-term trajectory of WBT. Investors should remain vigilant as possible volatility unfolds in the upcoming days.