- Despite market optimism, Jim Cramer dismisses Bitcoin’s $200K target, calling it unrealistic.

- Bitcoin hits $103K amid U.S. trade easing, but trading volume drops over 21%.

- Analyst sees BTC peaking near $122K before a bearish correction per Elliott Wave model.

CNBC’s Jim Cramer has dismissed speculation that Bitcoin could go above $200,000 this year, calling such predictions unrealistic. His comments come as the crypto market is gaining renewed growth, with Bitcoin rising above $103,000. Cramer’s remarks also follow a shift in financial sentiment sparked by changes in U.S. trade policy under President Donald Trump.

Cramer pointed to the recent market recovery as a response to Trump’s move to ease tariff pressures, a departure from earlier expectations of a more aggressive approach. The rollback of proposed tariffs on key trading partners, including China, led to a large rebound across major U.S. stock indexes.

Cramer argued that those who expected the market to collapse under renewed trade tensions misjudged the administration’s direction. However, he emphasized that this recovery does not justify extreme projections in assets like Bitcoin.

Bitcoin Climbs Above $103K Showing Strong Uptrend

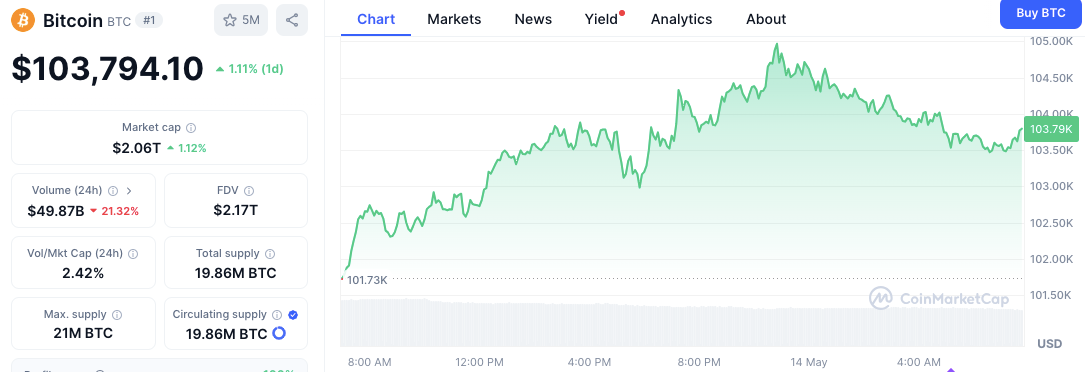

While equities rebounded on improved trade sentiment, Bitcoin maintained its upward trend. During the time of writing, Bitcoin traded at $103,794.10, marking a 1.11% increase over 24 hours. Its total market capitalization rose to $2.06 trillion, up 1.12% from the previous day.

Source: CoinMarketCap

Source: CoinMarketCap

The cryptocurrency reached above $105,000 during the session before declining. Despite the positive price movement, daily trading volume dropped by more than 21%, falling to $49.87 billion.

The market data also reflects Bitcoin’s changing supply patterns. With a circulating supply of 19.86 million BTC, the asset continues approaching its maximum limit of 21 million. The fully diluted valuation reached $2.17 trillion, and the volume-to-market cap ratio stood at 2.42%.

Analyst Xanrox Forecasts Bitcoin Peak Near $122K-$125K Before Subsequent Decline

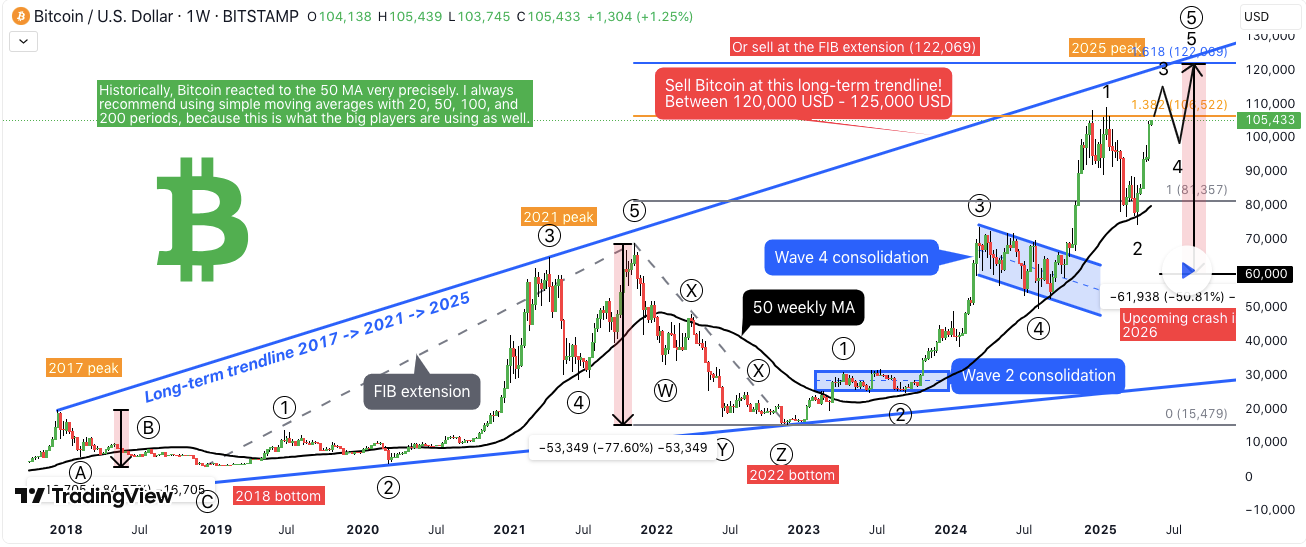

Crypto analyst Xanrox supports this view, forecasting that Bitcoin is nearing the final stages of a bullish wave structure. Using Elliott Wave theory, the analyst identifies Bitcoin as being in Wave 3 of a five-wave pattern.

According to his TradingView post, this pattern signals the last upward movements before a larger market correction. Xanrox projects a top between $120,000 and $125,000, indicating $122,069 as a likely peak based on Fibonacci Extension levels.

Source: TradingView

Source: TradingView

His target coincides with a historical trend line connecting Bitcoin’s 2017 and 2021 highs, forming a projected arc toward the 2025 peak. Xanrox warns that once Waves 4 and 5 conclude, the market could enter a bearish phase.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.