Ethereum’s (ETH) 40% Rally at Risk as US Investors Cash Out

Ethereum’s recent price surge is at risk as U.S. investors exit, indicated by a falling Coinbase Premium Index and weak on-chain metrics, pointing to a potential pullback.

Leading altcoin Ethereum has surged by over 40% in the past week, fueled by renewed optimism across the cryptocurrency market. At press time, the coin rests solidly above the psychological $2,500 price mark.

However, this rally may be losing steam, especially as US-based investors appear to be cashing out. How will this impact ETH’s price performance in the near term?

ETH’s Price Rally Faces Risk as US Investors Exit

According to CryptoQuant, ETH’s Coinbase Premium Index (CPI) reached a weekly peak of 0.022 on May 10 and has since trended downward. As of this writing, the metric sits at 0.0063.

Ethereum Coinbase Premium Index. Source:

CryptoQuant

Ethereum Coinbase Premium Index. Source:

CryptoQuant

This metric has noted a decline despite ETH’s 5% price rally during the same period. This suggests increased selling pressure from US investors, a trend that can weigh heavily on the altcoin’s price.

ETH’s CPI measures the difference between the coin’s prices on Coinbase and Binance. It is a good indicator for tracking US investor sentiment.

When the CPI rises, it means ETH is trading at a premium on Coinbase compared to international exchanges, reflecting stronger buying pressure from US-based institutional and retail investors.

Conversely, when the CPI falls—or worse, turns negative—it signals that demand on Coinbase is lagging behind global markets, due to profit-taking or waning interest among US buyers. ETH’s falling CPI amid its price rally indicates that American investors are exiting their positions and realizing gains, rather than buying into the rally.

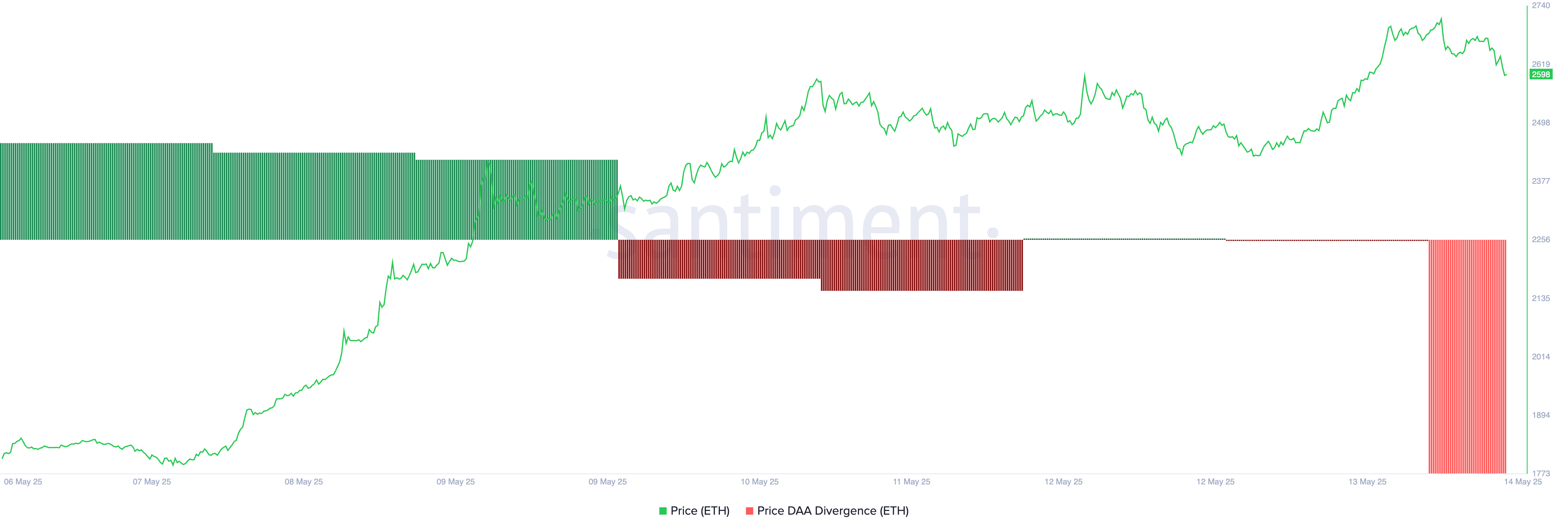

Moreover, readings from ETH’s Price-to-Daily Active Addresses (DAA) divergence, an on-chain metric that compares price movement with network activity, confirm this bearish outlook. Per Santiment, the metric has been negative over the past few days even as ETH’s price climbs. As of this writing, it is at -58.2%.

Ethereum Price DAA Divergence. Source:

Santiment

Ethereum Price DAA Divergence. Source:

Santiment

This negative value indicates that a corresponding rise in user engagement does not support ETH’s recent price gains. In essence, not enough demand is driving ETH’s rally, hence it risks a pullback in the near term.

Will Bulls Reclaim $2,745 or Is a Deeper Drop Ahead?

ETH trades at $2,598 at press time, resting just below the multi-month resistance formed at $2,725. As US-based investors lock in profits, downward pressure on ETH is intensifying and could push its price toward $2,424.

If the bulls fail to defend this level, the coin’s price could plummet further to $2,243.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if bullish pressure strengthens, ETH could make another attempt to climb back to $2,745.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Launches PLUME On-chain Earn With 4.5% APR

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Subscribe to UNITE Savings and enjoy up to 15% APR