Asia's largest Bitcoin ETF holder boosts stake in BlackRock's IBIT

Key Takeaways

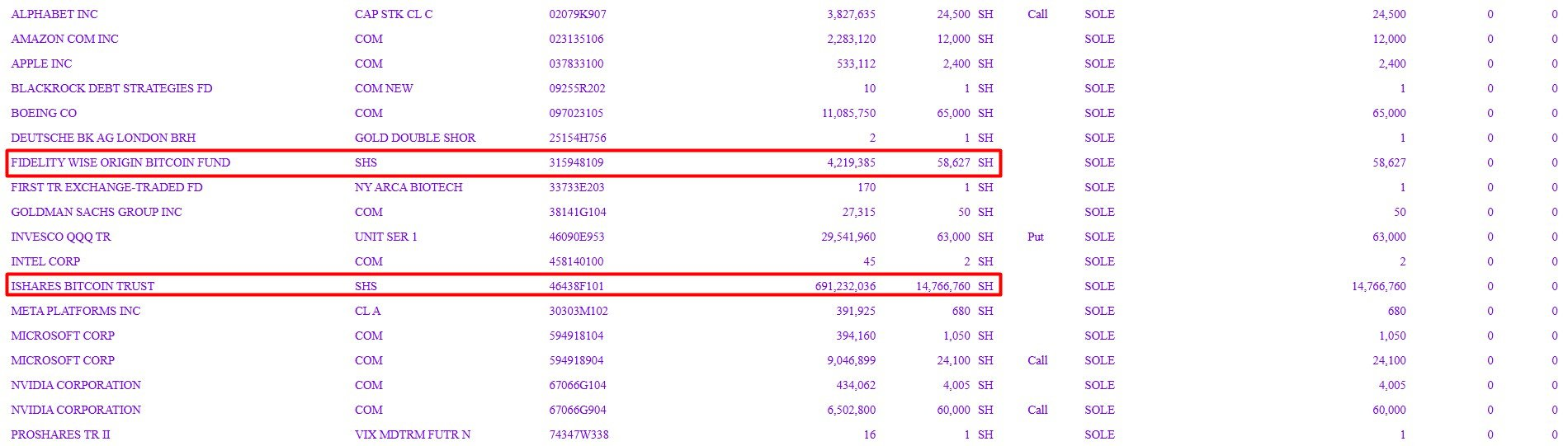

- Avenir Group increased its stake in BlackRock's iShares Bitcoin Trust to 14.7 million shares worth $691 million.

- Goldman Sachs remains the largest IBIT investor with 30.8 million shares after a 28% increase in holdings.

Avenir Group, Asia’s largest Bitcoin ETF investor, increased its holdings in BlackRock’s flagship crypto fund, the iShares Bitcoin Trust (IBIT), during the first quarter of 2025, according to a new SEC disclosure .

The Hong Kong-based institutional family office reported holding approximately 14.7 million IBIT shares valued at $691 million as of March 31, up from 11.3 million at the end of last year.

The firm also disclosed ownership of over 58,000 shares worth about $4 million in the Fidelity Wise Origin Bitcoin Fund (FBTC).

The filing follows Goldman Sachs’ recent disclosure of holding 30.8 million IBIT shares valued at over $1.4 billion as of March 31, representing a 28% increase from its previous 24 million shares.

Goldman Sachs maintains its position as IBIT’s largest institutional investor and holds additional positions in Fidelity’s FBTC and BlackRock’s spot Ethereum ETF.

Founded in 2023, Avenir Group has offices in Hong Kong, the US, the UK, Japan, and Singapore, focusing on financial innovation and emerging technologies through its investment platform and the Avenir Foundation.

IBIT, which Bloomberg Intelligence identifies as one of the fastest-growing ETFs in history, has amassed over $64 billion in assets under management as of May 14.

The fund’s shares closed at $58.70 on Wednesday, down 1.5%, according to Yahoo Finance data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Launches PLUME On-chain Earn With 4.5% APR

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Bitget Trading Club Championship (Phase 2) – Grab a share of 50,000 BGB, up to 500 BGB per user!

Subscribe to UNITE Savings and enjoy up to 15% APR