Bitget Research Institute: Bitcoin Expected to Reach $180,000 This Year

Ryan Lee, Chief Analyst at Bitget Research Institute, stated that from a technical perspective, Bitcoin is approaching a "golden cross" pattern, which is expected to initiate a new upward trend. This signal is highly similar to the trend from late 2024 when Bitcoin rose from $70,000 to $100,000, with a short-term target range of $110,000 to $125,000.

From a mid-term trend perspective, the outlook is optimistic. Driven by spot ETF inflows, post-halving supply tightening, and continued institutional entry, Bitcoin is expected to reach $112,000 to $180,000 within the year. For Ethereum, if ETH-related ETFs gain more attention and the "Pectra" upgrade makes substantial progress in L2 scaling, its price is expected to reach $3,900 to $6,900.

Investors should also be aware of related risks. In the short term, if there is a large-scale profit-taking, Bitcoin may retrace to the $90,000–$95,000 range, and Ethereum may also dip to $1,800. It is recommended that investors continuously monitor key indicators such as U.S. Treasury yields, ETF inflows, and net exchange flows to assess the sustainability of market trends. Maintaining patience and robust risk control is particularly important before the next wave of increases is confirmed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

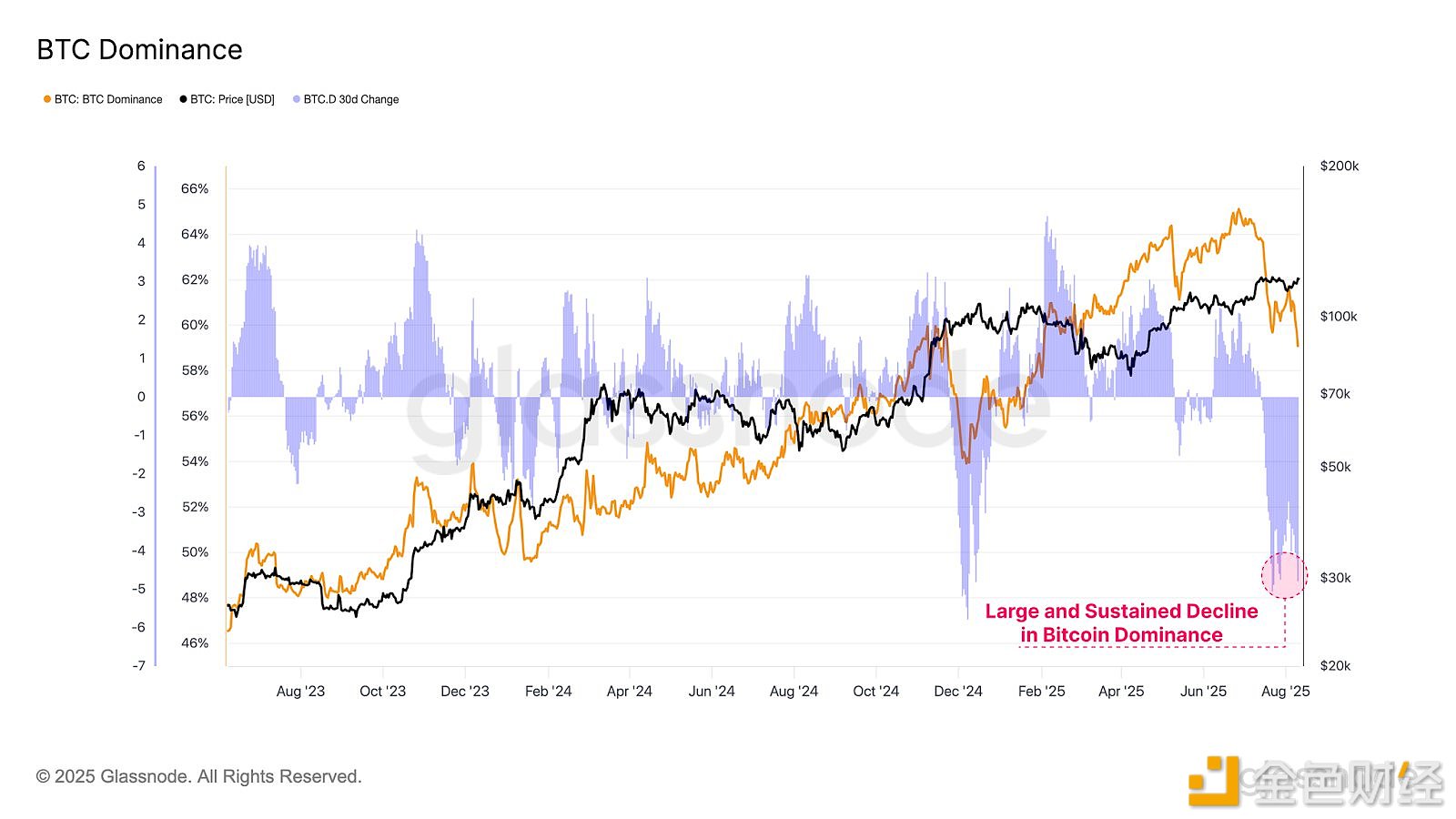

Bitcoin dominance has dropped from 65% to 59% over the past two months

US Treasury Department Calls for Public Comments on Illicit Activities Involving Cryptocurrency

The three major U.S. stock indexes closed nearly flat

U.S. Stocks Close: iQIYI Surges 17%, Intel Falls 3.6%