Solana's REV Surge: Is the Network's Value Truly Undervalued?

REV measures the overall on-chain transactional demand for the currency.

Original Author: @mteamisloading, Co-founder of @spire_labs

Original Translation: zhouzhou, BlockBeats

Editor's Note: REV measures on-chain economic activity and reflects user willingness to pay. Solana's REV is higher than Ethereum's, but REV is lagging and manipulable. There is a significant difference in FDV/REV ratio, and the chain's value does not entirely correspond to the token value, requiring a comprehensive evaluation of the chain's value.

The following is the original content (slightly reorganized for readability):

What is REV?

REV stands for Real Economic Value, measuring the total fees users pay to use the entire chain. The REV generated by Solana is approximately 2 to 4 times that of Ethereum L1. So why is this metric essential? Are SOL and ETH severely undervalued?

REV Timeline:

REV is standardized by @Blockworks_ and widely promoted by the Blockworks Research team (@blockworksres). Jon Charb (@jon_charb) is also a significant contributor to pushing REV as a crucial blockchain metric.

Revenue to a company is to blockchain as REV is to the blockchain.

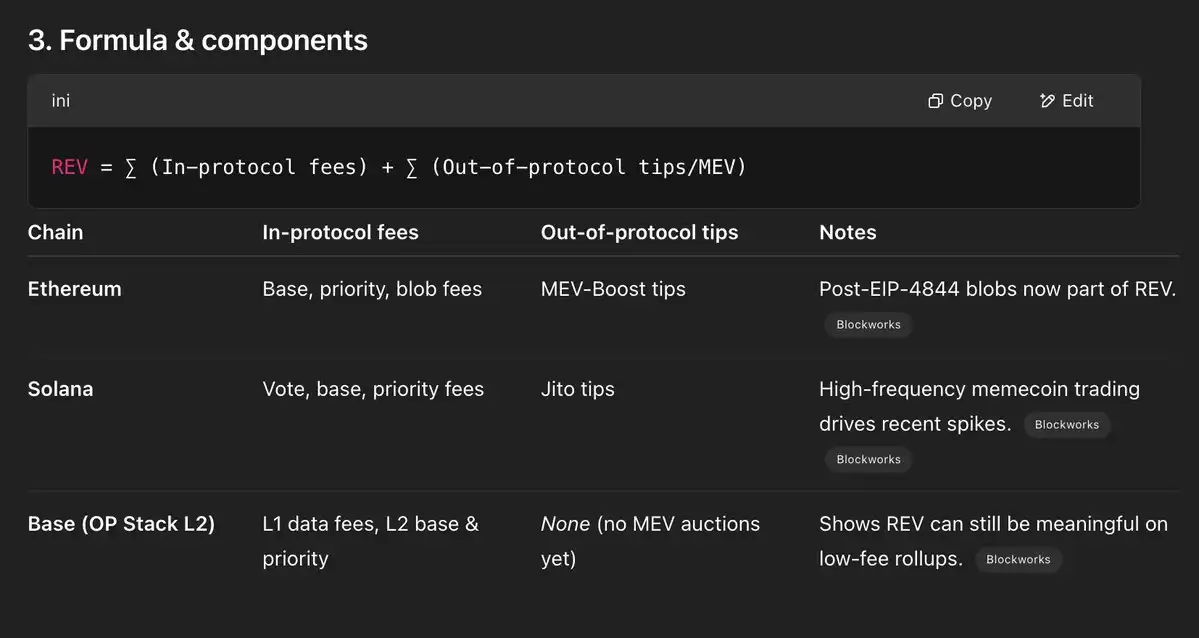

"REV includes both in-protocol transaction fees and off-chain tips users pay to get transactions executed, making it a measure of overall monetary demand on-chain." —@blockworksres

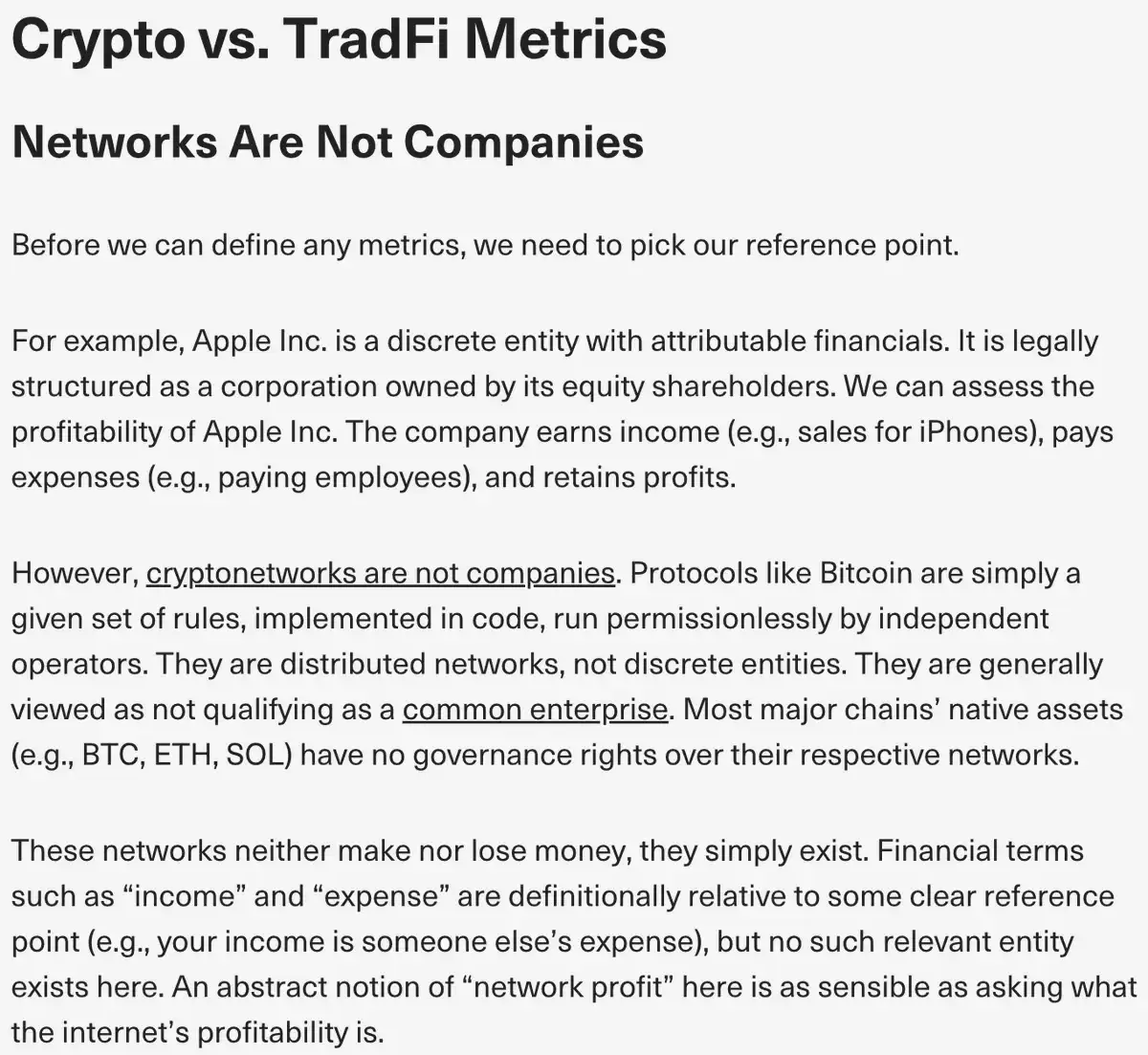

However, the blockchain is not a company, and comparing the two can lead to significant misconceptions: while they have similarities, they also have differences. The devil is in the details.

Let's take a look at today's data, with the chart provided by @blockworksres.

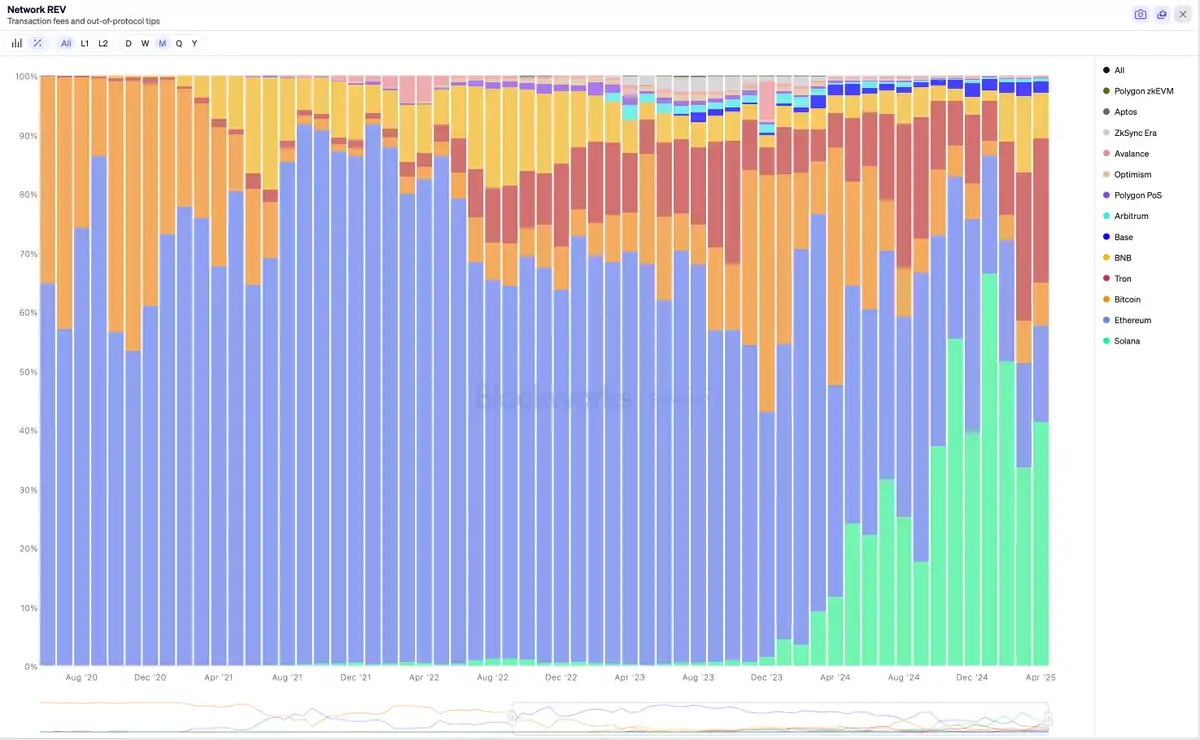

Comparing REV share across chains over the past approximately five years:

·Ethereum Dominated in 2021-2022

·Currently, Solana is Ranked First, Tron is Ranked Second, Both Surpassing Ethereum

·Bitcoin's REV is Nearly Zero

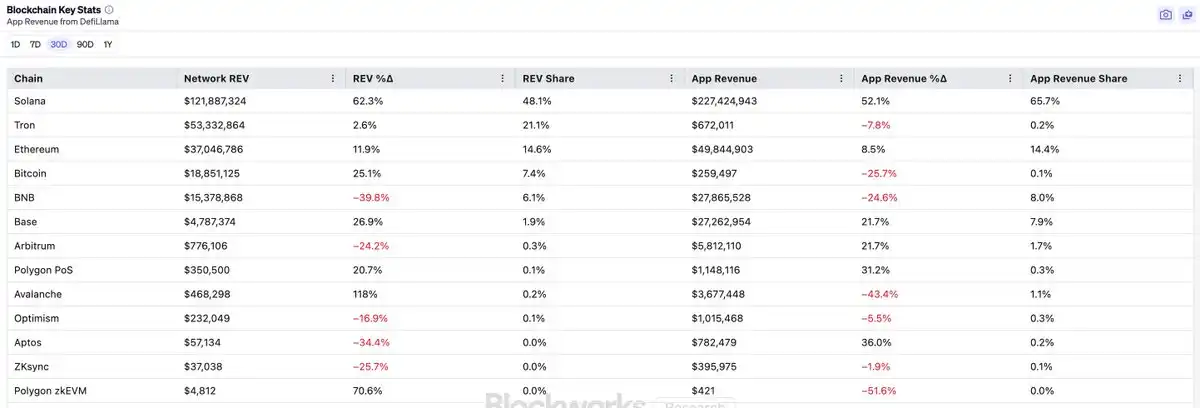

Here is some data from the past 90 days, including application revenue.

So, what does REV really tell us about a chain?

It is one of many metrics, each with its pros and cons:

Pros:

· Compared to metrics like active addresses or transaction volume, REV is more resistant to manipulation, especially when some REV is burned.

· Historically, it has been able to better reflect the activity of retail users.

Cons:

· Historically, it has often been a lagging indicator.

· Like all core metrics, REV cannot capture the full picture.

· REV, like other metrics, can also be manipulated.

· Some activities generate significantly more MEV (Maximal Extractable Value) and REV than others.

· REV is often affected by the immature on-chain MEV infrastructure.

@_bfarmer sums this up very well:

o3 also points out several more nuanced aspects of REV as a metric:

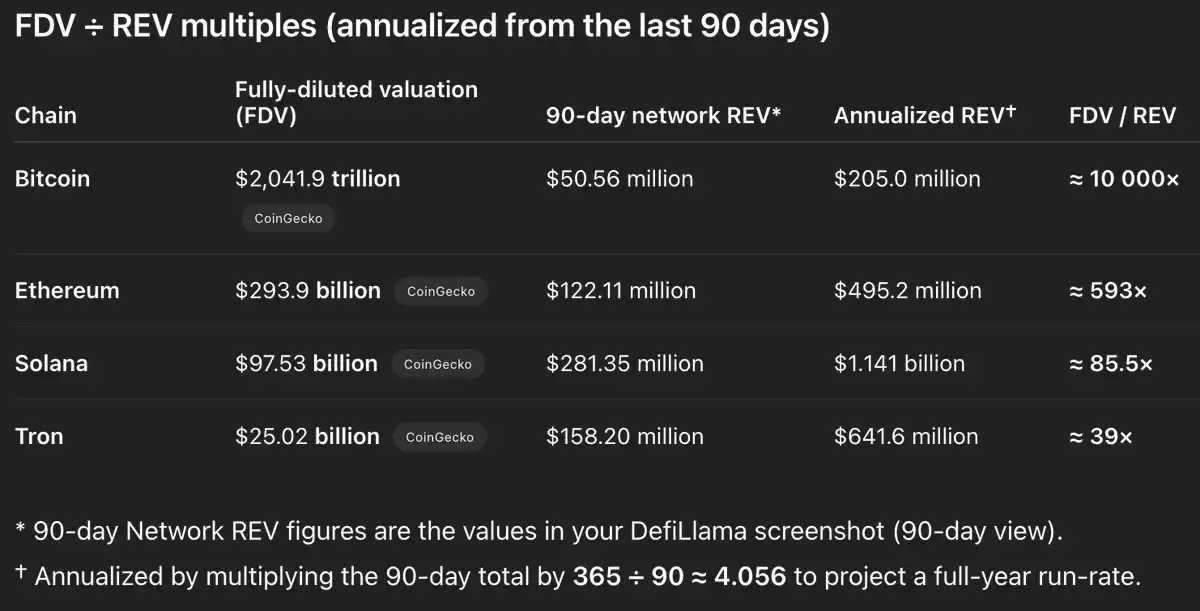

If we were to compare chains' financial performance using REV, akin to comparing companies, their FDV to REV ratios would be as follows:

· Bitcoin: 10,000x

· Ethereum: 593x

· Solana: 85.5x

· Tron: 39x

By this logic, is Solana severely undervalued compared to Ethereum? Not quite.

At least REV (or FDV/REV ratio) is not sufficient to be used in isolation to evaluate the reasonable value of a chain's native token. There are three reasons for this:

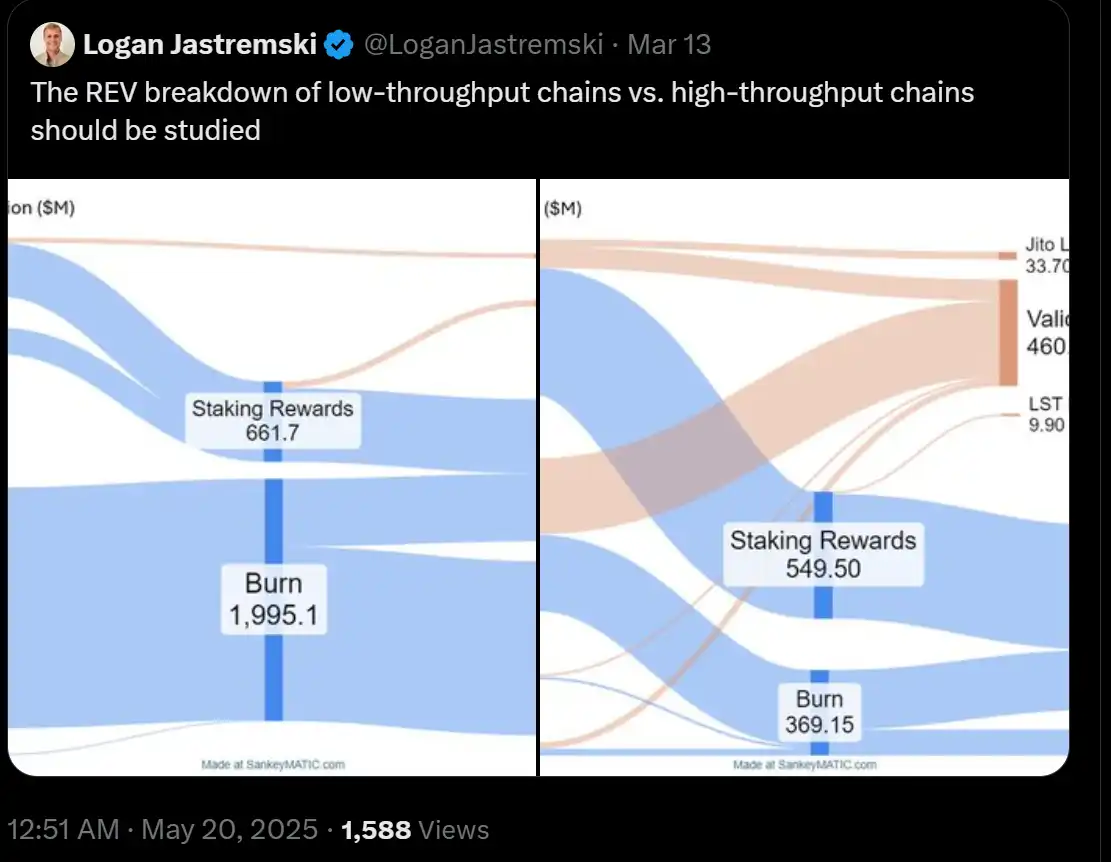

1. REV ≠ Value capture of the native token on-chain. Often, REV is burned, distributed back to users through incentive mechanisms, or paid to validator operators as operational fees, and so on.

For example: (data may be outdated):

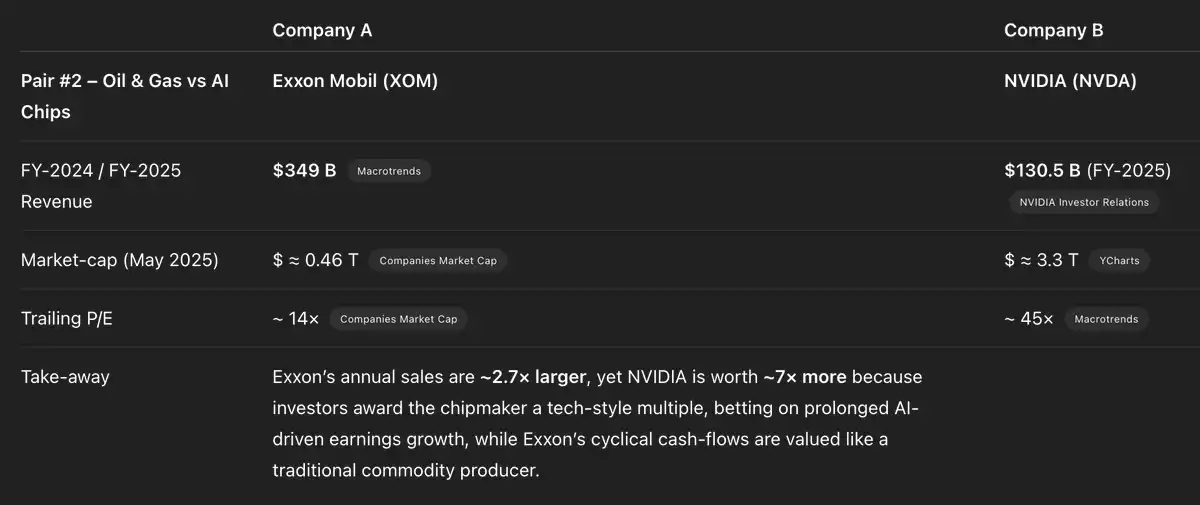

2. FDV/REV ratio (similar to Price-to-Earnings ratio) naturally differs across different chains (and companies). For tokens, factors like yield and monetary premium significantly affect the price. Additionally, the quality and sustainability of REV on different chains also vary.

Refer to:

3. A blockchain is not a company, and the native token is not an equity share.

This should be quite evident.

By the way, in the past few days, discussions about REV from both sides have had some interesting logical fallacies (perhaps more severe from the REV minimalist camp).

In the long run, there are indeed many aspects worth emphasizing in maximizing REV:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!