Short-Term Profit-Taking by Holders May Challenge Dogecoin’s Rally Potential

Dogecoin’s recent performance has captured investor attention, showcasing a possible trajectory toward $0.3 amid fluctuating market dynamics.

-

After successfully retesting the pivotal $0.212 support level, Dogecoin has shown significant upward momentum.

-

The recent consolidation phase near November’s lows, coupled with an ensuing breakout, suggests a robust long-term uptrend.

Dogecoin [DOGE] recently broke free from a two-month price range, elevating its price to approximately $0.26—not far from the $0.264 resistance level. Following a persistent downtrend since January, this surge aligns with Bitcoin’s [BTC] revival over the past six weeks, contributing positively to the altcoin market’s sentiment.

While Bitcoin remains a market leader, analysts suggest that an altseason is yet to materialize. However, optimism surrounding Dogecoin’s continued upward trajectory is palpable among traders and investors.

Dogecoin is ready to rally to $0.3 next

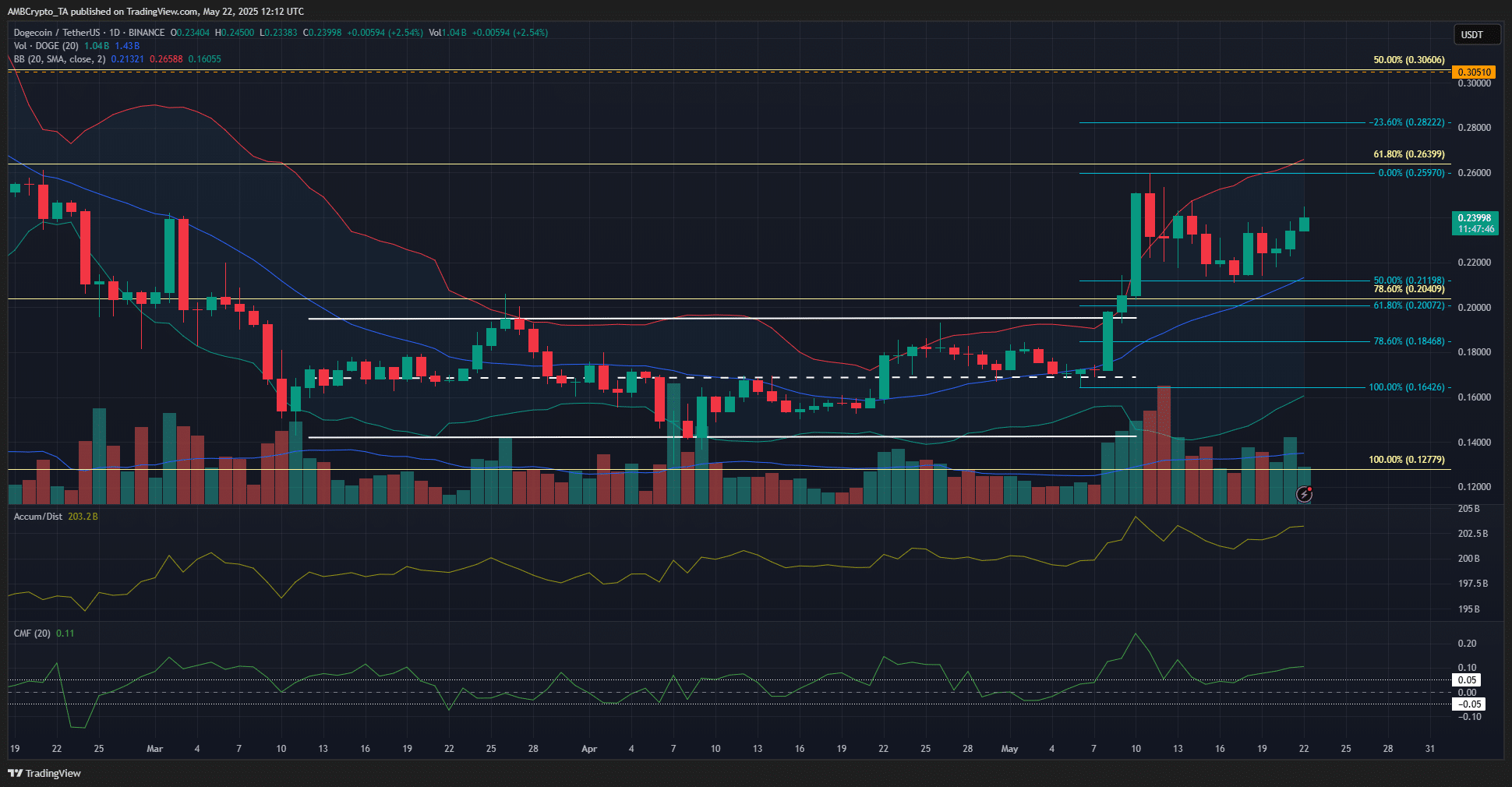

Source: DOGE/USDT on TradingView

On May 10, Dogecoin’s price surpassed the upper Bollinger Band, although it was subsequently forced to retrace. Fibonacci retracement levels indicated a test of the 50% mark, with momentum returning at press time.

The breakout beyond the established range has resulted in a bullish market structure on the one-day chart. Consistent buying pressure is evidenced by volume indicators, showcasing a constructive trend.

The Accumulation/Distribution (A/D) indicator has shown a steady increase over the last two months, suggesting that buying volume has outstripped selling. Additionally, the Chaikin Money Flow (CMF) is positioned above +0.05, further indicating positive capital inflows into the Dogecoin market.

A potential move beyond the upper Bollinger Band may prompt a pullback; however, the 20-day moving average serves as a dynamic support level. Long-term Fibonacci levels indicate that the next resistance target stands at $0.306.

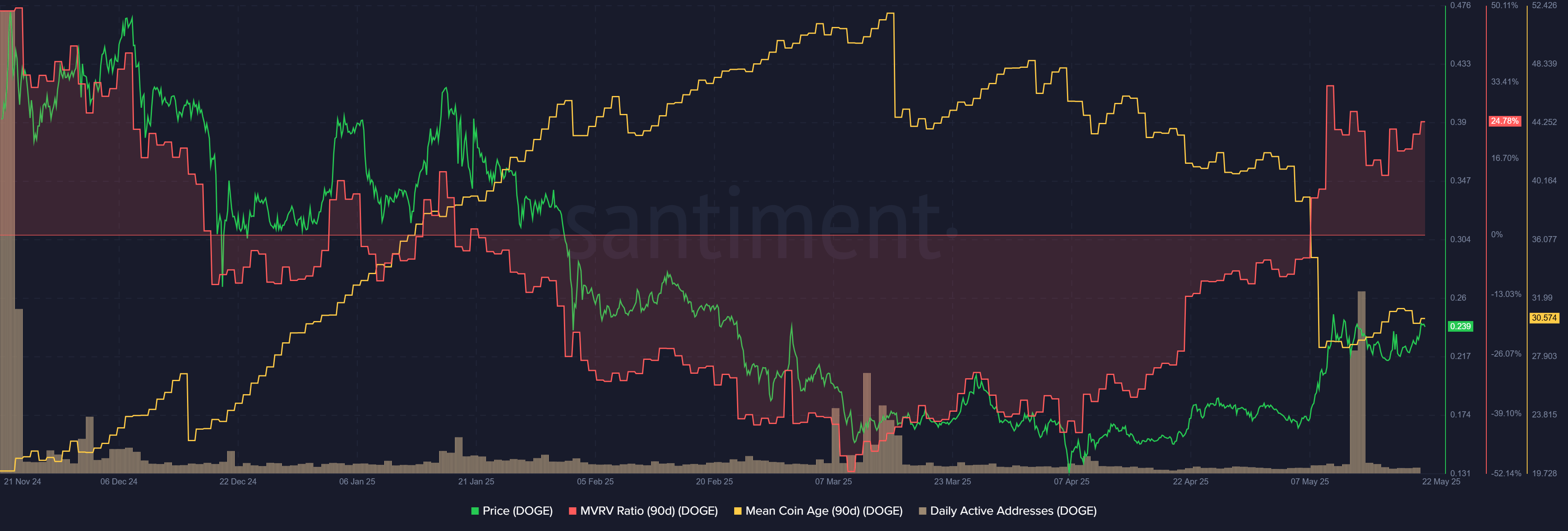

Source: Santiment

Despite robust buying activity in recent weeks, the mean coin age metric reveals a widening distribution across the Dogecoin network during the May rally. This decline in mean coin age suggests heightened transaction volumes among DOGE holders, likely influenced by profit-taking.

The uptick in daily active addresses splashed across the network was noteworthy, peaking on May 14. The 90-day Market Value to Realized Value (MVRV) ratio indicates that those who acquired DOGE in the last three months are enjoying a reasonable profit margin. However, this environment also signals that profit-taking by short-term holders may present a challenge to Dogecoin’s ongoing rally.

Conclusion

In summary, while Dogecoin shows promising signs for a potential rally towards $0.3, on-chain metrics suggest caution is warranted. The dynamic interplay between buying pressure and short-term profit-taking could shape Dogecoin’s immediate future. Investors are encouraged to monitor these developments carefully to navigate the upcoming market conditions effectively.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Security Breach: Cetus Protocol Offers Bounty for Stolen Funds

U.S. Representative Waters Launches ‘Stop TRUMP in Crypto Act’

SEC Postpones Decision on Crypto ETFs Amid Uncertainty

Tom Emmer Reintroduces Bill for Crypto Regulatory Clarity