Bitcoin Long-Term Holders Data Hint When the Next All-Time High Might Be

Bitcoin’s rally is under pressure as long-term holders sell and new wallet growth falters. BTC must defend $106,265 to aim for a fresh all-time high.

Bitcoin recently achieved a new all-time high (ATH), which reignited bullish sentiment among crypto enthusiasts. However, as the price approaches new highs, investor skepticism is growing.

Some investors are locking in profits, creating uncertainty about whether this rally can be sustained. The question remains: can Bitcoin continue its bullish momentum, or is the current price action a sign of things to come?

Bitcoin Investors Remain Uncertain

Bitcoin’s Liveliness, a key metric used to track the activity of long-term holders (LTH), has reached its highest level in nearly four years. This increase in Liveliness indicates that long-term holders are beginning to sell, signaling that they may be securing their gains after Bitcoin’s recent price surge.

LTHs are typically seen as the backbones of Bitcoin’s price stability, and their selling behavior often suggests that investor sentiment is shifting toward skepticism.

When LTHs decide to sell, it often marks a turning point in the market. Their selling can lead to increased market volatility and a potential price correction. With more LTHs exiting the market, Bitcoin faces additional pressure that may impede further price growth in the short term.

Bitcoin Liveliness. Source:

Glassnode

Bitcoin Liveliness. Source:

Glassnode

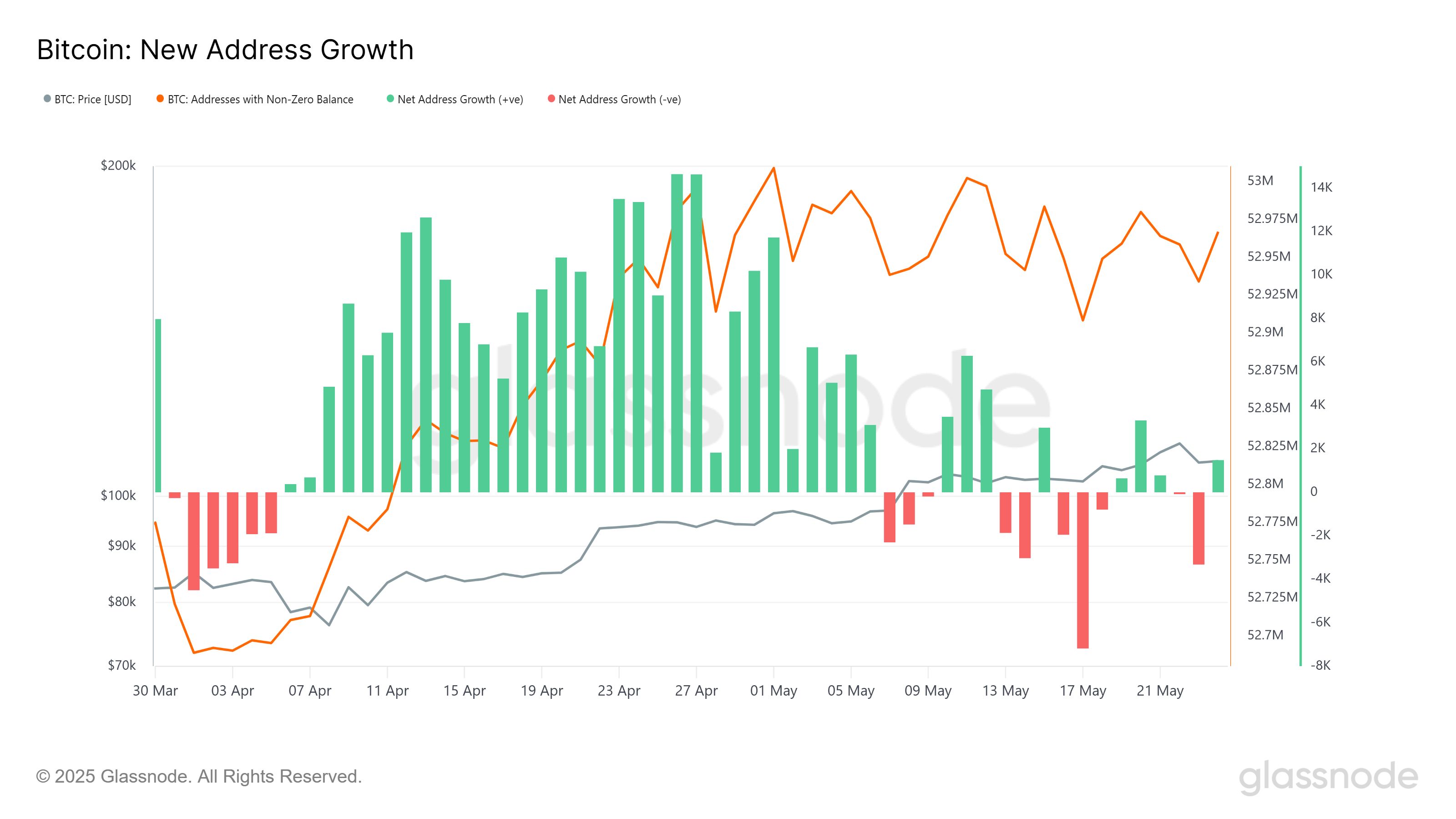

The growth of new Bitcoin addresses has been highly volatile this month. The number of new addresses reached new highs earlier in the month, but now, red bars on the chart signal a sharp decline.

This slowdown in address growth suggests that fewer new investors are entering the market, and some existing holders are choosing to exit. This could indicate a purging of wallets, a move typically seen during periods of rising skepticism.

Compared to April, address growth has been considerably more erratic this month. As Bitcoin’s price climbs, investors are becoming more cautious and focused on securing their profits.

The volatility in new address growth reflects the uncertainty surrounding Bitcoin’s future price action, with investors remaining wary of the long-term sustainability of this rally.

Bitcoin New Address Growth. Source:

Glassnode

Bitcoin New Address Growth. Source:

Glassnode

BTC Price Is Not Too Far From ATH

Bitcoin’s price is currently at $106,708, just under 5% from its ATH of $111,980, achieved last week. However, the path to reaching this level again depends largely on how investors react to the current market conditions.

If skepticism and selling continue, Bitcoin could face difficulty regaining its bullish momentum.

If the price continues to slide, Bitcoin may struggle to recover. A break below the support level of $106,265 could lead to further declines, potentially pushing the price down to $105,000 or even $102,734 in the short term.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if Bitcoin manages to hold above $106,265 and sees renewed buying interest, it could easily invalidate the bearish outlook. A breach of the $110,000 resistance level would provide the momentum needed to push through $111,980, paving the way for a new ATH.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Elon Musk takes Apple and OpenAI to court for ganging up on him

Share link:In this post: Elon Musk’s xAI sued Apple and OpenAI for allegedly colluding to block AI competition in smartphones and app rankings. The lawsuit says Apple boosts ChatGPT on its devices while suppressing rivals like xAI’s Grok in the App Store. Sam Altman and OpenAI deny wrongdoing and accuse Elon of harassment and manipulation through X.

Porsche abandons EV battery plans as European carmakers struggle to gain market share

Share link:In this post: Porsche will no longer produce high-performance EV batteries at its Cellforce unit. About 200 of nearly 300 Cellforce jobs will be cut as the unit focuses on research and development. European automakers are struggling to compete with Asia’s dominance in battery production.

Cardano announces comprehensive XRP integration

Galaxy Digital, Multicoin, and Jump Crypto in talks to raise $1 billion for Solana purchases