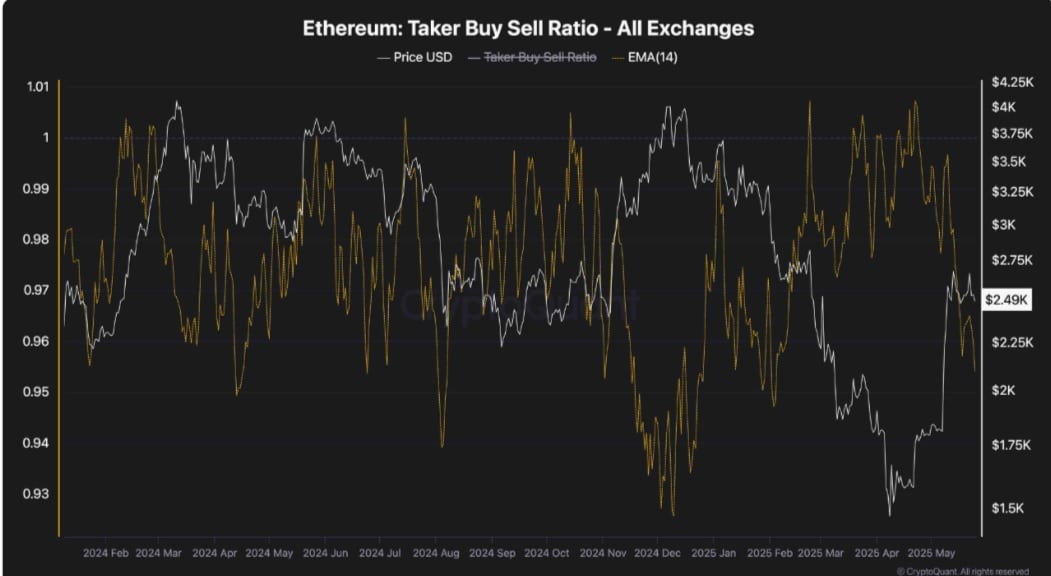

Ethereum is currently under significant pressure, with sellers dominating the market and the Taker Buy-Sell Ratio showing a stark decline, indicating a shift in market sentiment.

-

Ethereum fell to $2,476 after a rejection at $2.7K, marking a 3.05% decline in 24 hours.

-

The spot market recorded 113.1K ETH sold compared to 90K ETH bought, reinforcing the sell-side dominance.

After rallying to $2.7K just two days ago, Ethereum [ETH] faced a strong rejection, dropping to a low of $2,463. As of press time, it was trading at $2,476, reflecting a 3.05% loss over the last 24 hours. This pullback is attributed to both technical factors and a rise in sell-side conviction across derivatives and spot markets.

Taker Buy-Sell Ratio nosedives as sellers take over

According to CryptoQuant, the 14-day Moving Average of the Taker Buy-Sell Ratio has seen a sharp decline, signaling that aggressive sell orders are currently surpassing buy orders.

Source: CryptoQuant

This selling pressure is evident among both small and large holders, with whale activity showing a pronounced tendency toward selling. Ethereum’s large holders have been net sellers overall.

Source: IntoTheBlock

IntoTheBlock’s Large Holder Netflow metric has flipped negative, revealing a net outflow of -12.7K ETH, indicating that whales have sold over 188.6K ETH in just one day. This drop in net flow confirms that whales are predominantly in a selling mode currently.

Source: Coinalyze

The market behavior reflects similar trends among retail investors, with spot trading volumes dominated by sellers. Over the past day, the Spot Buy vs. Sell Volume showed a negative delta of 22.53K, with 113.1K ETH sold against 90K ETH bought. This trend indicates a stronger push towards selling orders in the market.

Will ETH crack below $2.2K next?

Ethereum is hovering around a critical breakdown zone, with bearish momentum maintaining its grip on the market. Currently, sellers dominate the trading landscape, increasing the likelihood of further price declines. The key support level to watch is $2.2K, and if selling pressure persists, Ethereum might break below this threshold.

It is crucial for Ethereum to hold above the $2.2K mark to prevent a potential drop below $2K. However, if this sell-off is primarily led by short-term traders or “weak hands,” it could suggest a consolidation phase, potentially setting the stage for a larger bullish breakout. Should selling pressure decrease, ETH might attempt to rebound towards $2.7K and potentially reach up to $3K, but bulls would need to regain momentum first.

Conclusion

In summary, Ethereum faces substantial selling pressure as market sentiment tilts toward bearishness. The decline in the Taker Buy-Sell Ratio and net outflows from whales indicate a strong sell-side presence that could further influence Ethereum’s price trajectory. Stakeholders should keep a close eye on the critical support levels, as the market dynamics evolve amidst rising selling activity.