-

XRP price faces mounting pressure as overvaluation issues loom, while the NVT Ratio suggests a price correction could be on the horizon.

-

Meanwhile, long-term holders are stepping up their accumulation efforts, offering crucial support as XRP struggles near the $2.27 mark amidst a two-week downtrend.

-

If XRP holds above the $2.27 support, it could potentially rebound to $2.56; however, a slip below this level may see it tumble toward $2.12, prolonging bearish trends.

XRP is experiencing significant selling pressure, with key indicators suggesting the need for a price correction; long-term holders remain optimistic about recovery potential.

XRP Investors Stand Resilient Amid Price Fluctuations

The Network Value to Transactions (NVT) Ratio for XRP has risen, now at its highest point in a month, which typically points towards an overvaluation compared to transaction activity. This situation often indicates an impending price correction, signaling that XRP might be trading at unsustainable levels.

Despite this, XRP has historically shown a knack for rebounding after periods of perceived overvaluation, and many investors are counting on a similar turnaround this time, driven by renewed buying interest.

XRP NVT Ratio. Source: Santiment

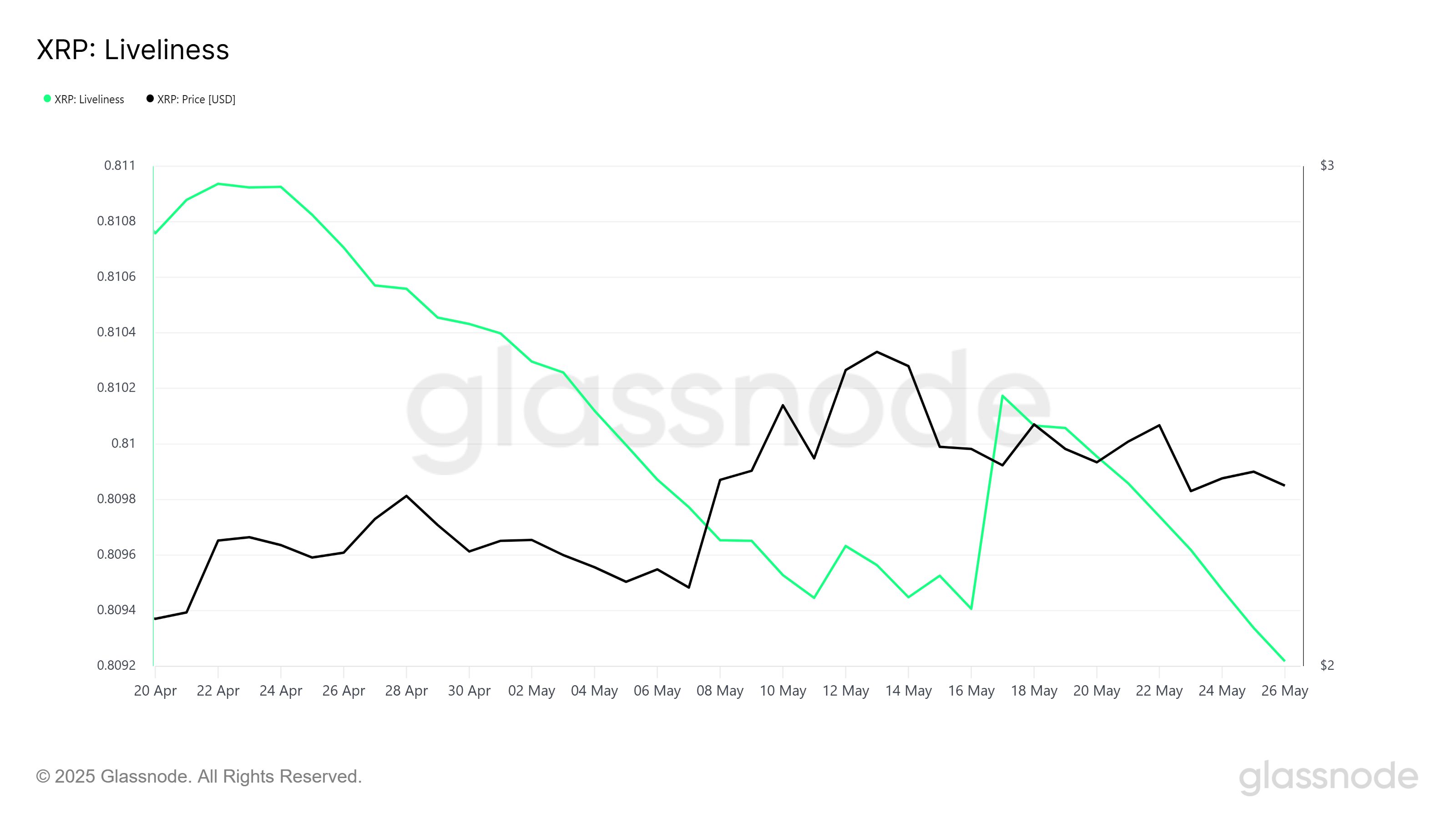

Moreover, XRP’s Liveliness indicator has been declining, which signifies active accumulation by long-term holders (LTHs). A falling Liveliness metric demonstrates that these investors are retaining their assets despite market volatility, aiming to mitigate downward pressure. This behavior contrasts with a rising Liveliness, which would indicate a selling frenzy.

The accumulation trend among LTHs during price dips conveys a strong belief in XRP’s long-term value, as these holders absorb selling pressure, positioning themselves for potential profits when a price recovery occurs, thereby providing a vital support base.

XRP Liveliness. Source: Glassnode

XRP Price Faces Critical Support Test

Currently trading at approximately $2.30, XRP has been in a persistent downtrend over the past two weeks. It is precariously positioned just above a crucial support level at $2.27, which is essential for reversing the bearish trend and establishing a base for potential upward movement.

If favorable market conditions materialize, XRP may successfully bounce back from the $2.27 support, perhaps transitioning its resistance at $2.38 into new support and paving the way toward a recovery to $2.56. Such an upward movement would signal a resurgence of investor confidence.

XRP Price Analysis. Source: TradingView

On the flip side, should XRP fail to secure the $2.27 support level, a further drop to around $2.12 becomes a possibility. Such a decline would undermine any bullish sentiments and extend the ongoing downtrend, causing further losses for investors and continued bearish pressure.

Conclusion

As XRP navigates through these turbulent waters, the ability to maintain key support levels will be critical. Long-term holders seem to be actively involved in stabilizing the market, but the challenge remains formidable. A tight watch on the $2.27 level is essential; a rebound could open doors for recovery, while a breach could lead to deeper troubles.