Bitcoin Consolidates Around $110K Amid Large Volume Surges

- Bitcoin price moves between $105,500 and $111,800 with solid support near $106,000.

- Institutional trades over $10M drive volume past $80 billion, showing market interest.

- Institutional transactions over 10M drive most On-Chain volume, showing large-scale volume.

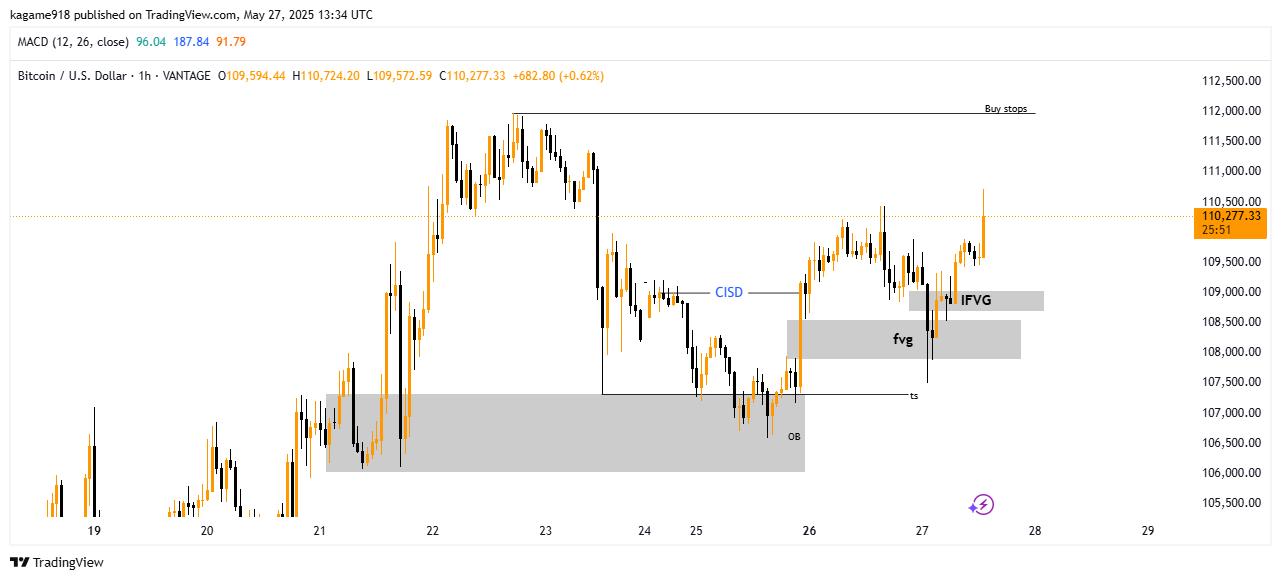

Bitcoin price action from May 19 to May 27, 2025, indicates consolidation with growing upward momentum near $110,277, as per TradingView data. The asset fluctuated within a range, dipping to lows near $105,500 and climbing to highs around $111,800. This, in turn, shows how key support and resistance zones drive active trader participation. Additionally, the main order blocks and fair value gaps suggest that buyers are accumulating at a steady pace, hinting at potential long-term gains.

Source:

TradingView

Source:

TradingView

Support Zones and Price Action Signal Bitcoin Accumulation

Between $106,000 and $107,500 lies an order block where buying pressure repeatedly absorbed selling attempts. This zone acted as a firm base for price rebounds. Around May 25, a liquidity sweep (termed “ts”) tested this OB, triggering a swift rally. The Fair value gap (FVG) between roughly $108,000 and $108,500 exposes price inefficiencies that commonly attract price fills.

In comparison, a more prominent zone near $109,000 appears to be an inverse fair value gap (IFVG), a sign of aggressive buying momentum as price not only fills the gap but also rejects lower levels, reinforcing bullish strength.

A critical inflection point labeled CISD at about $108,750 was broken upwards, marking a shift toward bullish momentum. Above, buy stop orders cluster between $111,000 and $112,000, hinting at breakout potential if these zones are challenged.

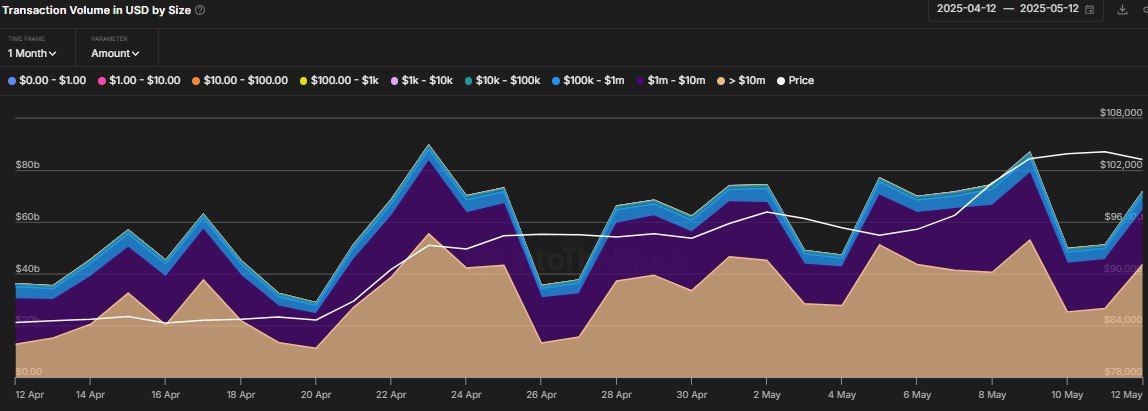

Institutional Transaction Volume Dominates April to May Activity

On-chain transaction volume data from IntoTheBlock, covering the period from April 12 to May 12, shows a high level of institutional participation. Daily volumes peaked above $80 billion, especially on April 22 and May 10, while the overall remains above $40 billion. Transactions over $10 million dominate the volume, highlighted by a large tan area on the chart, reflecting considerable institutional activity.

Source:

IntoTheBlock

Source:

IntoTheBlock

Mid-sized transactions between $100,000 and $1 million and between $1 million and $10 million also sustain consistent levels, suggesting a continuation of engagement by wealthy investors. Conversely, retail transactions below $100,000 contribute modestly, showing their relatively smaller role in total volume.

Related: Strategy Secures $427M to Expand Bitcoin Treasury to $40B

Bitcoin Price Gains Correlate with Rising Institutional Demand

Bitcoin has been following an upward path from about $84,000 in mid-April to a little above $102,000 on May 12. Price appreciation is consistent with the surge in transaction volumes, indicating growing institutional demand.

Combining on-chain transaction volumes with detailed technical analysis reveals an apparent upward propensity for the Bitcoin price to scale. Very high demand, large transactions, and strong technical levels put bullish momentum on. Unless Bitcoin plummets through the $106,000 support, all indicators are positive toward further gains.

The post Bitcoin Consolidates Around $110K Amid Large Volume Surges appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Notice: Maintenance for VND deposit service

TAUSDT now launched for futures trading and trading bots

Bitget to decouple loan interest rates from futures funding rates for select coins in spot margin trading

Bitget Launches HYPE On-chain Earn With 2.1~4.5% APR